Bitcoin Price Watch: Will BTC Break $118K Resistance or Face a Correction?

Bitcoin traded at $116,393 on Sept. 19, 2025, placing its market cap at $2.31 trillion with a 24-hour trading volume of $36.67 billion. The cryptocurrency’s intraday range spanned from $116,349 to $117,888, reflecting a tight consolidation near key resistance.

Bitcoin

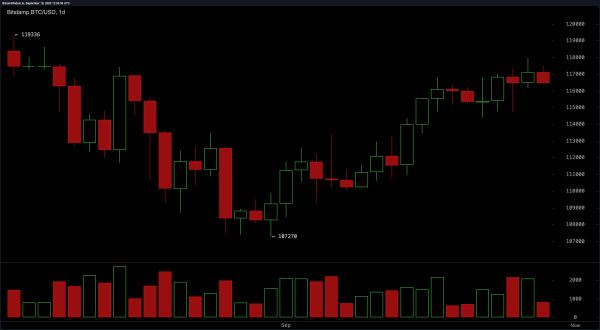

On the daily chart, bitcoin has been in a confirmed uptrend since early September, having bounced strongly from the $107,270 support level, where it formed a double-bottom structure. Since then, price action has steadily climbed, albeit now stalling just beneath a significant resistance zone at $119,336.

The uptrend remains intact, but the current consolidation near the $117,000–$118,000 range indicates indecision. Volume has modestly increased during upward pushes, although the latest candles suggest caution as price approaches overhead resistance. Key buy zones lie between $113,500 and $114,500, with an optimal take-profit level between $118,000 and $119,500, and a stop-loss placed under $111,000.

BTC/USD 1-day chart via Bitstamp on Sept. 19, 2025.

On the 4-hour chart, bitcoin recently peaked at $117,968 before declining, forming several bearish candles with diminishing momentum. This shift was accompanied by a notable spike in red volume, hinting at possible short-term distribution. Despite this, the broader structure remains supportive, with strong prior support observed around $114,421. The asset is likely to retest the $115,000–$115,500 area before resuming its broader trend. Traders watching this zone for a bullish reversal candle may find a favorable risk-reward scenario, targeting $117,500–$118,000 on the upside with a protective stop-loss set at $114,000.

BTC/USD 4-hour chart via Bitstamp on Sept. 19, 2025.

The 1-hour bitcoin chart shows a clear short-term downtrend, characterized by a series of lower highs and lower lows following the $117,968 top. Recent price action touched $116,369, brushing against minor support. This movement appears corrective within the context of a broader bullish structure seen on higher timeframes. Volume is incrementally rising on the sell side, further confirming a retracement phase. Unless a strong bullish candle materializes near the $116,000 level, immediate long entries are discouraged. A tight entry between $116,000–$116,300 may be considered if upward momentum returns, with a suggested exit around $117,000–$117,500 and a stop-loss below $115,700.

BTC/USD 1-hour chart via Bitstamp on Sept. 19, 2025.

Among key technical indicators, oscillators paint a mixed picture. The relative strength index (RSI) stands at 58, reflecting neutral momentum. The Stochastic is in overbought territory at 87, signaling a potential sell-off. Meanwhile, the commodity channel index (CCI) at 95 and the average directional index (ADX) at 19 both indicate a non-committal stance, while the awesome oscillator reads 3,185 with a neutral bias. Notably, momentum (10) is flashing a bearish signal at 4,930, while the moving average convergence divergence (MACD) at 961 remains bullish.

Moving averages (MAs) offer more definitive directional guidance, with all major short- and long-term averages suggesting bullish momentum. The exponential moving average (EMA) and simple moving average (SMA) for 10, 20, 30, 50, 100, and 200 periods all align below the current price, indicating strong underlying trend support. The EMA (10) is at $115,575, and the SMA (10) is at $115,924, both signaling bullish conditions. Longer-term moving averages such as the EMA (200) at $105,738 and the SMA (200) at $103,240 reinforce the positive outlook.

Overall, while bitcoin remains technically strong on the daily timeframe, traders must remain cautious amid signs of short-term fatigue. Ideal entries now depend on lower timeframe support confirmations, particularly near the $115,000–$116,000 range. A breakout above $118,000, backed by volume, would invalidate the consolidation thesis and reintroduce momentum to test new highs.

Bull Verdict:

Bitcoin maintains a structurally bullish posture, with consistent support from all major moving averages and a well-established uptrend on the daily chart. Should price hold above the $115,000–$116,000 support zone and break above $118,000 with volume confirmation, a continuation toward $120,000 and beyond appears likely in the near term.

Bear Verdict:

Despite a strong daily trend, bitcoin faces immediate resistance pressure and weakening momentum on lower timeframes. Failure to reclaim $117,500 convincingly, coupled with a breakdown below $115,000, could initiate a deeper retracement toward the $113,000 range, undermining the recent rally.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  USDC

USDC  Solana

Solana  JUSD

JUSD  TRON

TRON  Lido Staked Ether

Lido Staked Ether  Dogecoin

Dogecoin  Figure Heloc

Figure Heloc  WhiteBIT Coin

WhiteBIT Coin  Bitcoin Cash

Bitcoin Cash  Cardano

Cardano  USDS

USDS  Wrapped stETH

Wrapped stETH  Hyperliquid

Hyperliquid  LEO Token

LEO Token  Wrapped Bitcoin

Wrapped Bitcoin  Monero

Monero  Binance Bridged USDT (BNB Smart Chain)

Binance Bridged USDT (BNB Smart Chain)  Canton

Canton  Chainlink

Chainlink  Ethena USDe

Ethena USDe  Stellar

Stellar  Wrapped eETH

Wrapped eETH  USD1

USD1  Litecoin

Litecoin  sUSDS

sUSDS  Dai

Dai  Zcash

Zcash  Coinbase Wrapped BTC

Coinbase Wrapped BTC  Avalanche

Avalanche  Sui

Sui  Shiba Inu

Shiba Inu  WETH

WETH  Hedera

Hedera  World Liberty Financial

World Liberty Financial  PayPal USD

PayPal USD  USDT0

USDT0  Tether Gold

Tether Gold  Toncoin

Toncoin  Cronos

Cronos  Rain

Rain  MemeCore

MemeCore  Polkadot

Polkadot  Uniswap

Uniswap  Ethena Staked USDe

Ethena Staked USDe  Mantle

Mantle  PAX Gold

PAX Gold  Bitget Token

Bitget Token  Falcon USD

Falcon USD  Aave

Aave  Bittensor

Bittensor  Pepe

Pepe  BlackRock USD Institutional Digital Liquidity Fund

BlackRock USD Institutional Digital Liquidity Fund  OKB

OKB  Circle USYC

Circle USYC  HTX DAO

HTX DAO  syrupUSDC

syrupUSDC  Global Dollar

Global Dollar  NEAR Protocol

NEAR Protocol  Ripple USD

Ripple USD  Ethereum Classic

Ethereum Classic  Internet Computer

Internet Computer  Sky

Sky  Pi Network

Pi Network  Pump.fun

Pump.fun  Aster

Aster  BFUSD

BFUSD  Ondo

Ondo  KuCoin

KuCoin  MYX Finance

MYX Finance  Worldcoin

Worldcoin  POL (ex-MATIC)

POL (ex-MATIC)  Jupiter Perpetuals Liquidity Provider Token

Jupiter Perpetuals Liquidity Provider Token  Gate

Gate  Ethena

Ethena  USDD

USDD  Cosmos Hub

Cosmos Hub  Jito Staked SOL

Jito Staked SOL  Official Trump

Official Trump  Quant

Quant  Aptos

Aptos  Algorand

Algorand  Binance-Peg WETH

Binance-Peg WETH  USDtb

USDtb  Rocket Pool ETH

Rocket Pool ETH  Superstate Short Duration U.S. Government Securities Fund (USTB)

Superstate Short Duration U.S. Government Securities Fund (USTB)  Binance Bridged USDC (BNB Smart Chain)

Binance Bridged USDC (BNB Smart Chain)  Midnight

Midnight  Wrapped BNB

Wrapped BNB  Render

Render  Function FBTC

Function FBTC  Filecoin

Filecoin  NEXO

NEXO  Arbitrum

Arbitrum  Janus Henderson Anemoy AAA CLO Fund

Janus Henderson Anemoy AAA CLO Fund  VeChain

VeChain  syrupUSDT

syrupUSDT  Ondo US Dollar Yield

Ondo US Dollar Yield  OUSG

OUSG  Spiko EU T-Bills Money Market Fund

Spiko EU T-Bills Money Market Fund  Binance Staked SOL

Binance Staked SOL  Jupiter

Jupiter  Beldex

Beldex  USDai

USDai  Bonk

Bonk  Polygon Bridged USDC (Polygon PoS)

Polygon Bridged USDC (Polygon PoS)  Usual USD

Usual USD  Solv Protocol BTC

Solv Protocol BTC  Janus Henderson Anemoy Treasury Fund

Janus Henderson Anemoy Treasury Fund  Lombard Staked BTC

Lombard Staked BTC  Sei

Sei  GHO

GHO  PancakeSwap

PancakeSwap  clBTC

clBTC  Dash

Dash  A7A5

A7A5  Tezos

Tezos  Stacks

Stacks  TrueUSD

TrueUSD  StakeWise Staked ETH

StakeWise Staked ETH  Story

Story  Pudgy Penguins

Pudgy Penguins  Kinetiq Staked HYPE

Kinetiq Staked HYPE  Stable

Stable  Chiliz

Chiliz  WrappedM by M0

WrappedM by M0  tBTC

tBTC  EURC

EURC  Optimism

Optimism  Virtuals Protocol

Virtuals Protocol  Artificial Superintelligence Alliance

Artificial Superintelligence Alliance  c8ntinuum

c8ntinuum  Mantle Staked Ether

Mantle Staked Ether  Curve DAO

Curve DAO  Lighter

Lighter  Polygon PoS Bridged DAI (Polygon POS)

Polygon PoS Bridged DAI (Polygon POS)  Resolv USR

Resolv USR  Resolv wstUSR

Resolv wstUSR  COCA

COCA  Kinesis Gold

Kinesis Gold  DoubleZero

DoubleZero  JUST

JUST  Liquid Staked ETH

Liquid Staked ETH  LayerZero

LayerZero  Arbitrum Bridged WBTC (Arbitrum One)

Arbitrum Bridged WBTC (Arbitrum One)  Ether.fi

Ether.fi  Sun Token

Sun Token  Injective

Injective  Maple Finance

Maple Finance  Wrapped Flare

Wrapped Flare  Lido DAO

Lido DAO  Kaia

Kaia  L2 Standard Bridged WETH (Base)

L2 Standard Bridged WETH (Base)  Decred

Decred  Steakhouse USDC Morpho Vault

Steakhouse USDC Morpho Vault  BitTorrent

BitTorrent  AINFT

AINFT  Aerodrome Finance

Aerodrome Finance  FLOKI

FLOKI  Kinesis Silver

Kinesis Silver  Binance-Peg XRP

Binance-Peg XRP  IOTA

IOTA  Ether.Fi Liquid ETH

Ether.Fi Liquid ETH  Celestia

Celestia  Renzo Restaked ETH

Renzo Restaked ETH  The Graph

The Graph  crvUSD

crvUSD  sBTC

sBTC  Gnosis

Gnosis  Trust Wallet

Trust Wallet  Jupiter Staked SOL

Jupiter Staked SOL  Starknet

Starknet  Savings USDD

Savings USDD  JasmyCoin

JasmyCoin  Conflux

Conflux  Bitcoin SV

Bitcoin SV  Marinade Staked SOL

Marinade Staked SOL  SPX6900

SPX6900  Arbitrum Bridged WETH (Arbitrum One)

Arbitrum Bridged WETH (Arbitrum One)  Pyth Network

Pyth Network  River

River  Cap USD

Cap USD  Staked Aave

Staked Aave  Legacy Frax Dollar

Legacy Frax Dollar