Bitcoin Stuck Between $99K And $102K – Analyst Explains Macro Situation

Bitcoin has remained range-bound between $99,000 and $102,000 since breaking above the psychological $100,000 level. While the breakout initially sparked excitement among investors, the current price action reflects market indecision, with no clear direction for the weeks ahead. Concerns about a potential correction linger as the broader market awaits stronger signals to confirm the next trend.

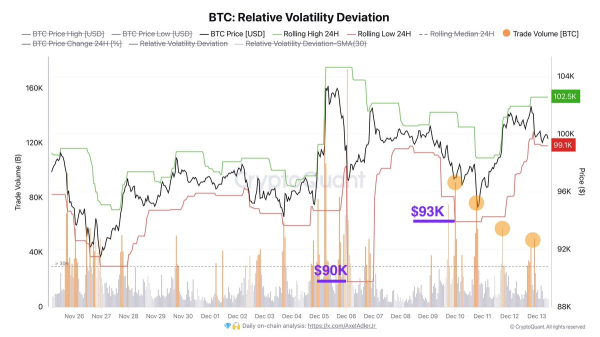

Top analyst Axel Adler recently shared insights on X, supported by data from CryptoQuant, highlighting two crucial support levels at $90,000 and $93,000. These levels represent key demand areas, underscoring that the market floor has moved higher—a positive sign of resilience even amid the uncertainty. According to Adler, these supports could act as safety nets, absorbing selling pressure if Bitcoin fails to sustain its momentum above $100,000.

Despite the hesitation, Bitcoin’s ability to hold above $100,000 for consecutive days has provided some optimism among investors. It remains uncertain whether the market will break out of its current range to continue the bull run or face a correction. For now, all eyes are on Bitcoin’s price action near these critical levels as traders look for clues that could set the tone for the remainder of the year.

Bitcoin Technical Details Explained

Bitcoin has faced choppy price action recently, leaving the market in anticipation of the next big move, whether upward or downward. Traders and investors remain cautious, closely watching key technical and macroeconomic signals. The uncertainty has kept Bitcoin trading between $99,000 and $102,000 as market participants wait for a decisive breakout.

Top analyst Axel Adler recently shared a detailed macro analysis on X, shedding light on Bitcoin’s current position. According to Adler, the market has established two crucial support levels at $90,000 and $93,000, signaling that the overall market floor has shifted higher.

These levels could act as strong safety nets if Bitcoin experiences a short-term pullback. Adler emphasized that these supports reflect growing confidence in Bitcoin’s long-term potential despite the current indecision.

One notable observation is the decline in trading volume peaks, which presents a neutral signal. This indicates that traders avoid excessive risk, preferring to wait for clearer market signals before entering significant positions. The declining volume also suggests a reduced likelihood of extreme price volatility in the immediate term.

With Bitcoin stuck in its current range, the market remains highly sensitive to external factors. Any significant news or events could quickly trigger a breakout or breakdown, setting the stage for Bitcoin’s next major move.

BTC Price Action

Bitcoin is trading at $100,100 after failing to break above its all-time high of $103,600. The current consolidation reflects market indecision while the price remains above key demand levels. Bitcoin’s resilience above $100,000 suggests bullish momentum may still be in play, as buyers look for opportunities to push the price higher.

However, the next few days will be critical. A correction could be imminent if Bitcoin fails to hold above the psychologically significant $100,000 level and struggles to find the momentum to surpass $103,600. Analysts warn that a break below $100,000 could trigger a wave of selling pressure, pushing the price toward lower support zones.

The $93,000 level is a crucial area to watch during a downturn. Losing this key support would significantly heighten bearish risks, as it represents a critical demand zone for the market. A failure at this level could result in a sharper correction, potentially challenging Bitcoin’s bullish structure.

Bitcoin’s ability to hold above $100,000 provides a cautious sense of optimism. If bulls can maintain support and fuel a breakout above the all-time high, Bitcoin could enter a new price discovery phase. However, the high stakes make every move above or below these levels pivotal for short-term direction.

Featured image from Dall-E, chart from TradingView

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  USDC

USDC  Solana

Solana  TRON

TRON  Lido Staked Ether

Lido Staked Ether  Figure Heloc

Figure Heloc  Dogecoin

Dogecoin  WhiteBIT Coin

WhiteBIT Coin  USDS

USDS  Cardano

Cardano  Bitcoin Cash

Bitcoin Cash  Wrapped stETH

Wrapped stETH  LEO Token

LEO Token  Hyperliquid

Hyperliquid  Wrapped Bitcoin

Wrapped Bitcoin  Chainlink

Chainlink  Binance Bridged USDT (BNB Smart Chain)

Binance Bridged USDT (BNB Smart Chain)  Monero

Monero  Ethena USDe

Ethena USDe  Canton

Canton  Stellar

Stellar  Wrapped eETH

Wrapped eETH  USD1

USD1  Dai

Dai  sUSDS

sUSDS  Rain

Rain  Hedera

Hedera  Avalanche

Avalanche  Coinbase Wrapped BTC

Coinbase Wrapped BTC  Litecoin

Litecoin  PayPal USD

PayPal USD  Sui

Sui  WETH

WETH  Zcash

Zcash  Shiba Inu

Shiba Inu  Toncoin

Toncoin  USDT0

USDT0  Cronos

Cronos  Tether Gold

Tether Gold  World Liberty Financial

World Liberty Financial  PAX Gold

PAX Gold  MemeCore

MemeCore  Polkadot

Polkadot  Uniswap

Uniswap  Ethena Staked USDe

Ethena Staked USDe  Mantle

Mantle  Pi Network

Pi Network  Circle USYC

Circle USYC  OKB

OKB  BlackRock USD Institutional Digital Liquidity Fund

BlackRock USD Institutional Digital Liquidity Fund  Bittensor

Bittensor  Sky

Sky  Falcon USD

Falcon USD  Aster

Aster  Global Dollar

Global Dollar  Aave

Aave  NEAR Protocol

NEAR Protocol  syrupUSDC

syrupUSDC  Ripple USD

Ripple USD  Bitget Token

Bitget Token  HTX DAO

HTX DAO  Pepe

Pepe  Internet Computer

Internet Computer  BFUSD

BFUSD  Ethereum Classic

Ethereum Classic  Ondo US Dollar Yield

Ondo US Dollar Yield  Ondo

Ondo  Pump.fun

Pump.fun  Gate

Gate  Superstate Short Duration U.S. Government Securities Fund (USTB)

Superstate Short Duration U.S. Government Securities Fund (USTB)  KuCoin

KuCoin  Jupiter Perpetuals Liquidity Provider Token

Jupiter Perpetuals Liquidity Provider Token  Worldcoin

Worldcoin  POL (ex-MATIC)

POL (ex-MATIC)  Spiko EU T-Bills Money Market Fund

Spiko EU T-Bills Money Market Fund  Midnight

Midnight  Quant

Quant  Jito Staked SOL

Jito Staked SOL  NEXO

NEXO  Cosmos Hub

Cosmos Hub  Ethena

Ethena  USDtb

USDtb  Binance-Peg WETH

Binance-Peg WETH  Rocket Pool ETH

Rocket Pool ETH  Render

Render  Binance Bridged USDC (BNB Smart Chain)

Binance Bridged USDC (BNB Smart Chain)  Algorand

Algorand  Aptos

Aptos  Wrapped BNB

Wrapped BNB  OUSG

OUSG  Function FBTC

Function FBTC  Janus Henderson Anemoy AAA CLO Fund

Janus Henderson Anemoy AAA CLO Fund  USDD

USDD  Official Trump

Official Trump  Filecoin

Filecoin  syrupUSDT

syrupUSDT  Beldex

Beldex  VeChain

VeChain  Binance Staked SOL

Binance Staked SOL  Stable

Stable  YLDS

YLDS  Jupiter

Jupiter  Arbitrum

Arbitrum  GHO

GHO  Janus Henderson Anemoy Treasury Fund

Janus Henderson Anemoy Treasury Fund  Polygon Bridged USDC (Polygon PoS)

Polygon Bridged USDC (Polygon PoS)  Usual USD

Usual USD  Solv Protocol BTC

Solv Protocol BTC  Bonk

Bonk  Lombard Staked BTC

Lombard Staked BTC  Decred

Decred  TrueUSD

TrueUSD  clBTC

clBTC  A7A5

A7A5  Stacks

Stacks  EURC

EURC  Virtuals Protocol

Virtuals Protocol  PancakeSwap

PancakeSwap  StakeWise Staked ETH

StakeWise Staked ETH  JUST

JUST  Pudgy Penguins

Pudgy Penguins  Kinetiq Staked HYPE

Kinetiq Staked HYPE  tBTC

tBTC  Sei

Sei  Ether.fi

Ether.fi  WrappedM by M0

WrappedM by M0  LayerZero

LayerZero  Dash

Dash  Chiliz

Chiliz  Kinesis Gold

Kinesis Gold  Tezos

Tezos  c8ntinuum

c8ntinuum  Mantle Staked Ether

Mantle Staked Ether  Curve DAO

Curve DAO  Siren

Siren  Polygon PoS Bridged DAI (Polygon POS)

Polygon PoS Bridged DAI (Polygon POS)  Artificial Superintelligence Alliance

Artificial Superintelligence Alliance  Resolv wstUSR

Resolv wstUSR  pippin

pippin  COCA

COCA  Gnosis

Gnosis  AINFT

AINFT  ADI

ADI  Liquid Staked ETH

Liquid Staked ETH  Kaia

Kaia  Arbitrum Bridged WBTC (Arbitrum One)

Arbitrum Bridged WBTC (Arbitrum One)  BitTorrent

BitTorrent  PRIME

PRIME  USDai

USDai  Aerodrome Finance

Aerodrome Finance  Wrapped Flare

Wrapped Flare  Sun Token

Sun Token  Bitcoin SV

Bitcoin SV  L2 Standard Bridged WETH (Base)

L2 Standard Bridged WETH (Base)  Injective

Injective  Steakhouse USDC Morpho Vault

Steakhouse USDC Morpho Vault  Celestia

Celestia  JasmyCoin

JasmyCoin  SPX6900

SPX6900  FLOKI

FLOKI  Story

Story  Binance-Peg XRP

Binance-Peg XRP  River

River  Ether.Fi Liquid ETH

Ether.Fi Liquid ETH  IOTA

IOTA  Renzo Restaked ETH

Renzo Restaked ETH  Legacy Frax Dollar

Legacy Frax Dollar  The Graph

The Graph  sBTC

sBTC  Olympus

Olympus  Pyth Network

Pyth Network  Lombard

Lombard  Jupiter Staked SOL

Jupiter Staked SOL  crvUSD

crvUSD  Savings USDD

Savings USDD  DoubleZero

DoubleZero  Maple Finance

Maple Finance  BTSE Token

BTSE Token  Marinade Staked SOL

Marinade Staked SOL  Lighter

Lighter  Arbitrum Bridged WETH (Arbitrum One)

Arbitrum Bridged WETH (Arbitrum One)  Conflux

Conflux  Optimism

Optimism  Telcoin

Telcoin  Lido DAO

Lido DAO