Bitcoin Finds Opportunity in PBOC Rate Cuts and Moody’s US Credit Downgrade

Macroeconomic tremors from China and the US have put Bitcoin (BTC) in the spotlight, offering fertile ground for its narrative as a hedge against traditional finance (TradFi) instability.

The influence of macroeconomic factors and forces on Bitcoin has escalated from 2024 to 2025, after a period when it dissipated in 2023.

Bitcoin Gains from China’s Rate Cut and US Credit Downgrade

On Tuesday, the People’s Bank of China (PBOC) cut its benchmark lending rates for the first time in seven months. Specifically, it lowered the 1-year Loan Prime Rate (LPR) from 3.10% to 3.00% and the 5-year LPR from 3.60% to 3.50%.

The move injects fresh liquidity into global markets. It aims to stimulate a sluggish economy weighed down by weak domestic demand and bolster a shaky property sector, all amid recent trade tensions with the US.

“The PBOC cut… to support the economy amid slowing growth and US trade pressures. Essentially, this injects additional momentum into risk assets by providing cheaper liquidity and fostering a risk-on sentiment,” noted Axel Adler Jr., an on-chain and macro researcher.

While China’s easing measures aim to boost local borrowing and spending, they may also spill over into global asset markets, including crypto.

Often viewed as a high-beta asset, Bitcoin typically benefits from such liquidity tailwinds. This is especially true when coupled with fiat weakening or broader economic instability.

Simultaneously, the US faces its own credibility crisis. Moody’s downgraded the US sovereign credit rating from AAA to AA1. It cited persistent fiscal deficits, ballooning interest expenses, and a projected federal debt burden of 134% of GDP by 2035.

This marks only the third major downgrade in US history, following similar moves by Fitch in 2023 and S&P in 2011. Nick Drendel, a data integrity analyst, highlighted the pattern of volatile market reactions following previous downgrades.

“[The Fitch downgrade in 2023] led to a 74 trading day (-10.6%) correction for the Nasdaq before closing above the close from before the downgrade,” Drendel noted.

This downgrade mirrors those concerns amid massive debt, political gridlock, and rising default risk.

Moody’s Downgrade, US Fiscal Woes Boost Bitcoin’s Safe-Haven Appeal

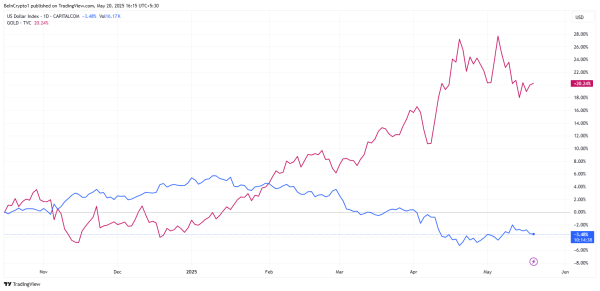

On-chain analyst Adler points out that the market’s reaction was swift. The US Dollar Index (DXY) weakened to 100.85, while gold rose 0.4%, signaling a classic flight to safety.

DXY weakens while Gold rises. Source: TradingView

Bitcoin, frequently dubbed digital gold, saw renewed interest as a non-sovereign store of value.

“…despite the prevailing ‘risk-off’ sentiment… Bitcoin may find itself in a relatively stronger position in the current environment due to its “digital gold” narrative and the supportive effect of a weaker dollar,” Adler noted.

Ray Dalio, founder of Bridgewater Associates, criticized credit ratings for underplaying the broader monetary risks.

“…they only rate the risk of the government not paying its debt. They don’t include the greater risk that countries in debt will print money to pay their debts, thus causing holders of the bonds to suffer losses from the decreased value of the money they’re getting (rather than from the decreased quantity of money they’re getting),” Dalio warned.

Against this backdrop, Dalio concludes that the risks for US government debt are greater than the rating agencies are conveying.

Echoing that sentiment, economist Peter Schiff argued that inflation risk should be front and center when rating sovereign debt. In his opinion, this is especially true when foreign investors who lack political leverage hold much of it.

“…when a nation owes a lot of debt to foreigners, who can’t vote, the odds of a default on foreign-owned debt should be factored in,” he noted.

The dual macro shifts, China injecting liquidity and the US showing fiscal cracks, present Bitcoin with a unique tailwind. Historically, BTC has thrived under similar conditions – rising inflation fears, weakened fiat credibility, and global capital looking for resilient alternatives.

Though markets remain volatile, the confluence of dovish Chinese policy and renewed doubts about US fiscal discipline could drive institutional and retail investors toward decentralized assets like Bitcoin.

If the dollar continues to lose appeal and central banks adopt easier policies, Bitcoin’s value proposition as a politically neutral, non-inflationary asset will become harder to ignore.

Bitcoin (BTC) Price Performance. Source: BeInCrypto

BeInCrypto data shows BTC was trading for $105,156 as of this writing. This represents a modest 2.11% surge in the last 24 hours.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  USDC

USDC  JUSD

JUSD  Lido Staked Ether

Lido Staked Ether  TRON

TRON  Dogecoin

Dogecoin  Figure Heloc

Figure Heloc  Cardano

Cardano  Wrapped stETH

Wrapped stETH  Bitcoin Cash

Bitcoin Cash  WhiteBIT Coin

WhiteBIT Coin  Wrapped Bitcoin

Wrapped Bitcoin  Wrapped eETH

Wrapped eETH  USDS

USDS  Binance Bridged USDT (BNB Smart Chain)

Binance Bridged USDT (BNB Smart Chain)  Monero

Monero  Chainlink

Chainlink  LEO Token

LEO Token  Hyperliquid

Hyperliquid  Coinbase Wrapped BTC

Coinbase Wrapped BTC  WETH

WETH  Stellar

Stellar  Ethena USDe

Ethena USDe  Zcash

Zcash  Canton

Canton  Sui

Sui  Litecoin

Litecoin  Avalanche

Avalanche  USD1

USD1  Shiba Inu

Shiba Inu  Hedera

Hedera  World Liberty Financial

World Liberty Financial  USDT0

USDT0  Dai

Dai  sUSDS

sUSDS  PayPal USD

PayPal USD  Ethena Staked USDe

Ethena Staked USDe  Toncoin

Toncoin  Cronos

Cronos  Rain

Rain  Polkadot

Polkadot  Uniswap

Uniswap  Mantle

Mantle  MemeCore

MemeCore  Tether Gold

Tether Gold  Bitget Token

Bitget Token  Aave

Aave  Bittensor

Bittensor  OKB

OKB  Falcon USD

Falcon USD  PAX Gold

PAX Gold  Pepe

Pepe  NEAR Protocol

NEAR Protocol  Pump.fun

Pump.fun  Jito Staked SOL

Jito Staked SOL  Internet Computer

Internet Computer  Binance-Peg WETH

Binance-Peg WETH  Ethereum Classic

Ethereum Classic  BlackRock USD Institutional Digital Liquidity Fund

BlackRock USD Institutional Digital Liquidity Fund  Ondo

Ondo  Aster

Aster  HTX DAO

HTX DAO  Circle USYC

Circle USYC  Wrapped SOL

Wrapped SOL  Global Dollar

Global Dollar  Jupiter Perpetuals Liquidity Provider Token

Jupiter Perpetuals Liquidity Provider Token  Pi Network

Pi Network  Sky

Sky  KuCoin

KuCoin  Ripple USD

Ripple USD  Binance Staked SOL

Binance Staked SOL  Ethena

Ethena  Wrapped BNB

Wrapped BNB  syrupUSDC

syrupUSDC  BFUSD

BFUSD  Binance Bridged USDC (BNB Smart Chain)

Binance Bridged USDC (BNB Smart Chain)  Worldcoin

Worldcoin  POL (ex-MATIC)

POL (ex-MATIC)  Rocket Pool ETH

Rocket Pool ETH  River

River  Aptos

Aptos  Quant

Quant  MYX Finance

MYX Finance  Gate

Gate  USDD

USDD  Cosmos Hub

Cosmos Hub  Algorand

Algorand  Midnight

Midnight  Arbitrum

Arbitrum  Lombard Staked BTC

Lombard Staked BTC  Function FBTC

Function FBTC  Render

Render  Official Trump

Official Trump  NEXO

NEXO  Filecoin

Filecoin  VeChain

VeChain  Polygon Bridged USDC (Polygon PoS)

Polygon Bridged USDC (Polygon PoS)  USDtb

USDtb  Mantle Staked Ether

Mantle Staked Ether  Superstate Short Duration U.S. Government Securities Fund (USTB)

Superstate Short Duration U.S. Government Securities Fund (USTB)  Liquid Staked ETH

Liquid Staked ETH  syrupUSDT

syrupUSDT  Dash

Dash  Bonk

Bonk  Story

Story  WrappedM by M0

WrappedM by M0  Solv Protocol BTC

Solv Protocol BTC  Janus Henderson Anemoy AAA CLO Fund

Janus Henderson Anemoy AAA CLO Fund  Renzo Restaked ETH

Renzo Restaked ETH  Sei

Sei  Arbitrum Bridged WBTC (Arbitrum One)

Arbitrum Bridged WBTC (Arbitrum One)  Ondo US Dollar Yield

Ondo US Dollar Yield  clBTC

clBTC  StakeWise Staked ETH

StakeWise Staked ETH  OUSG

OUSG  Kinetiq Staked HYPE

Kinetiq Staked HYPE  Jupiter

Jupiter  COCA

COCA  Spiko EU T-Bills Money Market Fund

Spiko EU T-Bills Money Market Fund  PancakeSwap

PancakeSwap  L2 Standard Bridged WETH (Base)

L2 Standard Bridged WETH (Base)  Polygon PoS Bridged DAI (Polygon POS)

Polygon PoS Bridged DAI (Polygon POS)  Jupiter Staked SOL

Jupiter Staked SOL  USDai

USDai  Binance-Peg XRP

Binance-Peg XRP  Pudgy Penguins

Pudgy Penguins  Tezos

Tezos  Wrapped Flare

Wrapped Flare  Beldex

Beldex  Usual USD

Usual USD  Optimism

Optimism  Chiliz

Chiliz  Arbitrum Bridged WETH (Arbitrum One)

Arbitrum Bridged WETH (Arbitrum One)  Virtuals Protocol

Virtuals Protocol  c8ntinuum

c8ntinuum  Stacks

Stacks  tBTC

tBTC  Janus Henderson Anemoy Treasury Fund

Janus Henderson Anemoy Treasury Fund  Artificial Superintelligence Alliance

Artificial Superintelligence Alliance  Curve DAO

Curve DAO  A7A5

A7A5  GTETH

GTETH  Lighter

Lighter  GHO

GHO  TrueUSD

TrueUSD  Ether.Fi Liquid ETH

Ether.Fi Liquid ETH  Injective

Injective  pippin

pippin  Lido DAO

Lido DAO  Cap USD

Cap USD  Ether.fi

Ether.fi  Marinade Staked SOL

Marinade Staked SOL  Axie Infinity

Axie Infinity  Coinbase Wrapped Staked ETH

Coinbase Wrapped Staked ETH  Steakhouse USDC Morpho Vault

Steakhouse USDC Morpho Vault  Kaia

Kaia  Aerodrome Finance

Aerodrome Finance  Kinesis Silver

Kinesis Silver  Stader ETHx

Stader ETHx  DoubleZero

DoubleZero  LayerZero

LayerZero  FLOKI

FLOKI  Stable

Stable  sBTC

sBTC  Kinesis Gold

Kinesis Gold  BitTorrent

BitTorrent  Resolv USR

Resolv USR  Staked Aave

Staked Aave  EURC

EURC  Celestia

Celestia  Maple Finance

Maple Finance  The Graph

The Graph  Resolv wstUSR

Resolv wstUSR  ether.fi Staked ETH

ether.fi Staked ETH  Gnosis

Gnosis  IOTA

IOTA  Wrapped ApeCoin

Wrapped ApeCoin  AB

AB  Starknet

Starknet  Pyth Network

Pyth Network  SPX6900

SPX6900  Trust Wallet

Trust Wallet  Bitcoin SV

Bitcoin SV  Conflux

Conflux  JUST

JUST  AINFT

AINFT