Over $689M in Crypto Positions Liquidated as Traders Face Heavy Losses

- Over $689M liquidated in 24h as 267K traders hit by leveraged crypto sell-off.

- BTC and ETH led liquidation losses with $153M and $125M wiped out respectively.

- Longs dominated liquidations on Binance and Bitrue, revealing failed bullish bets.

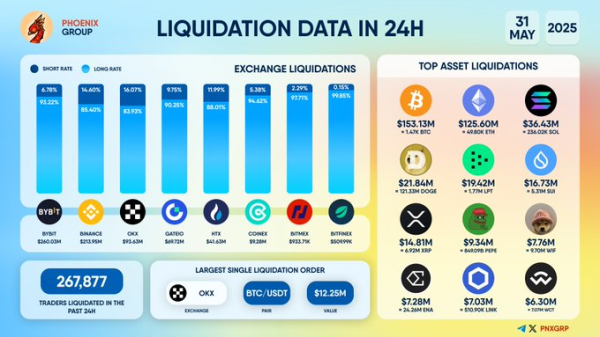

A wave of forced liquidations surged through the crypto market on May 31, 2025, wiping out more than $689.68 million in positions within a 24-hour window. According to data from Phoenix Group, a total of 267,877 traders were affected as a result of sharp price movements and excessive leverage across major exchanges. Bitcoin led the liquidation charts, with losses totaling $153.13 million, followed closely by Ethereum and Solana.

LIQUIDATION DATA IN 24 HOURS

TOTAL LIQUIDATIONS: UP TO $689.68M

TOP 5 COINS WITH HIGHEST LIQUIDATION: $BTC ~ $153.13M… pic.twitter.com/XidDnI6QWt

— PHOENIX – Crypto News & Analytics (@pnxgrp) May 31, 2025

Bitcoin accounted for the largest share of liquidations, reflecting its high trading volume and leverage exposure. Ethereum followed with $125.60 million in liquidated positions. Other major tokens impacted included Solana, which saw $36.43 million in losses, and Dogecoin, which recorded $21.84 million in liquidations. Livepeer (LPT) also made the top five with $19.42 million in wiped-out positions.

The data further shows losses in highly speculative tokens. Meme coins like PEPE and FLOKI registered $7.76 million and $6.30 million in liquidations, respectively, showing that retail traders with exposure to volatile assets faced severe losses during the price downturn.

Bybit, Binance, and OKX Lead Exchange Liquidation Totals

Bybit emerged as the exchange with the highest liquidation activity, recording $260.03 million in total losses. Binance followed with $213.59 million, and OKX saw $195.45 million in liquidated positions. GATEIO and HTX reported smaller yet significant figures, with $62.74 million and $41.64 million, respectively.

Source: X

The largest single liquidation order occurred on OKX, involving a BTC/USDT trade worth $12.25 million. This individual liquidation underscores the scale of exposure some traders carried during the volatile session.

Exchange-Specific Position Trends

Short and long position imbalances varied greatly by platform. On Bybit, 78.75% of liquidations came from short positions. Meanwhile, Binance and HTX saw the majority of liquidations from long positions, with 85.40% and 91.62% respectively. This shift reflects conflicting expectations among traders across different exchanges, some of whom were caught on the wrong side of rapid market movements.

Among all exchanges, Bitrue showed an overwhelming bias, with 99.85% of liquidated positions being long. As a result, there was increased bullish enthusiasm among altcoins, but this evidently could not hold in the face of higher volatility.

The data points out that leverage is high and risk controls are insufficient among market participants. Traders who owned too much of smaller-cap and meme tokens suffered significant drops since the prices fell and their margin calls led to quick liquidations.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  USDC

USDC  Solana

Solana  TRON

TRON  Lido Staked Ether

Lido Staked Ether  Dogecoin

Dogecoin  Figure Heloc

Figure Heloc  WhiteBIT Coin

WhiteBIT Coin  Cardano

Cardano  USDS

USDS  Bitcoin Cash

Bitcoin Cash  Wrapped stETH

Wrapped stETH  LEO Token

LEO Token  Hyperliquid

Hyperliquid  Wrapped Bitcoin

Wrapped Bitcoin  Chainlink

Chainlink  Binance Bridged USDT (BNB Smart Chain)

Binance Bridged USDT (BNB Smart Chain)  Monero

Monero  Canton

Canton  Ethena USDe

Ethena USDe  Stellar

Stellar  Wrapped eETH

Wrapped eETH  USD1

USD1  Rain

Rain  sUSDS

sUSDS  Hedera

Hedera  Litecoin

Litecoin  PayPal USD

PayPal USD  Coinbase Wrapped BTC

Coinbase Wrapped BTC  Dai

Dai  Avalanche

Avalanche  Zcash

Zcash  WETH

WETH  Sui

Sui  Shiba Inu

Shiba Inu  Cronos

Cronos  USDT0

USDT0  World Liberty Financial

World Liberty Financial  Toncoin

Toncoin  Tether Gold

Tether Gold  Polkadot

Polkadot  MemeCore

MemeCore  PAX Gold

PAX Gold  Uniswap

Uniswap  Ethena Staked USDe

Ethena Staked USDe  Mantle

Mantle  BlackRock USD Institutional Digital Liquidity Fund

BlackRock USD Institutional Digital Liquidity Fund  Circle USYC

Circle USYC  Aster

Aster  Bittensor

Bittensor  Aave

Aave  Global Dollar

Global Dollar  Falcon USD

Falcon USD  OKB

OKB  Pi Network

Pi Network  Sky

Sky  syrupUSDC

syrupUSDC  Pepe

Pepe  Bitget Token

Bitget Token  NEAR Protocol

NEAR Protocol  Ripple USD

Ripple USD  HTX DAO

HTX DAO  Internet Computer

Internet Computer  Ethereum Classic

Ethereum Classic  BFUSD

BFUSD  Ondo

Ondo  POL (ex-MATIC)

POL (ex-MATIC)  Worldcoin

Worldcoin  Pump.fun

Pump.fun  Superstate Short Duration U.S. Government Securities Fund (USTB)

Superstate Short Duration U.S. Government Securities Fund (USTB)  Gate

Gate  KuCoin

KuCoin  Jupiter Perpetuals Liquidity Provider Token

Jupiter Perpetuals Liquidity Provider Token  Midnight

Midnight  Cosmos Hub

Cosmos Hub  Jito Staked SOL

Jito Staked SOL  NEXO

NEXO  Ethena

Ethena  Official Trump

Official Trump  USDtb

USDtb  Binance-Peg WETH

Binance-Peg WETH  Rocket Pool ETH

Rocket Pool ETH  Algorand

Algorand  Binance Bridged USDC (BNB Smart Chain)

Binance Bridged USDC (BNB Smart Chain)  Spiko EU T-Bills Money Market Fund

Spiko EU T-Bills Money Market Fund  Filecoin

Filecoin  Wrapped BNB

Wrapped BNB  OUSG

OUSG  Function FBTC

Function FBTC  Aptos

Aptos  Render

Render  USDD

USDD  Janus Henderson Anemoy AAA CLO Fund

Janus Henderson Anemoy AAA CLO Fund  Stable

Stable  syrupUSDT

syrupUSDT  Ondo US Dollar Yield

Ondo US Dollar Yield  VeChain

VeChain  Binance Staked SOL

Binance Staked SOL  Arbitrum

Arbitrum  Beldex

Beldex  Jupiter

Jupiter  pippin

pippin  Janus Henderson Anemoy Treasury Fund

Janus Henderson Anemoy Treasury Fund  Decred

Decred  Polygon Bridged USDC (Polygon PoS)

Polygon Bridged USDC (Polygon PoS)  Usual USD

Usual USD  Solv Protocol BTC

Solv Protocol BTC  Bonk

Bonk  Lombard Staked BTC

Lombard Staked BTC  GHO

GHO  A7A5

A7A5  TrueUSD

TrueUSD  clBTC

clBTC  Stacks

Stacks  Virtuals Protocol

Virtuals Protocol  Sei

Sei  EURC

EURC  StakeWise Staked ETH

StakeWise Staked ETH  USDai

USDai  Pudgy Penguins

Pudgy Penguins  Kinetiq Staked HYPE

Kinetiq Staked HYPE  PancakeSwap

PancakeSwap  tBTC

tBTC  Dash

Dash  WrappedM by M0

WrappedM by M0  JUST

JUST  Tezos

Tezos  Kinesis Gold

Kinesis Gold  Power Protocol

Power Protocol  Ether.fi

Ether.fi  Curve DAO

Curve DAO  Mantle Staked Ether

Mantle Staked Ether  c8ntinuum

c8ntinuum  LayerZero

LayerZero  Polygon PoS Bridged DAI (Polygon POS)

Polygon PoS Bridged DAI (Polygon POS)  Artificial Superintelligence Alliance

Artificial Superintelligence Alliance  Resolv wstUSR

Resolv wstUSR  Chiliz

Chiliz  COCA

COCA  Lighter

Lighter  Gnosis

Gnosis  Liquid Staked ETH

Liquid Staked ETH  Aerodrome Finance

Aerodrome Finance  Arbitrum Bridged WBTC (Arbitrum One)

Arbitrum Bridged WBTC (Arbitrum One)  PRIME

PRIME  BitTorrent

BitTorrent  ADI

ADI  Story

Story  Wrapped Flare

Wrapped Flare  AINFT

AINFT  Kaia

Kaia  L2 Standard Bridged WETH (Base)

L2 Standard Bridged WETH (Base)  Bitcoin SV

Bitcoin SV  Steakhouse USDC Morpho Vault

Steakhouse USDC Morpho Vault  Injective

Injective  SPX6900

SPX6900  Sun Token

Sun Token  IOTA

IOTA  Celestia

Celestia  Binance-Peg XRP

Binance-Peg XRP  Pyth Network

Pyth Network  Ether.Fi Liquid ETH

Ether.Fi Liquid ETH  The Graph

The Graph  Renzo Restaked ETH

Renzo Restaked ETH  crvUSD

crvUSD  JasmyCoin

JasmyCoin  sBTC

sBTC  FLOKI

FLOKI  Olympus

Olympus  Legacy Frax Dollar

Legacy Frax Dollar  Jupiter Staked SOL

Jupiter Staked SOL  Maple Finance

Maple Finance  Savings USDD

Savings USDD  DoubleZero

DoubleZero  Lido DAO

Lido DAO  Optimism

Optimism  Marinade Staked SOL

Marinade Staked SOL  Conflux

Conflux  Arbitrum Bridged WETH (Arbitrum One)

Arbitrum Bridged WETH (Arbitrum One)  Telcoin

Telcoin  River

River  BTSE Token

BTSE Token  Venice Token

Venice Token  Staked Aave

Staked Aave  Helium

Helium