Is Bitcoin’s Bull Run Here to Stay? Insights from the Latest CryptoQuant Report

A recent analysis by a CryptoQuant analyst, presented on the QuickTake platform, sheds light on the critical indicators influencing Bitcoin’s current market stance. The report titled “Bitcoin Market Recovery Phase: Have We Reached a Bullish Normalcy or Is There Still Potential for a Decline?” provides a nuanced look at the factors that could dictate Bitcoin’s short-term future.

The analysis focuses primarily on the Market Value to Realized Value (MVRV) Ratio, which measures the disparity between Bitcoin’s market price and the realized price of Bitcoin holders, specifically targeting short-term holders.

Observations suggest that Bitcoin has consistently stayed above the average cost basis of these short-term holders, a bullish signal that typically encourages further capital inflows from new and existing investors. This aspect of holding above the cost basis is vital as it underscores a potential sustained bullish market sentiment, necessary for attracting ongoing investment.

Have We Reached a Bullish Normalcy or Is There Still Potential for a Decline?

“Historical #Bitcoin price cycles, based on holder behavior logic, emphasize the importance of price stabilization and a bullish market sentiment above the average cost basis of short-term investors.”… pic.twitter.com/BPUe240fR9

— CryptoQuant.com (@cryptoquant_com) July 22, 2024

Analyzing Holder Profitability and Market Sentiments

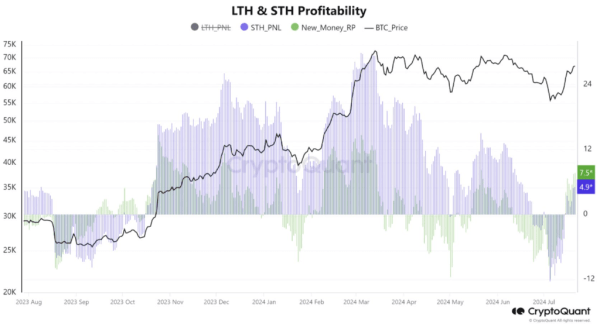

The report delves deeper into the profitability of holders, distinguishing between short-term holders (less than six months) and very new market entrants (less than one month).

The data illustrates that holders within these time frames are seeing average profits of 5% and 7.5%, respectively. Such profitability metrics are crucial as they reflect the recent entrants’ confidence and satisfaction with their investment decisions, potentially influencing their future market actions.

Furthermore, the Spent Output Profit Ratio (SOPR) metric, which assesses the profit or loss status of transacted Bitcoin, indicates a predominantly profitable disposition for most Bitcoins being moved. This trend points towards a recovering market where the majority of transactions are profitable, further reinforcing the notion of a positive market phase.

The implications of these metrics extend beyond mere numbers. They serve as a barometer for underlying market dynamics, influencing strategic investment decisions. Historical data on Bitcoin’s price cycles suggest that stability above the average cost basis is pivotal for maintaining a bullish atmosphere. It is in these phases that Bitcoin has historically seen sustained growth and increased investor participation.

The current market conditions, as outlined by the CryptoQuant analysis, pose the crucial question of whether Bitcoin can maintain this recovery trajectory. Investors are advised to exercise caution and avoid rash decisions. The potential for price stabilization remains contingent on continuous investor confidence and the absence of large-scale liquidity exits at break even points.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  USDC

USDC  Solana

Solana  JUSD

JUSD  TRON

TRON  Lido Staked Ether

Lido Staked Ether  Dogecoin

Dogecoin  Figure Heloc

Figure Heloc  Cardano

Cardano  WhiteBIT Coin

WhiteBIT Coin  Bitcoin Cash

Bitcoin Cash  Wrapped stETH

Wrapped stETH  Wrapped Bitcoin

Wrapped Bitcoin  USDS

USDS  Binance Bridged USDT (BNB Smart Chain)

Binance Bridged USDT (BNB Smart Chain)  Hyperliquid

Hyperliquid  LEO Token

LEO Token  Wrapped eETH

Wrapped eETH  Canton

Canton  Monero

Monero  Chainlink

Chainlink  Ethena USDe

Ethena USDe  Coinbase Wrapped BTC

Coinbase Wrapped BTC  Stellar

Stellar  WETH

WETH  USD1

USD1  Zcash

Zcash  Litecoin

Litecoin  Sui

Sui  Avalanche

Avalanche  Dai

Dai  USDT0

USDT0  sUSDS

sUSDS  Shiba Inu

Shiba Inu  Hedera

Hedera  Ethena Staked USDe

Ethena Staked USDe  PayPal USD

PayPal USD  World Liberty Financial

World Liberty Financial  Tether Gold

Tether Gold  Toncoin

Toncoin  Cronos

Cronos  Rain

Rain  MemeCore

MemeCore  Polkadot

Polkadot  Uniswap

Uniswap  Mantle

Mantle  PAX Gold

PAX Gold  Bitget Token

Bitget Token  Falcon USD

Falcon USD  Aave

Aave  Bittensor

Bittensor  OKB

OKB  Pepe

Pepe  BlackRock USD Institutional Digital Liquidity Fund

BlackRock USD Institutional Digital Liquidity Fund  Circle USYC

Circle USYC  HTX DAO

HTX DAO  Global Dollar

Global Dollar  NEAR Protocol

NEAR Protocol  Jupiter Perpetuals Liquidity Provider Token

Jupiter Perpetuals Liquidity Provider Token  Ethereum Classic

Ethereum Classic  Internet Computer

Internet Computer  syrupUSDC

syrupUSDC  Jito Staked SOL

Jito Staked SOL  Ripple USD

Ripple USD  Aster

Aster  Pump.fun

Pump.fun  Sky

Sky  Pi Network

Pi Network  Ondo

Ondo  Binance-Peg WETH

Binance-Peg WETH  BFUSD

BFUSD  Binance Bridged USDC (BNB Smart Chain)

Binance Bridged USDC (BNB Smart Chain)  KuCoin

KuCoin  Wrapped BNB

Wrapped BNB  POL (ex-MATIC)

POL (ex-MATIC)  Worldcoin

Worldcoin  Gate

Gate  MYX Finance

MYX Finance  Ethena

Ethena  Binance Staked SOL

Binance Staked SOL  USDD

USDD  Cosmos Hub

Cosmos Hub  Quant

Quant  Official Trump

Official Trump  Aptos

Aptos  Rocket Pool ETH

Rocket Pool ETH  Algorand

Algorand  Lombard Staked BTC

Lombard Staked BTC  USDtb

USDtb  Polygon Bridged USDC (Polygon PoS)

Polygon Bridged USDC (Polygon PoS)  Function FBTC

Function FBTC  Kinetiq Staked HYPE

Kinetiq Staked HYPE  Superstate Short Duration U.S. Government Securities Fund (USTB)

Superstate Short Duration U.S. Government Securities Fund (USTB)  Midnight

Midnight  Render

Render  NEXO

NEXO  syrupUSDT

syrupUSDT  Filecoin

Filecoin  Arbitrum

Arbitrum  VeChain

VeChain  WrappedM by M0

WrappedM by M0  Janus Henderson Anemoy AAA CLO Fund

Janus Henderson Anemoy AAA CLO Fund  Ondo US Dollar Yield

Ondo US Dollar Yield  OUSG

OUSG  Spiko EU T-Bills Money Market Fund

Spiko EU T-Bills Money Market Fund  Mantle Staked Ether

Mantle Staked Ether  Jupiter

Jupiter  Solv Protocol BTC

Solv Protocol BTC  Bonk

Bonk  Polygon PoS Bridged DAI (Polygon POS)

Polygon PoS Bridged DAI (Polygon POS)  COCA

COCA  Liquid Staked ETH

Liquid Staked ETH  USDai

USDai  Beldex

Beldex  Arbitrum Bridged WBTC (Arbitrum One)

Arbitrum Bridged WBTC (Arbitrum One)  clBTC

clBTC  Sei

Sei  Usual USD

Usual USD  Wrapped Flare

Wrapped Flare  Janus Henderson Anemoy Treasury Fund

Janus Henderson Anemoy Treasury Fund  L2 Standard Bridged WETH (Base)

L2 Standard Bridged WETH (Base)  Stacks

Stacks  Dash

Dash  StakeWise Staked ETH

StakeWise Staked ETH  Stable

Stable  PancakeSwap

PancakeSwap  Binance-Peg XRP

Binance-Peg XRP  Tezos

Tezos  Renzo Restaked ETH

Renzo Restaked ETH  GHO

GHO  Story

Story  A7A5

A7A5  Jupiter Staked SOL

Jupiter Staked SOL  TrueUSD

TrueUSD  Pudgy Penguins

Pudgy Penguins  tBTC

tBTC  Arbitrum Bridged WETH (Arbitrum One)

Arbitrum Bridged WETH (Arbitrum One)  Chiliz

Chiliz  Optimism

Optimism  c8ntinuum

c8ntinuum  Virtuals Protocol

Virtuals Protocol  EURC

EURC  Curve DAO

Curve DAO  Artificial Superintelligence Alliance

Artificial Superintelligence Alliance  Lighter

Lighter  Resolv USR

Resolv USR  GTETH

GTETH  Resolv wstUSR

Resolv wstUSR  Lorenzo Wrapped Bitcoin

Lorenzo Wrapped Bitcoin  DoubleZero

DoubleZero  Kinesis Gold

Kinesis Gold  LayerZero

LayerZero  Steakhouse USDC Morpho Vault

Steakhouse USDC Morpho Vault  JUST

JUST  Injective

Injective  Aerodrome Finance

Aerodrome Finance  Ether.Fi Liquid ETH

Ether.Fi Liquid ETH  Sun Token

Sun Token  Maple Finance

Maple Finance  sBTC

sBTC  Lido DAO

Lido DAO  Kaia

Kaia  Ether.fi

Ether.fi  Marinade Staked SOL

Marinade Staked SOL  AINFT

AINFT  BitTorrent

BitTorrent  FLOKI

FLOKI  Savings USDD

Savings USDD  Kinesis Silver

Kinesis Silver  Coinbase Wrapped Staked ETH

Coinbase Wrapped Staked ETH  Celestia

Celestia  Decred

Decred  The Graph

The Graph  Staked Aave

Staked Aave  IOTA

IOTA  Stader ETHx

Stader ETHx  Bitcoin SV

Bitcoin SV  Wrapped STX (Velar)

Wrapped STX (Velar)  Cap USD

Cap USD  JasmyCoin

JasmyCoin  crvUSD

crvUSD  ether.fi Staked ETH

ether.fi Staked ETH  Starknet

Starknet  Gnosis

Gnosis  Avalanche Bridged BTC (Avalanche)

Avalanche Bridged BTC (Avalanche)