Bitcoin vs. Gold: Does October’s near zero correlation shatter ‘digital gold’ myth?

Bitcoin and gold have told two different stories so far in October, and neither matched what traders expected.

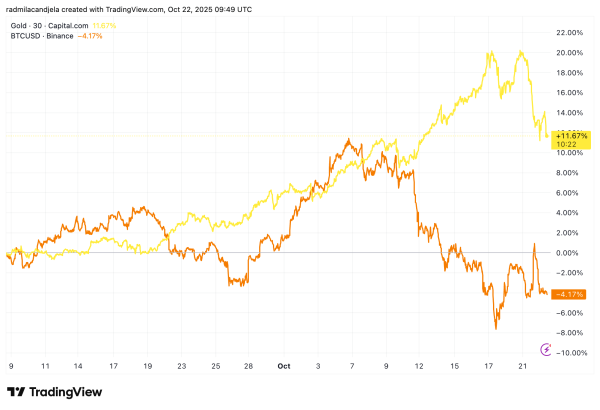

For most of October, Bitcoin and gold looked like they were living in different markets. Gold climbed steadily, adding about 10% over the last month, while Bitcoin slipped roughly 6%.

That divergence is interesting on its own, but the timing matters even more, because the story people think they saw isn’t the one that actually happened.

The common retelling is that gold dumped while Bitcoin rebounded, a classic “risk-on vs. safe haven” flip. But the data doesn’t line up that way. Gold’s big decline didn’t arrive until Oct. 21 to Oct. 22, when it fell over 5% in 24 hours.

Bitcoin didn’t surge into that weakness and instead dropped about 1.5% in the same window. The day Bitcoin really recovered its weekend losses was the day before, when gold was still rallying.

That sequencing turns the correlation story on its head. Instead of Bitcoin rallying as investors rotated out of metals, both assets moved in sync on Oct. 20 and most of Oct. 21. The later gold drawdown was an isolated metals move: a clean break from Bitcoin’s timeline, not an inverse trade.

However, Bitcoin did experience a short rally toward the end of Oct. 21 rallying 5% to $114,000 while gold continued to sell off. Unfortunately, the rally was short lived, with Bitcoin returning to $108,000 within 12 hours as gold continued to decline.

This matters for anyone still treating Bitcoin and gold as two ends of the same inflation hedge.

Over the last month, they’ve moved like different species: gold responding to rates and liquidity, Bitcoin to positioning and leverage. When you look under the hood, the on-chain data and derivatives flow tell you Bitcoin had already hit its short-term pain point by mid-October, when it briefly lost 17% from its local high.

Gold’s pain came five days later, after traders started trimming positions built through the earlier rally.

That lag explains why correlation metrics for the month barely register, hitting a shallow 0.1 between Bitcoin and gold. The low correlation shows temporal misalignment: the assets reacted to separate shocks spaced a few trading days apart.

Structurally, nothing was broken in gold’s crypto proxy either. The Bybit XAUTUSDT perpetual, a 24/7 gold contract priced in USDT, tracked the real-world spot price almost perfectly. There was no meaningful basis drift, no funding squeeze, no liquidity gap.

The move was about the broader gold market catching its breath after a relentless run. That tight tracking also shows how seamlessly tokenized commodity exposure now trades within crypto rails.

If you’re managing collateral or hedging inside the ecosystem, those perps give you round-the-clock coverage without dragging in futures expiry cycles.

For its part, Bitcoin did what you’d expect from a higher-volatility asset: it moved faster, hit its lows earlier, and found footing while gold was still peaking. By the time gold cracked, Bitcoin had already tested its support and stabilized above six figures. Its beta to gold (how much it moves when gold moves) was about 0.15, which is to say: only barely related.

That’s what makes the divergence interesting. For all the talk of “digital gold,” the two assets often live on different clocks. Gold trades in macro time, reacting to central bank moves and liquidity pulses.

Bitcoin trades in positioning time, where leverage, ETF flows, and on-chain distribution drive short-term volatility. The crossover moments when both respond to the same liquidity impulse are rarer than most investors assume.

What we saw this month is a reminder that correlation depends on the lens you use. Over a day, they can look uncoupled. Over a quarter, the shared inflation narrative might reassert itself. However, the October split shows how easily that narrative can fragment when one asset is driven by traditional funding markets and the other by crypto-native leverage.

The cleanest read? Bitcoin had its crash first, gold had its crash later. The link was chronological. And in a market where traders are still hunting for macro symmetry, sometimes the smartest play is simply noticing when two assets stop sharing the same clock.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  USDC

USDC  Solana

Solana  TRON

TRON  Lido Staked Ether

Lido Staked Ether  Figure Heloc

Figure Heloc  Dogecoin

Dogecoin  WhiteBIT Coin

WhiteBIT Coin  USDS

USDS  Cardano

Cardano  Bitcoin Cash

Bitcoin Cash  Wrapped stETH

Wrapped stETH  LEO Token

LEO Token  Hyperliquid

Hyperliquid  Wrapped Bitcoin

Wrapped Bitcoin  Monero

Monero  Binance Bridged USDT (BNB Smart Chain)

Binance Bridged USDT (BNB Smart Chain)  Chainlink

Chainlink  Ethena USDe

Ethena USDe  Canton

Canton  Stellar

Stellar  Wrapped eETH

Wrapped eETH  USD1

USD1  Rain

Rain  sUSDS

sUSDS  Dai

Dai  Hedera

Hedera  Litecoin

Litecoin  Coinbase Wrapped BTC

Coinbase Wrapped BTC  PayPal USD

PayPal USD  Avalanche

Avalanche  Sui

Sui  WETH

WETH  Zcash

Zcash  Toncoin

Toncoin  Shiba Inu

Shiba Inu  USDT0

USDT0  Cronos

Cronos  Tether Gold

Tether Gold  World Liberty Financial

World Liberty Financial  MemeCore

MemeCore  PAX Gold

PAX Gold  Polkadot

Polkadot  Uniswap

Uniswap  Ethena Staked USDe

Ethena Staked USDe  Mantle

Mantle  Pi Network

Pi Network  OKB

OKB  Circle USYC

Circle USYC  BlackRock USD Institutional Digital Liquidity Fund

BlackRock USD Institutional Digital Liquidity Fund  Bittensor

Bittensor  Falcon USD

Falcon USD  Aster

Aster  Global Dollar

Global Dollar  Aave

Aave  Sky

Sky  syrupUSDC

syrupUSDC  Ripple USD

Ripple USD  NEAR Protocol

NEAR Protocol  Bitget Token

Bitget Token  HTX DAO

HTX DAO  Pepe

Pepe  Internet Computer

Internet Computer  BFUSD

BFUSD  Ethereum Classic

Ethereum Classic  Ondo

Ondo  Gate

Gate  Pump.fun

Pump.fun  Worldcoin

Worldcoin  Superstate Short Duration U.S. Government Securities Fund (USTB)

Superstate Short Duration U.S. Government Securities Fund (USTB)  KuCoin

KuCoin  POL (ex-MATIC)

POL (ex-MATIC)  Jupiter Perpetuals Liquidity Provider Token

Jupiter Perpetuals Liquidity Provider Token  Midnight

Midnight  Quant

Quant  Ondo US Dollar Yield

Ondo US Dollar Yield  Cosmos Hub

Cosmos Hub  Jito Staked SOL

Jito Staked SOL  NEXO

NEXO  Spiko EU T-Bills Money Market Fund

Spiko EU T-Bills Money Market Fund  Ethena

Ethena  USDtb

USDtb  Binance-Peg WETH

Binance-Peg WETH  Rocket Pool ETH

Rocket Pool ETH  OUSG

OUSG  Binance Bridged USDC (BNB Smart Chain)

Binance Bridged USDC (BNB Smart Chain)  Janus Henderson Anemoy AAA CLO Fund

Janus Henderson Anemoy AAA CLO Fund  Algorand

Algorand  Wrapped BNB

Wrapped BNB  Function FBTC

Function FBTC  Aptos

Aptos  Filecoin

Filecoin  Render

Render  USDD

USDD  Official Trump

Official Trump  syrupUSDT

syrupUSDT  Jupiter

Jupiter  Beldex

Beldex  Binance Staked SOL

Binance Staked SOL  VeChain

VeChain  YLDS

YLDS  Stable

Stable  Arbitrum

Arbitrum  Janus Henderson Anemoy Treasury Fund

Janus Henderson Anemoy Treasury Fund  GHO

GHO  Polygon Bridged USDC (Polygon PoS)

Polygon Bridged USDC (Polygon PoS)  Usual USD

Usual USD  Solv Protocol BTC

Solv Protocol BTC  Bonk

Bonk  Lombard Staked BTC

Lombard Staked BTC  Decred

Decred  A7A5

A7A5  TrueUSD

TrueUSD  clBTC

clBTC  Stacks

Stacks  EURC

EURC  Virtuals Protocol

Virtuals Protocol  Sei

Sei  StakeWise Staked ETH

StakeWise Staked ETH  PancakeSwap

PancakeSwap  JUST

JUST  Kinetiq Staked HYPE

Kinetiq Staked HYPE  tBTC

tBTC  Pudgy Penguins

Pudgy Penguins  Kinesis Gold

Kinesis Gold  WrappedM by M0

WrappedM by M0  Dash

Dash  Tezos

Tezos  Ether.fi

Ether.fi  LayerZero

LayerZero  c8ntinuum

c8ntinuum  pippin

pippin  Mantle Staked Ether

Mantle Staked Ether  Chiliz

Chiliz  Curve DAO

Curve DAO  Polygon PoS Bridged DAI (Polygon POS)

Polygon PoS Bridged DAI (Polygon POS)  USDai

USDai  Resolv wstUSR

Resolv wstUSR  River

River  COCA

COCA  Gnosis

Gnosis  AINFT

AINFT  Artificial Superintelligence Alliance

Artificial Superintelligence Alliance  Liquid Staked ETH

Liquid Staked ETH  BitTorrent

BitTorrent  Arbitrum Bridged WBTC (Arbitrum One)

Arbitrum Bridged WBTC (Arbitrum One)  PRIME

PRIME  Kaia

Kaia  Sun Token

Sun Token  Aerodrome Finance

Aerodrome Finance  Wrapped Flare

Wrapped Flare  ADI

ADI  Siren

Siren  L2 Standard Bridged WETH (Base)

L2 Standard Bridged WETH (Base)  Humanity

Humanity  Steakhouse USDC Morpho Vault

Steakhouse USDC Morpho Vault  SPX6900

SPX6900  Story

Story  Injective

Injective  Celestia

Celestia  Lighter

Lighter  Binance-Peg XRP

Binance-Peg XRP  Bitcoin SV

Bitcoin SV  Ether.Fi Liquid ETH

Ether.Fi Liquid ETH  IOTA

IOTA  Renzo Restaked ETH

Renzo Restaked ETH  Legacy Frax Dollar

Legacy Frax Dollar  JasmyCoin

JasmyCoin  sBTC

sBTC  The Graph

The Graph  Pyth Network

Pyth Network  Olympus

Olympus  Jupiter Staked SOL

Jupiter Staked SOL  crvUSD

crvUSD  Savings USDD

Savings USDD  FLOKI

FLOKI  Lombard

Lombard  Venice Token

Venice Token  Marinade Staked SOL

Marinade Staked SOL  Maple Finance

Maple Finance  Arbitrum Bridged WETH (Arbitrum One)

Arbitrum Bridged WETH (Arbitrum One)  BTSE Token

BTSE Token  DoubleZero

DoubleZero  Optimism

Optimism  Conflux

Conflux