Yield protocol infiniFi replicates fractional reserve banking onchain

This is a segment from the 0xResearch newsletter. To read full editions, subscribe.

Banks take in deposits to invest a portion in riskier, illiquid assets — that’s how they make money.

This “borrow short, lend long” business model is otherwise known as fractional reserve banking. As long as not every depositor wants their money at once, everyone’s happy!

When crisis mode hits and users rush for the exits, the risk models of banks are put to the test.

At the heart of the problem is non-transparency around a bank’s liabilities and available assets. You could theoretically avoid this problem if that information was visible, as you could curate your own risk models.

Enter infiniFi, a new DeFi protocol on Ethereum that aims to replicate the entire stack of fractional reserve banking onchain.

How it works:

- Users deposit stablecoins for iUSD receipt stablecoin.

- For lower risk yield, stake iUSD for siUSD. This is liquid.

- For higher risk yield, lock up iUSD for liUSD. This is illiquid.

Now the “fractional reserve banking” component comes in.

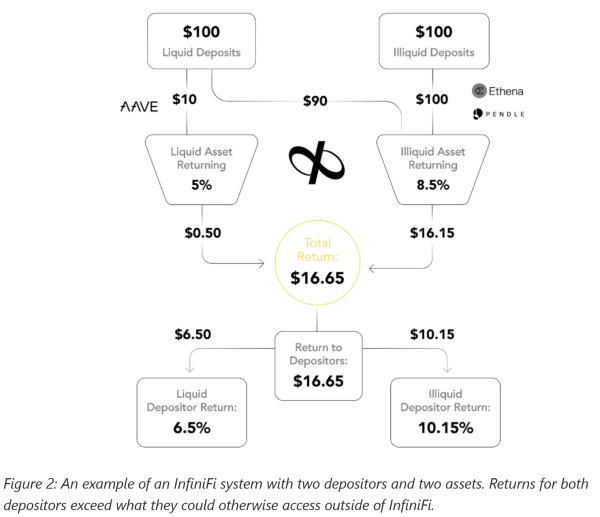

InfiniFi deploys the liUSD liquid tranche capital into lower risk return money markets like Aave or Fluid, while optionally deploying the siUSD illiquid tranche into higher risk return strategies. (Governance will eventually determine these decisions.)

That exact ratio is informed by the demonstrated preferences of depositors and which yield options they select (siUSD vs liUSD).

The positive-sum outcome? InfiniFi gets to distribute amplified yields for both groups of depositors than if they had pursued their strategies individually.

Source: infiniFi

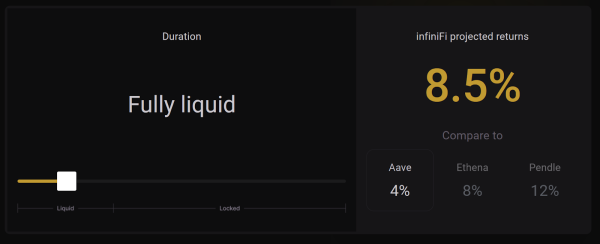

Based on infiniFi’s website, whether you’re opting for a liquid (siUSD) or locked (liUSD) yield, you get a comparatively superior yield than the underlying protocol.

Source: infiniFi.

It’s a neat business model.

But what infiniFi is doing in itself — borrowing short and lending long — isn’t all that different from what banks usually do.

The innovation comes from the fact that the entire stack is on the blockchain.

That’s how you, as a user, can sleep easily at night — you know your bank isn’t pulling a Sam Bankman-Fried and pursuing unchecked leverage against the most illiquid assets.

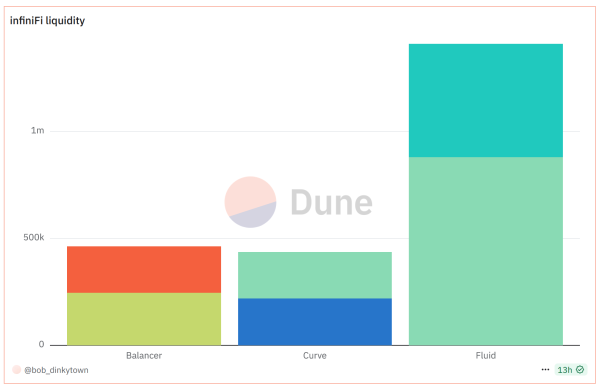

InfiniFi’s reserve composition is completely transparent onchain, so you don’t have to rely on a quarterly call report.

You can easily look up USDC deposits and iUSD tokens minted against it to determine its exact asset-liability mismatch, if any.

You can also examine a breakdown of the protocol’s yield strategies, or whether the protocol is abiding by its liquidity buffers — down to the amount and type of assets they’re made up of.

Source: Dune.

In the event of a hack or “bank run,” an explicitly coded loss waterfall will determine who gets paid in order.

The highest-yield and locked liUSD token holders are first in the firing line, absorbing losses first.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  USDC

USDC  Solana

Solana  JUSD

JUSD  TRON

TRON  Lido Staked Ether

Lido Staked Ether  Figure Heloc

Figure Heloc  Dogecoin

Dogecoin  WhiteBIT Coin

WhiteBIT Coin  Bitcoin Cash

Bitcoin Cash  USDS

USDS  Cardano

Cardano  Wrapped stETH

Wrapped stETH  LEO Token

LEO Token  Hyperliquid

Hyperliquid  Wrapped Bitcoin

Wrapped Bitcoin  Ethena USDe

Ethena USDe  Binance Bridged USDT (BNB Smart Chain)

Binance Bridged USDT (BNB Smart Chain)  Monero

Monero  Canton

Canton  Chainlink

Chainlink  USD1

USD1  Wrapped eETH

Wrapped eETH  Stellar

Stellar  Dai

Dai  sUSDS

sUSDS  Litecoin

Litecoin  PayPal USD

PayPal USD  Hedera

Hedera  Coinbase Wrapped BTC

Coinbase Wrapped BTC  Zcash

Zcash  Avalanche

Avalanche  Sui

Sui  WETH

WETH  Shiba Inu

Shiba Inu  Rain

Rain  Toncoin

Toncoin  USDT0

USDT0  Cronos

Cronos  World Liberty Financial

World Liberty Financial  Tether Gold

Tether Gold  Uniswap

Uniswap  MemeCore

MemeCore  PAX Gold

PAX Gold  Polkadot

Polkadot  Ethena Staked USDe

Ethena Staked USDe  Mantle

Mantle  BlackRock USD Institutional Digital Liquidity Fund

BlackRock USD Institutional Digital Liquidity Fund  Falcon USD

Falcon USD  Aave

Aave  Aster

Aster  Bitget Token

Bitget Token  Global Dollar

Global Dollar  Circle USYC

Circle USYC  OKB

OKB  Pepe

Pepe  HTX DAO

HTX DAO  syrupUSDC

syrupUSDC  Ripple USD

Ripple USD  Sky

Sky  Bittensor

Bittensor  BFUSD

BFUSD  Internet Computer

Internet Computer  Ethereum Classic

Ethereum Classic  NEAR Protocol

NEAR Protocol  Pi Network

Pi Network  Ondo

Ondo  Gate

Gate  Pump.fun

Pump.fun  KuCoin

KuCoin  Worldcoin

Worldcoin  Quant

Quant  Jupiter Perpetuals Liquidity Provider Token

Jupiter Perpetuals Liquidity Provider Token  USDD

USDD  Superstate Short Duration U.S. Government Securities Fund (USTB)

Superstate Short Duration U.S. Government Securities Fund (USTB)  Cosmos Hub

Cosmos Hub  POL (ex-MATIC)

POL (ex-MATIC)  Ethena

Ethena  Jito Staked SOL

Jito Staked SOL  MYX Finance

MYX Finance  USDtb

USDtb  NEXO

NEXO  Binance-Peg WETH

Binance-Peg WETH  Algorand

Algorand  Rocket Pool ETH

Rocket Pool ETH  Midnight

Midnight  Binance Bridged USDC (BNB Smart Chain)

Binance Bridged USDC (BNB Smart Chain)  Official Trump

Official Trump  Aptos

Aptos  Wrapped BNB

Wrapped BNB  Janus Henderson Anemoy AAA CLO Fund

Janus Henderson Anemoy AAA CLO Fund  Function FBTC

Function FBTC  Spiko EU T-Bills Money Market Fund

Spiko EU T-Bills Money Market Fund  Ondo US Dollar Yield

Ondo US Dollar Yield  OUSG

OUSG  Render

Render  syrupUSDT

syrupUSDT  Filecoin

Filecoin  VeChain

VeChain  Arbitrum

Arbitrum  Binance Staked SOL

Binance Staked SOL  Beldex

Beldex  Usual USD

Usual USD  Janus Henderson Anemoy Treasury Fund

Janus Henderson Anemoy Treasury Fund  USDai

USDai  GHO

GHO  Polygon Bridged USDC (Polygon PoS)

Polygon Bridged USDC (Polygon PoS)  Bonk

Bonk  Solv Protocol BTC

Solv Protocol BTC  LayerZero

LayerZero  Lombard Staked BTC

Lombard Staked BTC  A7A5

A7A5  TrueUSD

TrueUSD  Sei

Sei  clBTC

clBTC  pippin

pippin  Jupiter

Jupiter  EURC

EURC  Stacks

Stacks  PancakeSwap

PancakeSwap  StakeWise Staked ETH

StakeWise Staked ETH  Dash

Dash  Tezos

Tezos  Kinetiq Staked HYPE

Kinetiq Staked HYPE  tBTC

tBTC  Decred

Decred  Chiliz

Chiliz  WrappedM by M0

WrappedM by M0  Story

Story  Kinesis Gold

Kinesis Gold  Pudgy Penguins

Pudgy Penguins  Optimism

Optimism  Stable

Stable  River

River  Mantle Staked Ether

Mantle Staked Ether  Virtuals Protocol

Virtuals Protocol  JUST

JUST  Polygon PoS Bridged DAI (Polygon POS)

Polygon PoS Bridged DAI (Polygon POS)  c8ntinuum

c8ntinuum  Resolv wstUSR

Resolv wstUSR  Artificial Superintelligence Alliance

Artificial Superintelligence Alliance  COCA

COCA  Curve DAO

Curve DAO  Lighter

Lighter  BitTorrent

BitTorrent  Liquid Staked ETH

Liquid Staked ETH  Gnosis

Gnosis  Arbitrum Bridged WBTC (Arbitrum One)

Arbitrum Bridged WBTC (Arbitrum One)  Kaia

Kaia  Sun Token

Sun Token  Maple Finance

Maple Finance  Wrapped Flare

Wrapped Flare  Kinesis Silver

Kinesis Silver  AINFT

AINFT  L2 Standard Bridged WETH (Base)

L2 Standard Bridged WETH (Base)  Ether.fi

Ether.fi  Steakhouse USDC Morpho Vault

Steakhouse USDC Morpho Vault  Injective

Injective  Resolv USR

Resolv USR  crvUSD

crvUSD  PRIME

PRIME  Binance-Peg XRP

Binance-Peg XRP  FLOKI

FLOKI  Ether.Fi Liquid ETH

Ether.Fi Liquid ETH  IOTA

IOTA  Renzo Restaked ETH

Renzo Restaked ETH  Lido DAO

Lido DAO  The Graph

The Graph  sBTC

sBTC  Bitcoin SV

Bitcoin SV  Celestia

Celestia  Legacy Frax Dollar

Legacy Frax Dollar  Jupiter Staked SOL

Jupiter Staked SOL  SPX6900

SPX6900  Savings USDD

Savings USDD  JasmyCoin

JasmyCoin  Olympus

Olympus  Aerodrome Finance

Aerodrome Finance  Marinade Staked SOL

Marinade Staked SOL  Humanity

Humanity  Arbitrum Bridged WETH (Arbitrum One)

Arbitrum Bridged WETH (Arbitrum One)  DoubleZero

DoubleZero  ADI

ADI  Telcoin

Telcoin  Axie Infinity

Axie Infinity