Bitcoin Price Watch: Traders Brace for Volatility After Tight Price Coil

Bitcoin traded at $112,996 to $113,210 over the last hour on Aug. 28, 2025, with a market capitalization of $2.24 trillion. Over the past 24 hours, it saw $37.65 billion in trading volume, fluctuating within a tight intraday range between $110,985 and $113,329.

Bitcoin

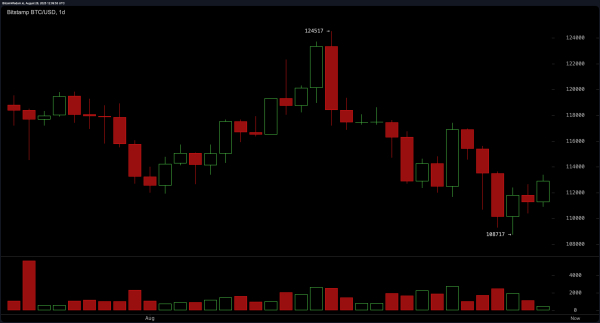

Bitcoin’s daily chart reveals a market in short-term consolidation following a downward break from a descending triangle pattern. Price structure indicates a lower high at $124,517 and a lower low at $108,717, placing current price levels near $113,000. A potential rebound is forming with volume increasing at recent lows, suggesting possible accumulation. Immediate support lies at $108,500, while resistance is seen at $117,500 and $124,500. A break above the $117,500 mark on strong volume could serve as a confirmation for bullish continuation, whereas a breach below $108,000 would likely negate this setup.

BTC/USD 1-day chart via Bitstamp on Aug. 28, 2025.

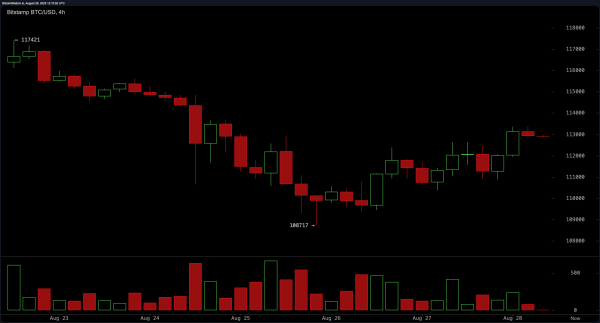

The 4-hour bitcoin chart illustrates a notable shift in trend from bearish to bullish, characterized by a higher high and higher low following a drop to $108,700. Momentum indicators show a subtle reversal pattern, supported by increased green volume bars. Bitcoin is currently trading near the $113,000–$113,500 range, a key resistance zone. A sustained breakout above this range with volume confirmation would reinforce upward momentum. Conversely, a failed attempt here combined with increased selling pressure could push prices back toward the $110,000 level, warranting cautious trade management.

BTC/USD 4-hour chart via Bitstamp on Aug. 28, 2025.

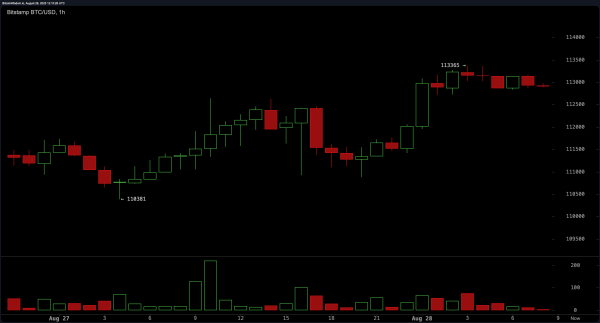

On the 1-hour chart, bitcoin is in a clear intraday uptrend, progressing from a base near $110,381 up to a recent high of $113,365. The price action is coiling within a flag-like pattern, typically indicative of a pending breakout or breakdown. Declining volume alongside this consolidation suggests trader indecision, awaiting a catalyst. An upside move above $113,500 could invite quick long entries targeting the $114,000–$114,500 region. However, if price slips below $111,500, stop-loss triggers should be considered for intraday trades.

BTC/USD 1-hour chart via Bitstamp on Aug. 28, 2025.

Oscillator readings across multiple indicators are largely neutral. The relative strength index (RSI) stands at 46, Stochastic oscillator at 25, and the commodity channel index (CCI) at -84, all suggesting indecision without extreme overbought or oversold signals. The average directional index (ADX) at 17 implies a weak trend. Notably, the momentum oscillator highlights a bullish signal at -3,349, while the moving average convergence divergence (MACD) level at -1,183 suggests a bearish trend. This divergence reflects the broader uncertainty within the market’s current phase.

Moving averages (MAs) portray a split landscape across timeframes. Shorter-term averages, including the exponential moving average (EMA) and simple moving average (SMA) for 10, 20, and 30 periods, all reflect bearish conditions with sell signals. However, longer-term EMAs and SMAs at the 100 and 200 intervals are bullish, indicating underlying strength. The EMA (100) at $110,905 and SMA (100) at $111,726 suggest the price is well supported at lower levels, while the EMA (200) at $103,939 and SMA (200) at $101,094 underline the broader bullish trend that remains intact despite recent volatility.

Bull Verdict:

If bitcoin decisively breaks above the $113,500 resistance level on strong volume and sustains this move, bullish momentum may accelerate toward the $117,500 and $124,500 resistance zones. The presence of higher lows, a recovering 4-hour trend, and longer-term moving average support all bolster the case for continued upward movement in the short to medium term.

Bear Verdict:

Should bitcoin fail to overcome the $113,500 resistance and instead drop below the $111,500–$110,000 support band, bearish pressure could resume. The presence of multiple short-term moving average sell signals and the lack of strong oscillator conviction warn that a downside continuation toward the $108,000 level remains a credible risk.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  USDC

USDC  Solana

Solana  TRON

TRON  Lido Staked Ether

Lido Staked Ether  Dogecoin

Dogecoin  Figure Heloc

Figure Heloc  WhiteBIT Coin

WhiteBIT Coin  Cardano

Cardano  USDS

USDS  Bitcoin Cash

Bitcoin Cash  Wrapped stETH

Wrapped stETH  LEO Token

LEO Token  Hyperliquid

Hyperliquid  Wrapped Bitcoin

Wrapped Bitcoin  Canton

Canton  Binance Bridged USDT (BNB Smart Chain)

Binance Bridged USDT (BNB Smart Chain)  Chainlink

Chainlink  Monero

Monero  Ethena USDe

Ethena USDe  Stellar

Stellar  Wrapped eETH

Wrapped eETH  USD1

USD1  Hedera

Hedera  sUSDS

sUSDS  Rain

Rain  Litecoin

Litecoin  Dai

Dai  Coinbase Wrapped BTC

Coinbase Wrapped BTC  PayPal USD

PayPal USD  Avalanche

Avalanche  Zcash

Zcash  WETH

WETH  Sui

Sui  Shiba Inu

Shiba Inu  Toncoin

Toncoin  USDT0

USDT0  Cronos

Cronos  World Liberty Financial

World Liberty Financial  Tether Gold

Tether Gold  Polkadot

Polkadot  MemeCore

MemeCore  Uniswap

Uniswap  PAX Gold

PAX Gold  Ethena Staked USDe

Ethena Staked USDe  Mantle

Mantle  BlackRock USD Institutional Digital Liquidity Fund

BlackRock USD Institutional Digital Liquidity Fund  Aave

Aave  Circle USYC

Circle USYC  Bittensor

Bittensor  Falcon USD

Falcon USD  Aster

Aster  Global Dollar

Global Dollar  OKB

OKB  Pepe

Pepe  Pi Network

Pi Network  syrupUSDC

syrupUSDC  Sky

Sky  Ripple USD

Ripple USD  Bitget Token

Bitget Token  HTX DAO

HTX DAO  NEAR Protocol

NEAR Protocol  Internet Computer

Internet Computer  Ethereum Classic

Ethereum Classic  Ondo

Ondo  BFUSD

BFUSD  POL (ex-MATIC)

POL (ex-MATIC)  Worldcoin

Worldcoin  KuCoin

KuCoin  Pump.fun

Pump.fun  Superstate Short Duration U.S. Government Securities Fund (USTB)

Superstate Short Duration U.S. Government Securities Fund (USTB)  Gate

Gate  Jupiter Perpetuals Liquidity Provider Token

Jupiter Perpetuals Liquidity Provider Token  Midnight

Midnight  Quant

Quant  Cosmos Hub

Cosmos Hub  Jito Staked SOL

Jito Staked SOL  Ethena

Ethena  NEXO

NEXO  USDtb

USDtb  Binance-Peg WETH

Binance-Peg WETH  Rocket Pool ETH

Rocket Pool ETH  Algorand

Algorand  Spiko EU T-Bills Money Market Fund

Spiko EU T-Bills Money Market Fund  Binance Bridged USDC (BNB Smart Chain)

Binance Bridged USDC (BNB Smart Chain)  Official Trump

Official Trump  Aptos

Aptos  Wrapped BNB

Wrapped BNB  Filecoin

Filecoin  Function FBTC

Function FBTC  Render

Render  USDD

USDD  OUSG

OUSG  Stable

Stable  pippin

pippin  syrupUSDT

syrupUSDT  Janus Henderson Anemoy AAA CLO Fund

Janus Henderson Anemoy AAA CLO Fund  Ondo US Dollar Yield

Ondo US Dollar Yield  Binance Staked SOL

Binance Staked SOL  VeChain

VeChain  Arbitrum

Arbitrum  Beldex

Beldex  Decred

Decred  Janus Henderson Anemoy Treasury Fund

Janus Henderson Anemoy Treasury Fund  Usual USD

Usual USD  Polygon Bridged USDC (Polygon PoS)

Polygon Bridged USDC (Polygon PoS)  Jupiter

Jupiter  Solv Protocol BTC

Solv Protocol BTC  Bonk

Bonk  Lombard Staked BTC

Lombard Staked BTC  GHO

GHO  A7A5

A7A5  Stacks

Stacks  clBTC

clBTC  TrueUSD

TrueUSD  Sei

Sei  Virtuals Protocol

Virtuals Protocol  EURC

EURC  USDai

USDai  StakeWise Staked ETH

StakeWise Staked ETH  Pudgy Penguins

Pudgy Penguins  Dash

Dash  Kinetiq Staked HYPE

Kinetiq Staked HYPE  tBTC

tBTC  PancakeSwap

PancakeSwap  Tezos

Tezos  WrappedM by M0

WrappedM by M0  Power Protocol

Power Protocol  JUST

JUST  Kinesis Gold

Kinesis Gold  Ether.fi

Ether.fi  Artificial Superintelligence Alliance

Artificial Superintelligence Alliance  Mantle Staked Ether

Mantle Staked Ether  Curve DAO

Curve DAO  c8ntinuum

c8ntinuum  Polygon PoS Bridged DAI (Polygon POS)

Polygon PoS Bridged DAI (Polygon POS)  Story

Story  Resolv wstUSR

Resolv wstUSR  Lighter

Lighter  COCA

COCA  LayerZero

LayerZero  BitTorrent

BitTorrent  Liquid Staked ETH

Liquid Staked ETH  Chiliz

Chiliz  Arbitrum Bridged WBTC (Arbitrum One)

Arbitrum Bridged WBTC (Arbitrum One)  Gnosis

Gnosis  PRIME

PRIME  Aerodrome Finance

Aerodrome Finance  AINFT

AINFT  Wrapped Flare

Wrapped Flare  Kaia

Kaia  Injective

Injective  L2 Standard Bridged WETH (Base)

L2 Standard Bridged WETH (Base)  Bitcoin SV

Bitcoin SV  Steakhouse USDC Morpho Vault

Steakhouse USDC Morpho Vault  ADI

ADI  Sun Token

Sun Token  Pyth Network

Pyth Network  Celestia

Celestia  SPX6900

SPX6900  Binance-Peg XRP

Binance-Peg XRP  IOTA

IOTA  Ether.Fi Liquid ETH

Ether.Fi Liquid ETH  The Graph

The Graph  Renzo Restaked ETH

Renzo Restaked ETH  FLOKI

FLOKI  JasmyCoin

JasmyCoin  sBTC

sBTC  crvUSD

crvUSD  DoubleZero

DoubleZero  Maple Finance

Maple Finance  Jupiter Staked SOL

Jupiter Staked SOL  Olympus

Olympus  Savings USDD

Savings USDD  Legacy Frax Dollar

Legacy Frax Dollar  Lido DAO

Lido DAO  Optimism

Optimism  Marinade Staked SOL

Marinade Staked SOL  Conflux

Conflux  Arbitrum Bridged WETH (Arbitrum One)

Arbitrum Bridged WETH (Arbitrum One)  Helium

Helium  Siren

Siren  BTSE Token

BTSE Token  Telcoin

Telcoin  Staked Aave

Staked Aave