Victim loses $330K to phishing scammers 408 days after signing approval

According to a report from Scam Sniffer, a Web3 anti-scam platform, one person just got drained of $330K because of a phishing approval, one that they interacted with more than a year ago.

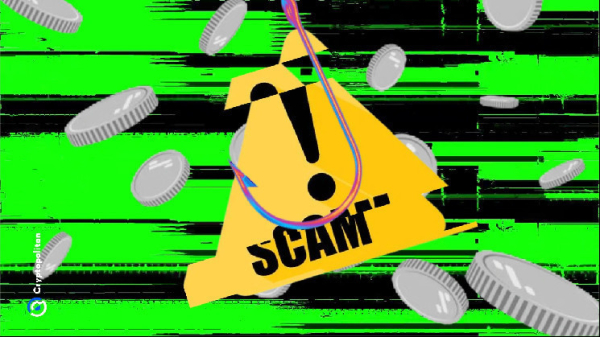

According to Etherscan, the victim lost a total of $329,743 in AAVE tokens to the exploit. One of the most peculiar facts about this case is that the phishing approval was signed 408 days prior, on February 10, 2024, at 12:51 AM UTC, giving the scammer access to the victim’s wallet.

The theft did not occur until March 24, 2025, at 12:35 AM UTC, when the attacker transferred 1,999.23 AAVE tokens, valued at $329,743, in a single transaction.

Prior to the theft, the targeted wallet held $527,498 in AAVE. By the time the hacker was done, the victim had only $197,755 left.

The victim signed the phishing approval signed 408 days ago. Source: Etherscan

The wallet contained other assets, including LPT. However, the hacker only moved the victim’s AAVE tokens, as it was the only token targeted in the transfer.

The hacker is yet to be identified, and the victim has limited options to recover the stolen funds as of now.

Approval phishing scams are a serious threat to crypto holders

According to a report from Chainalysis, the crypto space has lost about $1 billion to approval phishing scams since May 2021, with $374 million lost in 2023 alone.

While approval phishing as a scamming tactic has been around for many years, scammers historically targeted crypto users via the spread of fake crypto apps. Their techniques have become even more effective as the space evolves.

Usually, scammers trick victims into sending them cryptocurrency via a phony investment opportunity or by impersonating somebody else. However, where approval phishing scam is concerned, the scammer tricks the user into signing a malicious blockchain transaction that gives the scammer’s address approval to spend specific tokens from the victim’s wallet. This gives the scammer access to drain the victim’s address of those tokens at will.

Generally, approval phishers send the victim’s funds to a separate wallet from the one granted approval to make transactions on the victim’s behalf. The on-chain pattern typically sees the victim address sign a transaction approving the second address to spend its funds, after which the second address, an approved spender address, executes the transaction to move the funds to a new destination address.

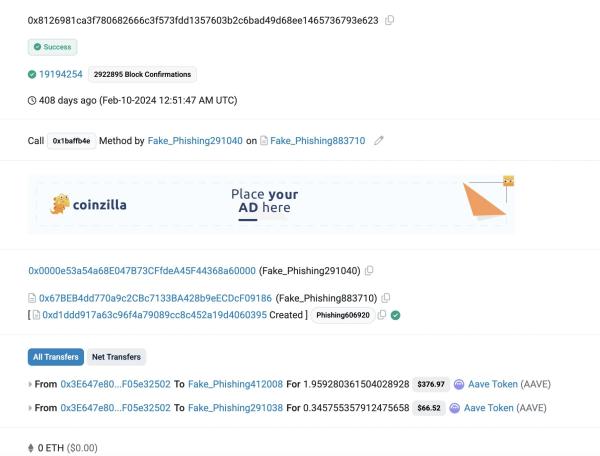

Principal security researcher for Metamask, Taylor Monahan (aka @tayvano_) is one of those tracking romance scam-style approval phishing with the custom Dune Analytics dashboard.

Taylor Monahan shared an example of a phishing email. Source: @tayvano_ (X/Twitter)

Victims of these romance scammers have reportedly lost approximately $1 billion to approval phishing scams since May 2021. It’s crucial to note that the $1 billion total is an estimate based on on-chain patterns. Some of it could represent the laundering of funds already controlled by the scammers.

This is because romance scams go notoriously underreported, and the analysis that yielded those results began from a limited set of reported instances.

It is believed that the vast majority of approval phishing scams are carried out by a few very successful actors, and addressing the problem can be done in various ways, from user education to employing pattern recognition tactics.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  USDC

USDC  Solana

Solana  TRON

TRON  Lido Staked Ether

Lido Staked Ether  Figure Heloc

Figure Heloc  Dogecoin

Dogecoin  WhiteBIT Coin

WhiteBIT Coin  Cardano

Cardano  USDS

USDS  Bitcoin Cash

Bitcoin Cash  Wrapped stETH

Wrapped stETH  LEO Token

LEO Token  Hyperliquid

Hyperliquid  Wrapped Bitcoin

Wrapped Bitcoin  Monero

Monero  Binance Bridged USDT (BNB Smart Chain)

Binance Bridged USDT (BNB Smart Chain)  Chainlink

Chainlink  Ethena USDe

Ethena USDe  Canton

Canton  Stellar

Stellar  Wrapped eETH

Wrapped eETH  USD1

USD1  Rain

Rain  sUSDS

sUSDS  Hedera

Hedera  PayPal USD

PayPal USD  Dai

Dai  Coinbase Wrapped BTC

Coinbase Wrapped BTC  Litecoin

Litecoin  Avalanche

Avalanche  Zcash

Zcash  WETH

WETH  Sui

Sui  Shiba Inu

Shiba Inu  Cronos

Cronos  USDT0

USDT0  Tether Gold

Tether Gold  World Liberty Financial

World Liberty Financial  Toncoin

Toncoin  MemeCore

MemeCore  Polkadot

Polkadot  PAX Gold

PAX Gold  Uniswap

Uniswap  Ethena Staked USDe

Ethena Staked USDe  Mantle

Mantle  BlackRock USD Institutional Digital Liquidity Fund

BlackRock USD Institutional Digital Liquidity Fund  Circle USYC

Circle USYC  Global Dollar

Global Dollar  Aave

Aave  Bittensor

Bittensor  Falcon USD

Falcon USD  Aster

Aster  OKB

OKB  Pi Network

Pi Network  Sky

Sky  syrupUSDC

syrupUSDC  NEAR Protocol

NEAR Protocol  Ripple USD

Ripple USD  Bitget Token

Bitget Token  Pepe

Pepe  HTX DAO

HTX DAO  Ethereum Classic

Ethereum Classic  Internet Computer

Internet Computer  BFUSD

BFUSD  Ondo

Ondo  Pump.fun

Pump.fun  Superstate Short Duration U.S. Government Securities Fund (USTB)

Superstate Short Duration U.S. Government Securities Fund (USTB)  POL (ex-MATIC)

POL (ex-MATIC)  Gate

Gate  Worldcoin

Worldcoin  KuCoin

KuCoin  Jupiter Perpetuals Liquidity Provider Token

Jupiter Perpetuals Liquidity Provider Token  Midnight

Midnight  Quant

Quant  Cosmos Hub

Cosmos Hub  Jito Staked SOL

Jito Staked SOL  Ethena

Ethena  NEXO

NEXO  USDtb

USDtb  Official Trump

Official Trump  Binance-Peg WETH

Binance-Peg WETH  Rocket Pool ETH

Rocket Pool ETH  Spiko EU T-Bills Money Market Fund

Spiko EU T-Bills Money Market Fund  Binance Bridged USDC (BNB Smart Chain)

Binance Bridged USDC (BNB Smart Chain)  Algorand

Algorand  OUSG

OUSG  Wrapped BNB

Wrapped BNB  Filecoin

Filecoin  Function FBTC

Function FBTC  Aptos

Aptos  Janus Henderson Anemoy AAA CLO Fund

Janus Henderson Anemoy AAA CLO Fund  USDD

USDD  Render

Render  Ondo US Dollar Yield

Ondo US Dollar Yield  syrupUSDT

syrupUSDT  Stable

Stable  VeChain

VeChain  Binance Staked SOL

Binance Staked SOL  Beldex

Beldex  Arbitrum

Arbitrum  Jupiter

Jupiter  YLDS

YLDS  Janus Henderson Anemoy Treasury Fund

Janus Henderson Anemoy Treasury Fund  Usual USD

Usual USD  Polygon Bridged USDC (Polygon PoS)

Polygon Bridged USDC (Polygon PoS)  pippin

pippin  Solv Protocol BTC

Solv Protocol BTC  Decred

Decred  Lombard Staked BTC

Lombard Staked BTC  Bonk

Bonk  GHO

GHO  A7A5

A7A5  clBTC

clBTC  TrueUSD

TrueUSD  Stacks

Stacks  Sei

Sei  EURC

EURC  Virtuals Protocol

Virtuals Protocol  StakeWise Staked ETH

StakeWise Staked ETH  USDai

USDai  Kinetiq Staked HYPE

Kinetiq Staked HYPE  PancakeSwap

PancakeSwap  tBTC

tBTC  Pudgy Penguins

Pudgy Penguins  WrappedM by M0

WrappedM by M0  JUST

JUST  Dash

Dash  Kinesis Gold

Kinesis Gold  Tezos

Tezos  LayerZero

LayerZero  Ether.fi

Ether.fi  Mantle Staked Ether

Mantle Staked Ether  Power Protocol

Power Protocol  Curve DAO

Curve DAO  Polygon PoS Bridged DAI (Polygon POS)

Polygon PoS Bridged DAI (Polygon POS)  c8ntinuum

c8ntinuum  Resolv wstUSR

Resolv wstUSR  COCA

COCA  Lighter

Lighter  Chiliz

Chiliz  Artificial Superintelligence Alliance

Artificial Superintelligence Alliance  Liquid Staked ETH

Liquid Staked ETH  Gnosis

Gnosis  Arbitrum Bridged WBTC (Arbitrum One)

Arbitrum Bridged WBTC (Arbitrum One)  PRIME

PRIME  BitTorrent

BitTorrent  AINFT

AINFT  ADI

ADI  Wrapped Flare

Wrapped Flare  Kaia

Kaia  Aerodrome Finance

Aerodrome Finance  L2 Standard Bridged WETH (Base)

L2 Standard Bridged WETH (Base)  Bitcoin SV

Bitcoin SV  Steakhouse USDC Morpho Vault

Steakhouse USDC Morpho Vault  Injective

Injective  Story

Story  SPX6900

SPX6900  Venice Token

Venice Token  Sun Token

Sun Token  Binance-Peg XRP

Binance-Peg XRP  Celestia

Celestia  Ether.Fi Liquid ETH

Ether.Fi Liquid ETH  IOTA

IOTA  Renzo Restaked ETH

Renzo Restaked ETH  crvUSD

crvUSD  Pyth Network

Pyth Network  sBTC

sBTC  The Graph

The Graph  River

River  Legacy Frax Dollar

Legacy Frax Dollar  Jupiter Staked SOL

Jupiter Staked SOL  Olympus

Olympus  Savings USDD

Savings USDD  Maple Finance

Maple Finance  FLOKI

FLOKI  JasmyCoin

JasmyCoin  Marinade Staked SOL

Marinade Staked SOL  Optimism

Optimism  Arbitrum Bridged WETH (Arbitrum One)

Arbitrum Bridged WETH (Arbitrum One)  Lido DAO

Lido DAO  DoubleZero

DoubleZero  BTSE Token

BTSE Token  Conflux

Conflux  Staked Aave

Staked Aave