Why “Sell in May” Could Be a Huge Mistake in 2025, Analyst Reveals

The old financial market adage “Sell in May and go away” has long been a guiding principle for investors looking to avoid potential summer volatility. However, some analysis suggests that this adage may not hold true for Bitcoin in the coming month.

Several arguments indicate significant differences in the market landscape for 2025. These factors suggest that May could see price increases instead of decreases.

4 Reasons Why Selling in May Could Be a Big Mistake in 2025

Many analysts recently emphasized a key reason: Bitcoin now aligns closely with the global M2 money supply.

M2 measures the amount of money circulating in the economy. It includes cash, savings deposits, and highly liquid assets. Historically, M2 has shown a strong correlation with Bitcoin prices. When central banks such as the FED, ECB, or PBoC increase the money supply, Bitcoin tends to rise.

Bitcoin And Global M2 (90-day Lag). Source: Kaduna

Kaduna shared a chart that confirms this trend will continue in 2025. According to this pattern, May could be a breakout month for Bitcoin. While not all analysts agree with this view, investors are increasingly accepting it, creating positive sentiment in the market.

“Sell in May and go away would be a huge mistake,” Kaduna emphasized.

Second, historical data backs up Kaduna’s outlook. According to Coinglass, Bitcoin has delivered an average return of over 7.9% in May over the past 12 years. Although financial markets often experience turbulence in summer, Bitcoin doesn’t always follow that pattern.

Bitcoin Price Performance by Month. Source: Coinglass

Instead, May often shows positive performance. It’s not the strongest month, but it outperforms June and September. One investor on X observed that since 2010, Bitcoin has seen nine green Mays and six red ones.

The original proverb comes from the stock market, where historical data shows it works better for equities, not necessarily for crypto.

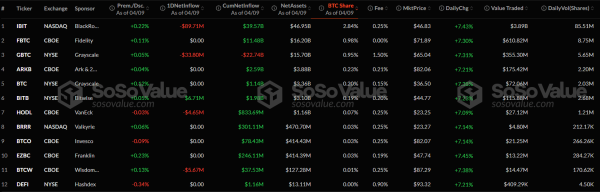

Another major point supporting Kaduna’s thesis is the surge in inflows into Bitcoin ETFs. BeInCrypto recently reported that spot Bitcoin ETFs attracted fresh investor demand on Monday. They recorded net inflows of $591.29 million and extended their winning streak to seven consecutive days.

Notably, BlackRock’s iShares Bitcoin Trust (IBIT) led the way. It recorded the largest inflow among its peers, attracting $970.93 million in one day, bringing its total accumulated net inflows to $42.17 billion.

Total Bitcoin Spot ETF Net Inflow. Source: SosoValue

This increase reflects growing investor confidence and long-term optimism for Bitcoin in 2025. That sentiment may well carry into May, giving further upward momentum to Bitcoin’s price.

Finally, Bitcoin is clearly decoupling from the S&P 500, which historically has signaled large price surges.

Investor arndxt noted this divergence. BeInCrypto also reported a growing disconnect between Bitcoin and the NASDAQ index. Bullish analysts interpret this as a sign that Bitcoin behaves more like an independent asset, less tied to traditional markets.

“The old ‘Sell in May and go away’ mantra doesn’t apply the same way for crypto, liquidity pressures are easing, and this time, May could mark the beginning of an acceleration, not a pause.” – arndxt predicted.

M2 Global, Bitcoin Price, and S&P500 Index Correlation. Source: arndxt

Strong support from M2 correlation, positive May performance in Bitcoin’s history, large ETF inflows, and decoupling from traditional indexes suggest that selling Bitcoin in May 2025 could be a serious mistake.

However, investors should remain cautious. Key data from the Fed, such as CPI, interest rates, and updates on trade tensions, could still introduce uncertainty into May’s outlook.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  USDC

USDC  Solana

Solana  TRON

TRON  Lido Staked Ether

Lido Staked Ether  Figure Heloc

Figure Heloc  Dogecoin

Dogecoin  WhiteBIT Coin

WhiteBIT Coin  USDS

USDS  Cardano

Cardano  Bitcoin Cash

Bitcoin Cash  Wrapped stETH

Wrapped stETH  Hyperliquid

Hyperliquid  LEO Token

LEO Token  Wrapped Bitcoin

Wrapped Bitcoin  Monero

Monero  Binance Bridged USDT (BNB Smart Chain)

Binance Bridged USDT (BNB Smart Chain)  Chainlink

Chainlink  Ethena USDe

Ethena USDe  Canton

Canton  Stellar

Stellar  Wrapped eETH

Wrapped eETH  USD1

USD1  Rain

Rain  sUSDS

sUSDS  Dai

Dai  Litecoin

Litecoin  Avalanche

Avalanche  Coinbase Wrapped BTC

Coinbase Wrapped BTC  PayPal USD

PayPal USD  Hedera

Hedera  Sui

Sui  WETH

WETH  Shiba Inu

Shiba Inu  Zcash

Zcash  Toncoin

Toncoin  USDT0

USDT0  Cronos

Cronos  Tether Gold

Tether Gold  World Liberty Financial

World Liberty Financial  MemeCore

MemeCore  PAX Gold

PAX Gold  Polkadot

Polkadot  Pi Network

Pi Network  Ethena Staked USDe

Ethena Staked USDe  Uniswap

Uniswap  Mantle

Mantle  Circle USYC

Circle USYC  Bittensor

Bittensor  BlackRock USD Institutional Digital Liquidity Fund

BlackRock USD Institutional Digital Liquidity Fund  OKB

OKB  Sky

Sky  Global Dollar

Global Dollar  Falcon USD

Falcon USD  NEAR Protocol

NEAR Protocol  Aster

Aster  Aave

Aave  syrupUSDC

syrupUSDC  Ripple USD

Ripple USD  Bitget Token

Bitget Token  HTX DAO

HTX DAO  Internet Computer

Internet Computer  Pepe

Pepe  BFUSD

BFUSD  Ondo US Dollar Yield

Ondo US Dollar Yield  Ethereum Classic

Ethereum Classic  Ondo

Ondo  Pump.fun

Pump.fun  Gate

Gate  Superstate Short Duration U.S. Government Securities Fund (USTB)

Superstate Short Duration U.S. Government Securities Fund (USTB)  KuCoin

KuCoin  Jupiter Perpetuals Liquidity Provider Token

Jupiter Perpetuals Liquidity Provider Token  Worldcoin

Worldcoin  POL (ex-MATIC)

POL (ex-MATIC)  Spiko EU T-Bills Money Market Fund

Spiko EU T-Bills Money Market Fund  Cosmos Hub

Cosmos Hub  Jito Staked SOL

Jito Staked SOL  NEXO

NEXO  Ethena

Ethena  Render

Render  USDtb

USDtb  Binance-Peg WETH

Binance-Peg WETH  Midnight

Midnight  Rocket Pool ETH

Rocket Pool ETH  Algorand

Algorand  Binance Bridged USDC (BNB Smart Chain)

Binance Bridged USDC (BNB Smart Chain)  USDD

USDD  Wrapped BNB

Wrapped BNB  Function FBTC

Function FBTC  OUSG

OUSG  Aptos

Aptos  Official Trump

Official Trump  Janus Henderson Anemoy Treasury Fund

Janus Henderson Anemoy Treasury Fund  syrupUSDT

syrupUSDT  Filecoin

Filecoin  VeChain

VeChain  Beldex

Beldex  Binance Staked SOL

Binance Staked SOL  Stable

Stable  Arbitrum

Arbitrum  YLDS

YLDS  GHO

GHO  Jupiter

Jupiter  Usual USD

Usual USD  Polygon Bridged USDC (Polygon PoS)

Polygon Bridged USDC (Polygon PoS)  Bonk

Bonk  Solv Protocol BTC

Solv Protocol BTC  TrueUSD

TrueUSD  Lombard Staked BTC

Lombard Staked BTC  A7A5

A7A5  JUST

JUST  clBTC

clBTC  Virtuals Protocol

Virtuals Protocol  Stacks

Stacks  Decred

Decred  PancakeSwap

PancakeSwap  Pudgy Penguins

Pudgy Penguins  EURC

EURC  StakeWise Staked ETH

StakeWise Staked ETH  Sei

Sei  Kinetiq Staked HYPE

Kinetiq Staked HYPE  tBTC

tBTC  Ether.fi

Ether.fi  LayerZero

LayerZero  WrappedM by M0

WrappedM by M0  Janus Henderson Anemoy AAA CLO Fund

Janus Henderson Anemoy AAA CLO Fund  Siren

Siren  Dash

Dash  Tezos

Tezos  Kinesis Gold

Kinesis Gold  Artificial Superintelligence Alliance

Artificial Superintelligence Alliance  c8ntinuum

c8ntinuum  Chiliz

Chiliz  Mantle Staked Ether

Mantle Staked Ether  Polygon PoS Bridged DAI (Polygon POS)

Polygon PoS Bridged DAI (Polygon POS)  River

River  Resolv wstUSR

Resolv wstUSR  pippin

pippin  COCA

COCA  Curve DAO

Curve DAO  ADI

ADI  Gnosis

Gnosis  Liquid Staked ETH

Liquid Staked ETH  AINFT

AINFT  Arbitrum Bridged WBTC (Arbitrum One)

Arbitrum Bridged WBTC (Arbitrum One)  USDai

USDai  PRIME

PRIME  BitTorrent

BitTorrent  Kaia

Kaia  Wrapped Flare

Wrapped Flare  Aerodrome Finance

Aerodrome Finance  Sun Token

Sun Token  L2 Standard Bridged WETH (Base)

L2 Standard Bridged WETH (Base)  Injective

Injective  Steakhouse USDC Morpho Vault

Steakhouse USDC Morpho Vault  Celestia

Celestia  The Graph

The Graph  Bitcoin SV

Bitcoin SV  FLOKI

FLOKI  JasmyCoin

JasmyCoin  Binance-Peg XRP

Binance-Peg XRP  Lighter

Lighter  Ether.Fi Liquid ETH

Ether.Fi Liquid ETH  SPX6900

SPX6900  Renzo Restaked ETH

Renzo Restaked ETH  Maple Finance

Maple Finance  DoubleZero

DoubleZero  sBTC

sBTC  Conflux

Conflux  Story

Story  Legacy Frax Dollar

Legacy Frax Dollar  Jupiter Staked SOL

Jupiter Staked SOL  IOTA

IOTA  Savings USDD

Savings USDD  Pyth Network

Pyth Network  BTSE Token

BTSE Token  Olympus

Olympus  Marinade Staked SOL

Marinade Staked SOL  Venice Token

Venice Token  Arbitrum Bridged WETH (Arbitrum One)

Arbitrum Bridged WETH (Arbitrum One)  crvUSD

crvUSD  Official FO

Official FO  Lombard

Lombard  Lido DAO

Lido DAO  Staked Aave

Staked Aave