Yield-Bearing Stablecoin Pools: The New Frontier of Passive Income in DeFi

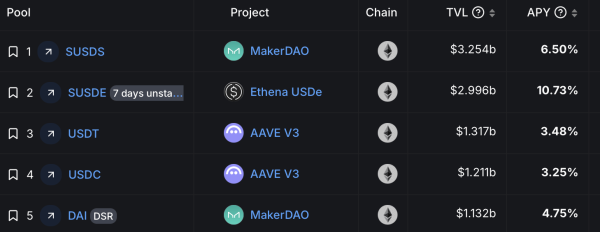

Similar to the practice of staking digital assets, yield-generating stablecoins and pools have garnered significant traction as a sophisticated mechanism for accumulating cryptocurrency holdings and generating passive income through prolonged holding periods. Below is an analytical snapshot of the top five stablecoin liquidity pools, ranked by total value locked (TVL) and their corresponding annual percentage yields (APY), as of Mar. 6, 2025.

Decoding the Rise of Yield-Generating Stablecoin Pools in 2025

Following the collapse of Terra’s ecosystem and Anchor, an emergent cohort of yield-bearing stablecoins has risen to prominence, captivating participants seeking reliable returns in decentralized finance. A yield-bearing stablecoin represents a category of fiat-pegged digital tokens that marries the stability inherent to traditional fiat currencies with opportunities to accrue passive income. Certain standard stablecoins, when deposited into sizable liquidity pools, accumulate returns generated by the pools’ operations.

Capital allocated to these instruments is typically channeled into liquidity pools or similar structured frameworks, which function as the backbone for producing returns via strategic protocols—including staking digital assets like ETH, decentralized lending, or deploying capital across diverse financial vehicles. According to metrics collected by defillama.com, the top five pools secure $8.699 billion as of March 6, 2025.

Sky’s USDS leads the rankings in total value locked (TVL) at $3.254 billion. According to defillama.com, the USDS pool currently delivers a 6.50% annual percentage yield (APY). Ethena’s SUSDE pool, offering a superior yield of 10.73% APY, secures $2.996 billion in locked capital. Meanwhile, the Tether (USDT) pool on Aave Version 3 maintains a TVL of $1.317 billion and provides users with a 3.48% APY.

Top five stablecoin pools on March 6, 2025, by TVL with their corresponding annual percentage yields (APY).

Similarly, the USDC pool on Aave V3 yields 3.25% APY, paired with a TVL of $1.211 billion. Utilizing the infrastructure of Sky (formerly MakerDAO), the DAI pool delivers a 4.75% APY, backed by $1.132 billion in holdings. Notable additions to this cohort include Usual’s USD0++ at 11.56% APY, the SPDAI pool on Morpho Blue at 8.58% APY, and USDS via Spark at 7.17% APY.

Allocating capital to these pools delivers distinct advantages, including consistent yield generation, liquidity for seamless redemptions, and accessible entry points for risk-conscious investors. Furthermore, they facilitate portfolio diversification and engagement with decentralized protocols without necessitating hands-on oversight.

While yield-bearing stablecoin pools present enticing return prospects, they are accompanied by meaningful risks. Participants must navigate potential hazards such as smart contract vulnerabilities, temporary valuation discrepancies, asset misappropriation, and stablecoin depegging events.

Compounding these concerns are regulatory ambiguities and fraudulent schemes within decentralized finance (DeFi), which heighten exposure to financial instability. Meticulous research and cautious strategy are imperative to mitigate losses in this dynamic and nascent ecosystem.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  USDC

USDC  Solana

Solana  TRON

TRON  Lido Staked Ether

Lido Staked Ether  Figure Heloc

Figure Heloc  Dogecoin

Dogecoin  WhiteBIT Coin

WhiteBIT Coin  USDS

USDS  Cardano

Cardano  Bitcoin Cash

Bitcoin Cash  Wrapped stETH

Wrapped stETH  LEO Token

LEO Token  Hyperliquid

Hyperliquid  Wrapped Bitcoin

Wrapped Bitcoin  Monero

Monero  Binance Bridged USDT (BNB Smart Chain)

Binance Bridged USDT (BNB Smart Chain)  Chainlink

Chainlink  Ethena USDe

Ethena USDe  Canton

Canton  Stellar

Stellar  Wrapped eETH

Wrapped eETH  USD1

USD1  Rain

Rain  sUSDS

sUSDS  Dai

Dai  Litecoin

Litecoin  PayPal USD

PayPal USD  Coinbase Wrapped BTC

Coinbase Wrapped BTC  Hedera

Hedera  Avalanche

Avalanche  Zcash

Zcash  WETH

WETH  Sui

Sui  Shiba Inu

Shiba Inu  Cronos

Cronos  USDT0

USDT0  Toncoin

Toncoin  World Liberty Financial

World Liberty Financial  Tether Gold

Tether Gold  Polkadot

Polkadot  PAX Gold

PAX Gold  Uniswap

Uniswap  MemeCore

MemeCore  Ethena Staked USDe

Ethena Staked USDe  Mantle

Mantle  BlackRock USD Institutional Digital Liquidity Fund

BlackRock USD Institutional Digital Liquidity Fund  Circle USYC

Circle USYC  Global Dollar

Global Dollar  Bittensor

Bittensor  NEAR Protocol

NEAR Protocol  Falcon USD

Falcon USD  Aster

Aster  Aave

Aave  Sky

Sky  Pi Network

Pi Network  OKB

OKB  syrupUSDC

syrupUSDC  Ripple USD

Ripple USD  Bitget Token

Bitget Token  Pepe

Pepe  HTX DAO

HTX DAO  Internet Computer

Internet Computer  Ethereum Classic

Ethereum Classic  BFUSD

BFUSD  Ondo

Ondo  Superstate Short Duration U.S. Government Securities Fund (USTB)

Superstate Short Duration U.S. Government Securities Fund (USTB)  Worldcoin

Worldcoin  Gate

Gate  Pump.fun

Pump.fun  POL (ex-MATIC)

POL (ex-MATIC)  Jupiter Perpetuals Liquidity Provider Token

Jupiter Perpetuals Liquidity Provider Token  KuCoin

KuCoin  Midnight

Midnight  Ondo US Dollar Yield

Ondo US Dollar Yield  Ethena

Ethena  Jito Staked SOL

Jito Staked SOL  Cosmos Hub

Cosmos Hub  NEXO

NEXO  USDtb

USDtb  Binance-Peg WETH

Binance-Peg WETH  Rocket Pool ETH

Rocket Pool ETH  Spiko EU T-Bills Money Market Fund

Spiko EU T-Bills Money Market Fund  Official Trump

Official Trump  Binance Bridged USDC (BNB Smart Chain)

Binance Bridged USDC (BNB Smart Chain)  Aptos

Aptos  Wrapped BNB

Wrapped BNB  Algorand

Algorand  Function FBTC

Function FBTC  Filecoin

Filecoin  OUSG

OUSG  Janus Henderson Anemoy AAA CLO Fund

Janus Henderson Anemoy AAA CLO Fund  USDD

USDD  syrupUSDT

syrupUSDT  Render

Render  Jupiter

Jupiter  Arbitrum

Arbitrum  Binance Staked SOL

Binance Staked SOL  Stable

Stable  VeChain

VeChain  Beldex

Beldex  YLDS

YLDS  Janus Henderson Anemoy Treasury Fund

Janus Henderson Anemoy Treasury Fund  Usual USD

Usual USD  Polygon Bridged USDC (Polygon PoS)

Polygon Bridged USDC (Polygon PoS)  GHO

GHO  Solv Protocol BTC

Solv Protocol BTC  Bonk

Bonk  Lombard Staked BTC

Lombard Staked BTC  Decred

Decred  A7A5

A7A5  TrueUSD

TrueUSD  clBTC

clBTC  Virtuals Protocol

Virtuals Protocol  Stacks

Stacks  EURC

EURC  USDai

USDai  Sei

Sei  StakeWise Staked ETH

StakeWise Staked ETH  PancakeSwap

PancakeSwap  Pudgy Penguins

Pudgy Penguins  Kinetiq Staked HYPE

Kinetiq Staked HYPE  tBTC

tBTC  JUST

JUST  Dash

Dash  WrappedM by M0

WrappedM by M0  Tezos

Tezos  Kinesis Gold

Kinesis Gold  pippin

pippin  Ether.fi

Ether.fi  Chiliz

Chiliz  Mantle Staked Ether

Mantle Staked Ether  LayerZero

LayerZero  Curve DAO

Curve DAO  Polygon PoS Bridged DAI (Polygon POS)

Polygon PoS Bridged DAI (Polygon POS)  Resolv wstUSR

Resolv wstUSR  c8ntinuum

c8ntinuum  COCA

COCA  River

River  Gnosis

Gnosis  Artificial Superintelligence Alliance

Artificial Superintelligence Alliance  Liquid Staked ETH

Liquid Staked ETH  AINFT

AINFT  Arbitrum Bridged WBTC (Arbitrum One)

Arbitrum Bridged WBTC (Arbitrum One)  PRIME

PRIME  BitTorrent

BitTorrent  Lighter

Lighter  Wrapped Flare

Wrapped Flare  Kaia

Kaia  ADI

ADI  L2 Standard Bridged WETH (Base)

L2 Standard Bridged WETH (Base)  Aerodrome Finance

Aerodrome Finance  Steakhouse USDC Morpho Vault

Steakhouse USDC Morpho Vault  Sun Token

Sun Token  Injective

Injective  SPX6900

SPX6900  Bitcoin SV

Bitcoin SV  Story

Story  Binance-Peg XRP

Binance-Peg XRP  Celestia

Celestia  Ether.Fi Liquid ETH

Ether.Fi Liquid ETH  Siren

Siren  Renzo Restaked ETH

Renzo Restaked ETH  crvUSD

crvUSD  IOTA

IOTA  sBTC

sBTC  The Graph

The Graph  Pyth Network

Pyth Network  Legacy Frax Dollar

Legacy Frax Dollar  Jupiter Staked SOL

Jupiter Staked SOL  JasmyCoin

JasmyCoin  Savings USDD

Savings USDD  FLOKI

FLOKI  Optimism

Optimism  Olympus

Olympus  Marinade Staked SOL

Marinade Staked SOL  Maple Finance

Maple Finance  Arbitrum Bridged WETH (Arbitrum One)

Arbitrum Bridged WETH (Arbitrum One)  Venice Token

Venice Token  Plasma

Plasma  Lido DAO

Lido DAO  BTSE Token

BTSE Token  Staked Aave

Staked Aave  DoubleZero

DoubleZero  Conflux

Conflux