With a sub‑30% underwater supply, Bitcoin price actions now looks eerily like early 2022

Bitcoin just spent two straight weeks sliding into a zone traders respect and fear at the same time. Price dropped toward the True Market Mean, the cost basis of all active coins minus miners, and then held there.

According to Glassnode, that level splits light bear phases from deep bear markets. For now, price is sitting just above it. The structure around it now matches what showed up in Q1 2022 almost tick for tick.

Spot price moved under the 0.75 supply quantile in mid‑November and now trades near $96.1K, putting more than 25% of total supply underwater.

At the same time, sellers may already be worn out. The line that changes everything is still the 0.85 quantile near $106.2K. Until price takes that level back, macro shocks keep full control of direction.

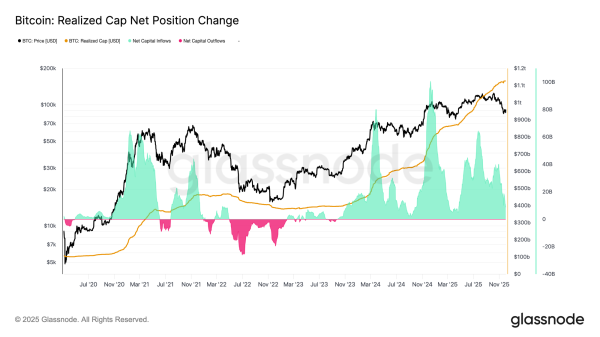

Glassnode data shows that Bitcoin’s Net Change in Realized Cap reads +$8.69B per month, which is pretty weak compared to the $64.3B per month peak in July, but it is not exactly negative either.

As long as this stays above zero, price can still build a base instead of falling apart. Meanwhile, long‑term investors continue to sell into strength, but at shrinking margins, with the Long‑Term Holder SOPR (30D‑SMA) stands at 1.43.

Derivatives and options reset risk across the board

Spot demand now looks lighter. U.S. Bitcoin ETFs flipped into net outflows across November on a three‑day average basis. The steady inflow that supported price earlier this year is gone. Outflows hit many issuers at once. Institutions pulled back as market pressure built. That leaves price more exposed to outside shocks.

At the same time, Cumulative Volume Delta turned negative on Binance and across the aggregate exchange group. That signals steady taker selling. Coinbase flattened as well. That removed a key sign of U.S. bid strength. With ETF flows and CVD both defensive, spot demand now runs thin.

Derivatives followed the same path. Futures open interest kept falling through late November. The unwind stayed slow and orderly. The leverage built during the uptrend is now mostly gone. New leverage is not entering. Funding rates cooled near zero after months of positive prints. Modest negative funding showed up at times but never lasted long. Shorts are not pressing hard. Positioning now sits neutral and flat.

In options, implied volatility dropped after last week’s spike. Bitcoin failed to hold above $92K, and sellers stepped back in, so short‑dated volatility fell from 57% to 48%, mid‑tenor slid from 52% to 45%, and long‑dated eased from 49% to 47%.

Short‑term skew fell from 18.6% to 8.4% after Bitcoin’s price rebounded from $84.5K, a drop tied to the Japanese bond shock. Longer maturities moved slower. Traders chased short‑term upside but stayed unsure about follow‑through.

Early week flow leaned heavy on put buying tied to fears of a repeat of the August 2024 carry‑trade stress. Once price stabilized, flow flipped to calls during the rebound.

At the $100K call strike, call premium sold still exceeds call premium bought, and the gap widened during the past 48 hours. That shows weak conviction to reclaim six figures. Traders also sit ahead of the FOMC meeting without chasing upside.

Crypto entrepreneur Lark Davis pointed out that crypto whales dumped the market, then “Charles Schwab, Vanguard and Bank of America all roll out crypto to their clients in the same week. What a happy coincidence!”

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  USDC

USDC  Solana

Solana  TRON

TRON  Lido Staked Ether

Lido Staked Ether  Figure Heloc

Figure Heloc  Dogecoin

Dogecoin  WhiteBIT Coin

WhiteBIT Coin  Cardano

Cardano  USDS

USDS  Bitcoin Cash

Bitcoin Cash  Wrapped stETH

Wrapped stETH  LEO Token

LEO Token  Hyperliquid

Hyperliquid  Wrapped Bitcoin

Wrapped Bitcoin  Chainlink

Chainlink  Binance Bridged USDT (BNB Smart Chain)

Binance Bridged USDT (BNB Smart Chain)  Monero

Monero  Ethena USDe

Ethena USDe  Canton

Canton  Stellar

Stellar  Wrapped eETH

Wrapped eETH  USD1

USD1  Rain

Rain  sUSDS

sUSDS  Hedera

Hedera  Litecoin

Litecoin  Dai

Dai  Coinbase Wrapped BTC

Coinbase Wrapped BTC  PayPal USD

PayPal USD  Avalanche

Avalanche  Zcash

Zcash  WETH

WETH  Sui

Sui  Shiba Inu

Shiba Inu  Toncoin

Toncoin  USDT0

USDT0  Cronos

Cronos  World Liberty Financial

World Liberty Financial  Tether Gold

Tether Gold  Polkadot

Polkadot  Uniswap

Uniswap  PAX Gold

PAX Gold  MemeCore

MemeCore  Ethena Staked USDe

Ethena Staked USDe  Mantle

Mantle  BlackRock USD Institutional Digital Liquidity Fund

BlackRock USD Institutional Digital Liquidity Fund  Circle USYC

Circle USYC  Bittensor

Bittensor  NEAR Protocol

NEAR Protocol  Global Dollar

Global Dollar  Aave

Aave  Aster

Aster  Falcon USD

Falcon USD  Sky

Sky  Pi Network

Pi Network  OKB

OKB  syrupUSDC

syrupUSDC  Ripple USD

Ripple USD  Pepe

Pepe  Bitget Token

Bitget Token  HTX DAO

HTX DAO  Internet Computer

Internet Computer  Ethereum Classic

Ethereum Classic  Ondo

Ondo  BFUSD

BFUSD  Pump.fun

Pump.fun  Worldcoin

Worldcoin  Superstate Short Duration U.S. Government Securities Fund (USTB)

Superstate Short Duration U.S. Government Securities Fund (USTB)  Gate

Gate  POL (ex-MATIC)

POL (ex-MATIC)  Jupiter Perpetuals Liquidity Provider Token

Jupiter Perpetuals Liquidity Provider Token  KuCoin

KuCoin  Midnight

Midnight  Ethena

Ethena  Cosmos Hub

Cosmos Hub  Quant

Quant  Jito Staked SOL

Jito Staked SOL  Ondo US Dollar Yield

Ondo US Dollar Yield  NEXO

NEXO  USDtb

USDtb  Binance-Peg WETH

Binance-Peg WETH  Rocket Pool ETH

Rocket Pool ETH  Official Trump

Official Trump  Aptos

Aptos  Binance Bridged USDC (BNB Smart Chain)

Binance Bridged USDC (BNB Smart Chain)  Spiko EU T-Bills Money Market Fund

Spiko EU T-Bills Money Market Fund  Wrapped BNB

Wrapped BNB  Algorand

Algorand  Function FBTC

Function FBTC  Filecoin

Filecoin  OUSG

OUSG  Janus Henderson Anemoy AAA CLO Fund

Janus Henderson Anemoy AAA CLO Fund  Render

Render  syrupUSDT

syrupUSDT  USDD

USDD  Jupiter

Jupiter  VeChain

VeChain  Binance Staked SOL

Binance Staked SOL  Stable

Stable  Arbitrum

Arbitrum  Beldex

Beldex  YLDS

YLDS  Janus Henderson Anemoy Treasury Fund

Janus Henderson Anemoy Treasury Fund  Usual USD

Usual USD  Polygon Bridged USDC (Polygon PoS)

Polygon Bridged USDC (Polygon PoS)  Bonk

Bonk  Solv Protocol BTC

Solv Protocol BTC  Decred

Decred  Lombard Staked BTC

Lombard Staked BTC  GHO

GHO  Virtuals Protocol

Virtuals Protocol  A7A5

A7A5  clBTC

clBTC  TrueUSD

TrueUSD  Stacks

Stacks  Sei

Sei  EURC

EURC  PancakeSwap

PancakeSwap  StakeWise Staked ETH

StakeWise Staked ETH  USDai

USDai  Pudgy Penguins

Pudgy Penguins  Kinetiq Staked HYPE

Kinetiq Staked HYPE  Dash

Dash  tBTC

tBTC  JUST

JUST  WrappedM by M0

WrappedM by M0  Tezos

Tezos  Ether.fi

Ether.fi  Kinesis Gold

Kinesis Gold  Curve DAO

Curve DAO  LayerZero

LayerZero  Chiliz

Chiliz  Mantle Staked Ether

Mantle Staked Ether  c8ntinuum

c8ntinuum  Polygon PoS Bridged DAI (Polygon POS)

Polygon PoS Bridged DAI (Polygon POS)  Resolv wstUSR

Resolv wstUSR  Gnosis

Gnosis  COCA

COCA  River

River  Artificial Superintelligence Alliance

Artificial Superintelligence Alliance  Aerodrome Finance

Aerodrome Finance  Liquid Staked ETH

Liquid Staked ETH  pippin

pippin  Arbitrum Bridged WBTC (Arbitrum One)

Arbitrum Bridged WBTC (Arbitrum One)  Lighter

Lighter  SPX6900

SPX6900  BitTorrent

BitTorrent  AINFT

AINFT  Wrapped Flare

Wrapped Flare  PRIME

PRIME  Kaia

Kaia  L2 Standard Bridged WETH (Base)

L2 Standard Bridged WETH (Base)  Steakhouse USDC Morpho Vault

Steakhouse USDC Morpho Vault  Injective

Injective  Celestia

Celestia  ADI

ADI  Sun Token

Sun Token  Bitcoin SV

Bitcoin SV  Binance-Peg XRP

Binance-Peg XRP  Story

Story  Ether.Fi Liquid ETH

Ether.Fi Liquid ETH  Pyth Network

Pyth Network  Renzo Restaked ETH

Renzo Restaked ETH  IOTA

IOTA  The Graph

The Graph  sBTC

sBTC  crvUSD

crvUSD  JasmyCoin

JasmyCoin  FLOKI

FLOKI  Jupiter Staked SOL

Jupiter Staked SOL  Optimism

Optimism  Savings USDD

Savings USDD  Venice Token

Venice Token  Maple Finance

Maple Finance  Siren

Siren  Marinade Staked SOL

Marinade Staked SOL  Legacy Frax Dollar

Legacy Frax Dollar  Arbitrum Bridged WETH (Arbitrum One)

Arbitrum Bridged WETH (Arbitrum One)  Olympus

Olympus  Plasma

Plasma  Lido DAO

Lido DAO  Conflux

Conflux  Staked Aave

Staked Aave  Telcoin

Telcoin