Trading Bitcoin With Elliott Wave Theory: Patterns and Psychology

Elliott Wave Theory offers traders a structured way to analyze market psychology and price trends, including the notoriously volatile bitcoin.

Using Elliott Wave Theory to Navigate Bitcoin’s Cycles

Having explored foundational tools like oscillators, moving averages, and Fibonacci retracement, it’s time to delve into Elliott Wave Theory for analyzing bitcoin prices. This advanced technical analysis method focuses on identifying recurring price patterns, or “waves,” driven by market psychology. Understanding Elliott Wave offers a unique lens to anticipate bitcoin’s volatile cycles and potential trend reversals by mapping its distinct impulse and corrective wave structures.

Elliott Wave Theory, developed by accountant Ralph Nelson Elliott in the 1930s, is a technical analysis method based on the observation that crowd psychology drives financial markets in predictable, repetitive cycles. Forced into retirement by illness, Elliott meticulously studied decades of stock market data and concluded that prices move in distinct, fractal patterns reflecting swings between optimism and pessimism. He detailed his findings in “The Wave Principle” published in 1938.

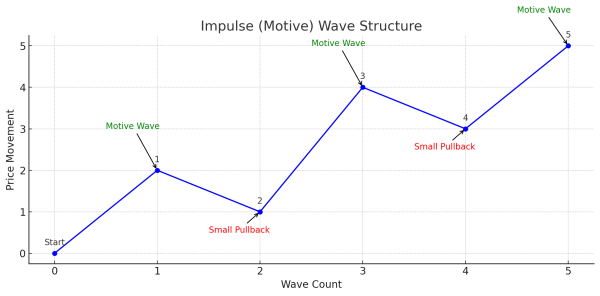

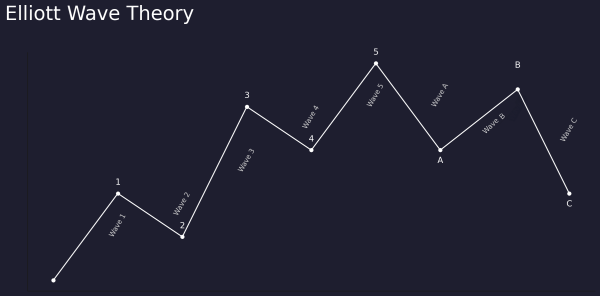

The theory identifies two primary wave types. Impulse (or motive) waves consist of five sub-waves (labeled 1, 2, 3, 4, 5) and move in the direction of the main trend. Within this structure, waves 1, 3, and 5 advance the trend, while waves 2 and 4 represent smaller pullbacks.

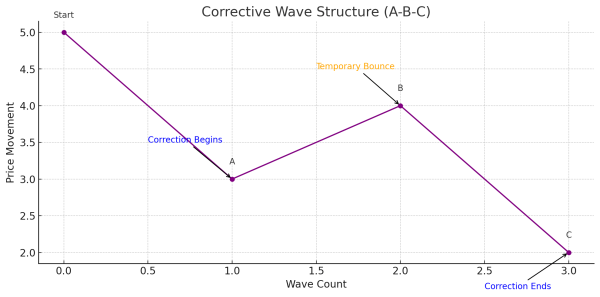

Corrective waves consist of three sub-waves (labeled A, B, C) and move against the main trend, acting as interruptions. A core tenet is the fractal nature of these patterns. This means the same basic wave structures – five waves up followed by three waves down in a bull market, or vice versa in a bear market – repeat across all timeframes, from minute charts to multi-decade charts.

Analysts also frequently observe relationships between wave lengths adhering to Fibonacci ratios (like 38%, 50%, or 62% retracements). Bitcoin’s well-documented volatility and cyclical price movements make it a frequent subject for Elliott Wave analysis. Traders apply the theory to identify potential trend direction, continuation points, and reversals within the cryptocurrency’s price charts.

Applying Elliott Wave Theory to bitcoin (BTC) trading follows a structured process. First, traders identify the primary trend – whether bitcoin is in a bullish (uptrend) or bearish (downtrend) phase. This sets the context for labeling the waves.

Next comes the crucial step of labeling the waves according to their position and characteristics. In an uptrend, traders look for a developing five-wave impulse pattern upwards (1-2-3-4-5), expected to be followed by a three-wave corrective pattern downwards (A-B-C). The reverse applies in a downtrend.

- Wave 1: A modest initial move, often starting from a low point with limited market participation.

- Wave 2: A pullback that retraces some of Wave 1’s gains but does not exceed its starting point.

- Wave 3: Usually the strongest, longest, and highest-volume wave in the sequence.

- Wave 4: A correction that typically doesn’t overlap with the price territory of Wave 1.

- Wave 5: The final push in the trend direction, often showing weaker momentum or divergence.

- Wave A: The first leg down in a correction after an uptrend (or up after a downtrend).

- Wave B: A partial recovery, often seen as a “sucker rally.”

- Wave C: Typically the strongest leg of the correction, often exceeding Wave A’s low.

Bitcoin traders use this wave identification to spot potential entry and exit points. Common strategies include looking for entry opportunities during the pullbacks of Wave 2 or Wave 4 within an uptrend impulse pattern, aiming to capitalize on the anticipated strong moves of Wave 3 or Wave 5. Traders often consider exiting long positions as Wave 5 matures or when the corrective A-B-C pattern begins. Conversely, corrective waves (A-B-C) signal caution for trend-following positions.

Analysis typically involves examining multiple timeframes. A five-wave impulse pattern visible on a weekly bitcoin chart might contain smaller, complete five-wave patterns within it on daily or hourly charts. This multi-scale analysis helps traders align their strategies with different time horizons.

Key rules help maintain consistency in wave counting: Wave 2 cannot retrace more than 100% of Wave 1; Wave 3 cannot be the shortest among waves 1, 3, and 5; and Wave 4 must not overlap with the price territory of Wave 1. Violation of these core rules invalidates the wave count.

However, applying Elliott Wave Theory effectively requires significant practice. The interpretation can be subjective, leading different analysts to see different wave counts on the same bitcoin chart. Its probabilistic nature, rather than deterministic, means it suggests possibilities, not certainties.

Therefore, Bitcoin traders are generally advised to use Elliott Wave analysis in conjunction with other technical indicators – such as moving averages, oscillators like the relative strength index (RSI), or volume analysis – for confirmation of signals and improved decision-making. It provides a framework for understanding market structure and psychology, but its application demands skill and disciplined risk management, especially in the fast-moving crypto markets.

As mentioned earlier, one of the inherent problems with Elliott Wave Theory lies in its deeply subjective nature—pinpointing where one wave concludes and another begins is often a matter of interpretation rather than empirical precision. Given that financial markets don’t arrive conveniently labeled, traders are left to lean on pattern recognition, contextual inference, and individual discretion when counting waves—a process that frequently spawns contention, even among seasoned analysts, with some critics dismissing the entire theory as little more than financial fortune-telling.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  USDC

USDC  Solana

Solana  TRON

TRON  Lido Staked Ether

Lido Staked Ether  Figure Heloc

Figure Heloc  Dogecoin

Dogecoin  WhiteBIT Coin

WhiteBIT Coin  USDS

USDS  Cardano

Cardano  Bitcoin Cash

Bitcoin Cash  Wrapped stETH

Wrapped stETH  LEO Token

LEO Token  Hyperliquid

Hyperliquid  Wrapped Bitcoin

Wrapped Bitcoin  Monero

Monero  Binance Bridged USDT (BNB Smart Chain)

Binance Bridged USDT (BNB Smart Chain)  Chainlink

Chainlink  Ethena USDe

Ethena USDe  Canton

Canton  Stellar

Stellar  Wrapped eETH

Wrapped eETH  USD1

USD1  Rain

Rain  sUSDS

sUSDS  Dai

Dai  Litecoin

Litecoin  Hedera

Hedera  Coinbase Wrapped BTC

Coinbase Wrapped BTC  PayPal USD

PayPal USD  Avalanche

Avalanche  Sui

Sui  WETH

WETH  Zcash

Zcash  Toncoin

Toncoin  Shiba Inu

Shiba Inu  USDT0

USDT0  Cronos

Cronos  Tether Gold

Tether Gold  World Liberty Financial

World Liberty Financial  MemeCore

MemeCore  PAX Gold

PAX Gold  Polkadot

Polkadot  Uniswap

Uniswap  Ethena Staked USDe

Ethena Staked USDe  Mantle

Mantle  Pi Network

Pi Network  OKB

OKB  Circle USYC

Circle USYC  BlackRock USD Institutional Digital Liquidity Fund

BlackRock USD Institutional Digital Liquidity Fund  Bittensor

Bittensor  Sky

Sky  Falcon USD

Falcon USD  Aster

Aster  Global Dollar

Global Dollar  Aave

Aave  NEAR Protocol

NEAR Protocol  syrupUSDC

syrupUSDC  Ripple USD

Ripple USD  Bitget Token

Bitget Token  HTX DAO

HTX DAO  Pepe

Pepe  Internet Computer

Internet Computer  BFUSD

BFUSD  Ondo US Dollar Yield

Ondo US Dollar Yield  Ethereum Classic

Ethereum Classic  Ondo

Ondo  Pump.fun

Pump.fun  Gate

Gate  KuCoin

KuCoin  Worldcoin

Worldcoin  Superstate Short Duration U.S. Government Securities Fund (USTB)

Superstate Short Duration U.S. Government Securities Fund (USTB)  Jupiter Perpetuals Liquidity Provider Token

Jupiter Perpetuals Liquidity Provider Token  POL (ex-MATIC)

POL (ex-MATIC)  Quant

Quant  Midnight

Midnight  Spiko EU T-Bills Money Market Fund

Spiko EU T-Bills Money Market Fund  Jito Staked SOL

Jito Staked SOL  NEXO

NEXO  Ethena

Ethena  Cosmos Hub

Cosmos Hub  USDtb

USDtb  Binance-Peg WETH

Binance-Peg WETH  Rocket Pool ETH

Rocket Pool ETH  Aptos

Aptos  Binance Bridged USDC (BNB Smart Chain)

Binance Bridged USDC (BNB Smart Chain)  OUSG

OUSG  Wrapped BNB

Wrapped BNB  Algorand

Algorand  Function FBTC

Function FBTC  Janus Henderson Anemoy AAA CLO Fund

Janus Henderson Anemoy AAA CLO Fund  USDD

USDD  Filecoin

Filecoin  Render

Render  Official Trump

Official Trump  syrupUSDT

syrupUSDT  Beldex

Beldex  VeChain

VeChain  Binance Staked SOL

Binance Staked SOL  YLDS

YLDS  Stable

Stable  Arbitrum

Arbitrum  Janus Henderson Anemoy Treasury Fund

Janus Henderson Anemoy Treasury Fund  GHO

GHO  Usual USD

Usual USD  Polygon Bridged USDC (Polygon PoS)

Polygon Bridged USDC (Polygon PoS)  Jupiter

Jupiter  Solv Protocol BTC

Solv Protocol BTC  Lombard Staked BTC

Lombard Staked BTC  Bonk

Bonk  Decred

Decred  TrueUSD

TrueUSD  clBTC

clBTC  A7A5

A7A5  Stacks

Stacks  EURC

EURC  PancakeSwap

PancakeSwap  Pudgy Penguins

Pudgy Penguins  StakeWise Staked ETH

StakeWise Staked ETH  JUST

JUST  Virtuals Protocol

Virtuals Protocol  Kinetiq Staked HYPE

Kinetiq Staked HYPE  tBTC

tBTC  Sei

Sei  Ether.fi

Ether.fi  WrappedM by M0

WrappedM by M0  Dash

Dash  LayerZero

LayerZero  Chiliz

Chiliz  Tezos

Tezos  Kinesis Gold

Kinesis Gold  c8ntinuum

c8ntinuum  Curve DAO

Curve DAO  Mantle Staked Ether

Mantle Staked Ether  pippin

pippin  Polygon PoS Bridged DAI (Polygon POS)

Polygon PoS Bridged DAI (Polygon POS)  Siren

Siren  Resolv wstUSR

Resolv wstUSR  Gnosis

Gnosis  COCA

COCA  AINFT

AINFT  Artificial Superintelligence Alliance

Artificial Superintelligence Alliance  BitTorrent

BitTorrent  Liquid Staked ETH

Liquid Staked ETH  PRIME

PRIME  Arbitrum Bridged WBTC (Arbitrum One)

Arbitrum Bridged WBTC (Arbitrum One)  USDai

USDai  Sun Token

Sun Token  ADI

ADI  Aerodrome Finance

Aerodrome Finance  Wrapped Flare

Wrapped Flare  Kaia

Kaia  Injective

Injective  L2 Standard Bridged WETH (Base)

L2 Standard Bridged WETH (Base)  Celestia

Celestia  Steakhouse USDC Morpho Vault

Steakhouse USDC Morpho Vault  JasmyCoin

JasmyCoin  SPX6900

SPX6900  IOTA

IOTA  Story

Story  FLOKI

FLOKI  Binance-Peg XRP

Binance-Peg XRP  Legacy Frax Dollar

Legacy Frax Dollar  Ether.Fi Liquid ETH

Ether.Fi Liquid ETH  The Graph

The Graph  Renzo Restaked ETH

Renzo Restaked ETH  Pyth Network

Pyth Network  crvUSD

crvUSD  sBTC

sBTC  Olympus

Olympus  Maple Finance

Maple Finance  DoubleZero

DoubleZero  Jupiter Staked SOL

Jupiter Staked SOL  Bitcoin SV

Bitcoin SV  Savings USDD

Savings USDD  BTSE Token

BTSE Token  Conflux

Conflux  Optimism

Optimism  Marinade Staked SOL

Marinade Staked SOL  Lighter

Lighter  Arbitrum Bridged WETH (Arbitrum One)

Arbitrum Bridged WETH (Arbitrum One)  Lombard

Lombard  Telcoin

Telcoin  Lido DAO

Lido DAO  Humanity

Humanity