Introducing the Bitcoin Everything Indicator

Wouldn’t it be great if we had one all-encompassing metric to guide our Bitcoin investing decisions? That’s precisely what has been created, the Bitcoin Everything Indicator. Recently added to Bitcoin Magazine Pro, this indicator aims to consolidate multiple metrics into a single framework, making Bitcoin analysis and investment decision-making more streamlined.

For a more in-depth look into this topic, check out a recent YouTube video here: The Official Bitcoin EVERYTHING Indicator

Why We Need a Comprehensive Indicator

Investors and analysts typically rely on various metrics, such as on-chain data, technical analysis, and derivative charts. However, focusing too much on one aspect can lead to an incomplete understanding of Bitcoin’s price movements. The Bitcoin Everything Indicator attempts to solve this by integrating key components into one clear metric.

Figure 1: The new Bitcoin Everything Indicator.

View Live Chart ?

The Core Components of the Bitcoin Everything Indicator

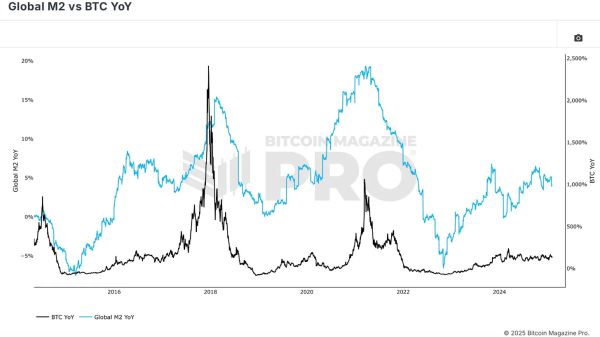

Bitcoin’s price action is deeply influenced by global liquidity cycles, making macroeconomic conditions a fundamental pillar of this indicator. The correlation between Bitcoin and broader financial markets, especially in terms of Global M2 money supply, is clear. When liquidity expands, Bitcoin typically appreciates.

Figure 2: Global Liquidity cycles have had a major influence on BTC price action.

View Live Chart ?

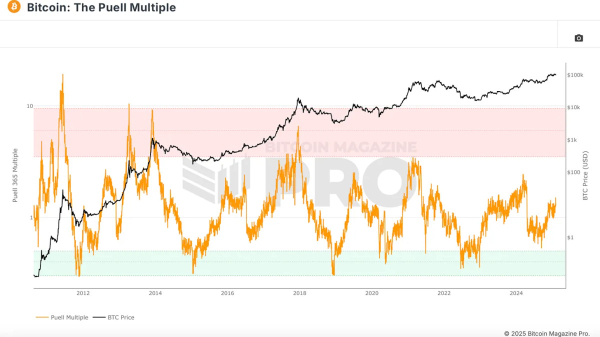

Fundamental factors like Bitcoin’s halving cycles and miner strength play an essential role in its valuation. While halvings decrease new Bitcoin supply, their impact on price appreciation has diminished as over 94% of Bitcoin’s total supply is already in circulation. However, miner profitability remains crucial. The Puell Multiple, which measures miner revenue relative to historical averages, provides insights into market cycles. Historically, when miner profitability is strong, Bitcoin tends to be in a favorable position.

Figure 3: BTC miner profitability has been an accurate gauge of network health.

View Live Chart ?

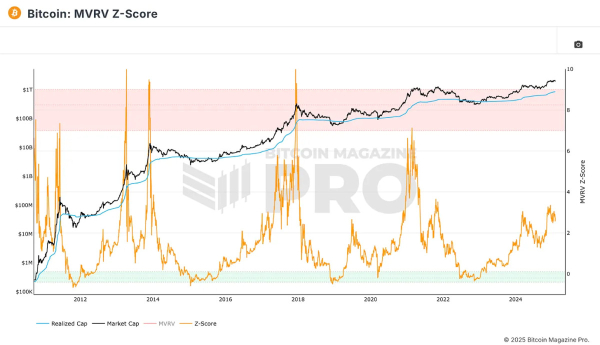

On-chain indicators help assess Bitcoin’s supply and demand dynamics. The MVRV Z-Score, for example, compares Bitcoin’s market cap to its realized cap (average purchase price of all coins). This metric identifies accumulation and distribution zones, highlighting when Bitcoin is overvalued or undervalued.

Figure 4: The MVRV Z-Score has historically been one of the most accurate cycle metrics.

View Live Chart ?

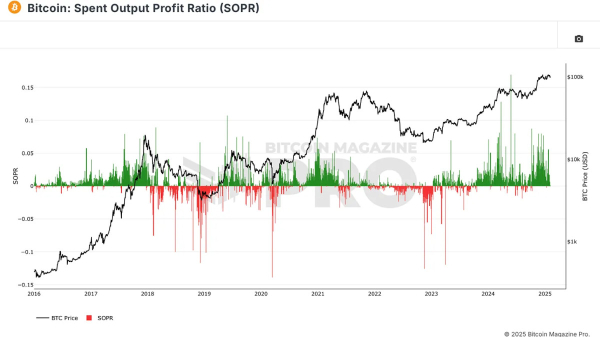

Another critical on-chain metric is the Spent Output Profit Ratio (SOPR), which examines the profitability of coins being spent. When Bitcoin holders realize massive profits, it often signals a market peak, whereas high losses indicate a market bottom.

Figure 5: SOPR gives insight into real-time realized investor profits and losses.

View Live Chart ?

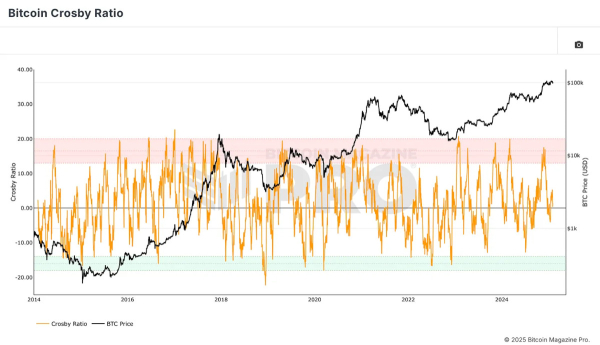

The Bitcoin Crosby Ratio is a technical metric that assesses Bitcoin’s overextended or discounted conditions purely based on price action. This ensures that market sentiment and momentum are also accounted for in the Bitcoin Everything Indicator.

Figure 6: The Crosby Ratio has technically identified peaks and bottoms for BTC.

View Live Chart ?

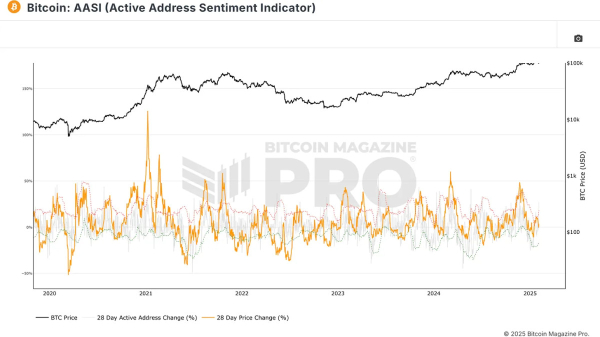

Network usage can offer vital clues about Bitcoin’s strength. The Active Address Sentiment Indicator measures the percentage change in active addresses over 28 days. A rise in active addresses generally confirms a bullish trend, while stagnation or decline may signal price weakness.

Figure 7: AASI monitors underlying network utilization.

View Live Chart ?

How the Bitcoin Everything Indicator Works

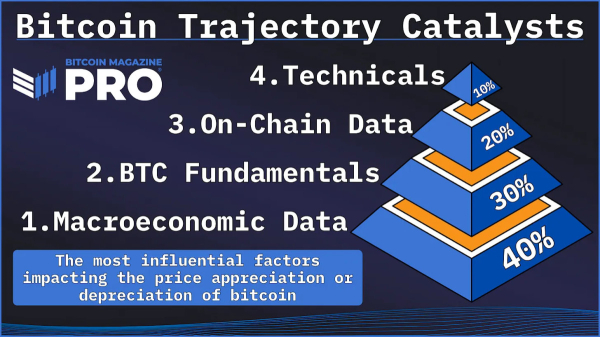

By blending these various metrics, the Bitcoin Everything Indicator ensures that no single factor is given undue weight. Unlike models that rely too heavily on specific signals, such as the MVRV Z-Score or the Pi Cycle Top, this indicator distributes influence equally across multiple categories. This prevents overfitting and allows the model to adapt to changing market conditions.

Figure 8: The most influential factors impacting the price of bitcoin.

Historical Performance vs. Buy-and-Hold Strategy

One of the most striking findings is that the Bitcoin Everything Indicator has outperformed a simple buy-and-hold strategy since Bitcoin was valued at under $6. Using a strategy of accumulating Bitcoin during oversold conditions and gradually selling in overbought zones, investors using this model would have significantly increased their portfolio’s performance with lower drawdowns.

Figure 9: Investing using this metric has outperformed buy & hold since 2011.

For instance, this model maintains a 20% drawdown compared to the 60-90% declines typically seen in Bitcoin’s history. This suggests that a well-balanced,>Bitcoin Magazine Pro.

Disclaimer: This article is for informational purposes only and should not be considered financial advice. Always do your own research before making any investment decisions.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  USDC

USDC  JUSD

JUSD  TRON

TRON  Lido Staked Ether

Lido Staked Ether  Dogecoin

Dogecoin  Figure Heloc

Figure Heloc  Cardano

Cardano  Wrapped stETH

Wrapped stETH  Bitcoin Cash

Bitcoin Cash  WhiteBIT Coin

WhiteBIT Coin  Wrapped Bitcoin

Wrapped Bitcoin  USDS

USDS  Wrapped eETH

Wrapped eETH  Binance Bridged USDT (BNB Smart Chain)

Binance Bridged USDT (BNB Smart Chain)  LEO Token

LEO Token  Monero

Monero  Chainlink

Chainlink  Hyperliquid

Hyperliquid  Coinbase Wrapped BTC

Coinbase Wrapped BTC  Canton

Canton  Ethena USDe

Ethena USDe  Stellar

Stellar  WETH

WETH  Zcash

Zcash  Litecoin

Litecoin  USD1

USD1  Sui

Sui  Avalanche

Avalanche  USDT0

USDT0  Hedera

Hedera  Dai

Dai  sUSDS

sUSDS  Shiba Inu

Shiba Inu  World Liberty Financial

World Liberty Financial  PayPal USD

PayPal USD  Ethena Staked USDe

Ethena Staked USDe  Toncoin

Toncoin  Cronos

Cronos  Rain

Rain  Polkadot

Polkadot  Tether Gold

Tether Gold  Uniswap

Uniswap  Mantle

Mantle  MemeCore

MemeCore  Bitget Token

Bitget Token  PAX Gold

PAX Gold  Aave

Aave  Falcon USD

Falcon USD  OKB

OKB  Bittensor

Bittensor  Pepe

Pepe  NEAR Protocol

NEAR Protocol  Binance-Peg WETH

Binance-Peg WETH  BlackRock USD Institutional Digital Liquidity Fund

BlackRock USD Institutional Digital Liquidity Fund  Jupiter Perpetuals Liquidity Provider Token

Jupiter Perpetuals Liquidity Provider Token  Internet Computer

Internet Computer  Pump.fun

Pump.fun  Ethereum Classic

Ethereum Classic  Jito Staked SOL

Jito Staked SOL  HTX DAO

HTX DAO  Circle USYC

Circle USYC  Global Dollar

Global Dollar  Ondo

Ondo  Aster

Aster  Sky

Sky  Solana

Solana  Ripple USD

Ripple USD  syrupUSDC

syrupUSDC  Pi Network

Pi Network  KuCoin

KuCoin  Worldcoin

Worldcoin  Wrapped BNB

Wrapped BNB  BFUSD

BFUSD  Binance Bridged USDC (BNB Smart Chain)

Binance Bridged USDC (BNB Smart Chain)  Binance Staked SOL

Binance Staked SOL  Ethena

Ethena  POL (ex-MATIC)

POL (ex-MATIC)  Rocket Pool ETH

Rocket Pool ETH  Aptos

Aptos  Gate

Gate  USDD

USDD  Quant

Quant  Cosmos Hub

Cosmos Hub  MYX Finance

MYX Finance  Algorand

Algorand  Lombard Staked BTC

Lombard Staked BTC  Function FBTC

Function FBTC  Arbitrum

Arbitrum  Official Trump

Official Trump  Render

Render  NEXO

NEXO  Midnight

Midnight  River

River  Filecoin

Filecoin  USDtb

USDtb  Polygon Bridged USDC (Polygon PoS)

Polygon Bridged USDC (Polygon PoS)  Superstate Short Duration U.S. Government Securities Fund (USTB)

Superstate Short Duration U.S. Government Securities Fund (USTB)  VeChain

VeChain  Mantle Staked Ether

Mantle Staked Ether  syrupUSDT

syrupUSDT  Liquid Staked ETH

Liquid Staked ETH  WrappedM by M0

WrappedM by M0  Janus Henderson Anemoy AAA CLO Fund

Janus Henderson Anemoy AAA CLO Fund  Bonk

Bonk  Kinetiq Staked HYPE

Kinetiq Staked HYPE  Ondo US Dollar Yield

Ondo US Dollar Yield  OUSG

OUSG  Dash

Dash  Solv Protocol BTC

Solv Protocol BTC  Story

Story  Arbitrum Bridged WBTC (Arbitrum One)

Arbitrum Bridged WBTC (Arbitrum One)  Sei

Sei  clBTC

clBTC  StakeWise Staked ETH

StakeWise Staked ETH  Spiko EU T-Bills Money Market Fund

Spiko EU T-Bills Money Market Fund  Jupiter

Jupiter  Polygon PoS Bridged DAI (Polygon POS)

Polygon PoS Bridged DAI (Polygon POS)  Renzo Restaked ETH

Renzo Restaked ETH  L2 Standard Bridged WETH (Base)

L2 Standard Bridged WETH (Base)  USDai

USDai  COCA

COCA  Beldex

Beldex  PancakeSwap

PancakeSwap  Wrapped Flare

Wrapped Flare  Binance-Peg XRP

Binance-Peg XRP  Jupiter Staked SOL

Jupiter Staked SOL  Usual USD

Usual USD  Pudgy Penguins

Pudgy Penguins  Arbitrum Bridged WETH (Arbitrum One)

Arbitrum Bridged WETH (Arbitrum One)  Tezos

Tezos  Janus Henderson Anemoy Treasury Fund

Janus Henderson Anemoy Treasury Fund  Optimism

Optimism  A7A5

A7A5  GHO

GHO  Virtuals Protocol

Virtuals Protocol  c8ntinuum

c8ntinuum  tBTC

tBTC  Stacks

Stacks  TrueUSD

TrueUSD  Artificial Superintelligence Alliance

Artificial Superintelligence Alliance  Curve DAO

Curve DAO  Chiliz

Chiliz  Stable

Stable  GTETH

GTETH  Lorenzo Wrapped Bitcoin

Lorenzo Wrapped Bitcoin  Kinesis Silver

Kinesis Silver  Ether.Fi Liquid ETH

Ether.Fi Liquid ETH  LayerZero

LayerZero  Steakhouse USDC Morpho Vault

Steakhouse USDC Morpho Vault  DoubleZero

DoubleZero  Kinesis Gold

Kinesis Gold  EURC

EURC  Resolv USR

Resolv USR  Injective

Injective  Lido DAO

Lido DAO  Coinbase Wrapped Staked ETH

Coinbase Wrapped Staked ETH  Lighter

Lighter  Marinade Staked SOL

Marinade Staked SOL  Resolv wstUSR

Resolv wstUSR  Ether.fi

Ether.fi  Maple Finance

Maple Finance  Aerodrome Finance

Aerodrome Finance  JUST

JUST  sBTC

sBTC  Stader ETHx

Stader ETHx  BitTorrent

BitTorrent  Axie Infinity

Axie Infinity  FLOKI

FLOKI  Sun Token

Sun Token  The Graph

The Graph  Staked Aave

Staked Aave  Celestia

Celestia  Gnosis

Gnosis  AINFT

AINFT  Pyth Network

Pyth Network  Trust Wallet

Trust Wallet  IOTA

IOTA  Bitcoin SV

Bitcoin SV  Kaia

Kaia  Cap USD

Cap USD  Wrapped ApeCoin

Wrapped ApeCoin  Starknet

Starknet  Conflux

Conflux  Telcoin

Telcoin  crvUSD

crvUSD