Top stablecoins shrink as crypto cash flees, posing risk to bitcoin’s bounce

The crypto market is seeing one of its rarest trends lately, and it doesn’t look good for the valuations of bitcoin BTC$89,217.52 and other tokens.

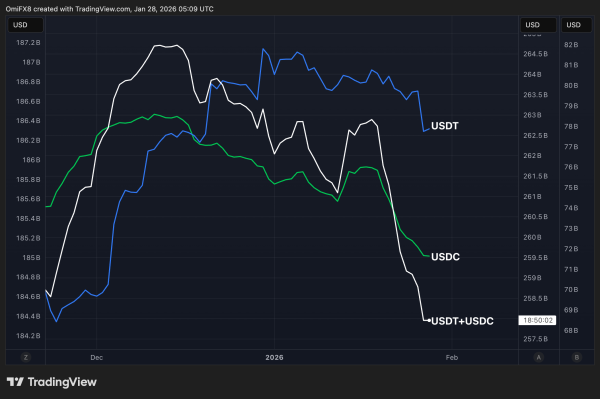

That trend is the contraction in the market capitalization of the top two dollar-pegged stablecoins, Tether USDT$0.9988 and USD Coin (USDC). Their combined market value has declined to 257.9 billion, the lowest since Nov. 20, after peaking near $265 billion in mid-December, according to data from CoinDesk. The drop has been particularly steep over the last ten days.

USDC accounts for most of the slide, with its market cap falling by over $4 billion in ten days and down $6 billion to $71.65 billion since mid-December. Tether’s value has dropped by just over $1 billion to $186.25 billion over the same period.

The downtrend shows traders withdrawing cash from the crypto market, a trend that coincides with institutions pulling billions out of U.S.-listed spot bitcoin exchange-traded funds.

Stablecoins like USDT and USDC, tied to the U.S. dollar, act as an easy door for regular money to flow into digital assets, funding crypto buys and DeFi yield plays, but now that’s reversing. Think of these like casino chips.You swap regular cash (fiat) for chips before hitting the gaming floor, play your games, then cash out whatever chips you have left back to dollars when you’re done and head home.

“Money is leaving crypto instead of waiting on the sidelines: Normally, when traders sell Bitcoin or altcoins, that money stays in crypto as stablecoins. A falling stablecoin market cap shows that many investors are cashing out to fiat instead of preparing to buy dips,” blockchain analytics firm Santiment said in an explainer post on X.

The firm added that the dwindling stablecoin supply raises questions about the sustainability of market gains, especially in alternative cryptocurrencies.

“Stablecoins are the main source of liquidity used to buy crypto. When their supply drops, there is less capital available to quickly push prices back up, making rebounds weaker or slower,” it noted.

In short, shrinking stablecoin supply could hinder the price rebound of bitcoin and other cryptocurrencies. Bitcoin, the leading cryptocurrency by market value, has bounced to nearly $89,000 from the weekend low of $86,000.

Market cap of top stablecoins. (TradingView)

The drop in stablecoin supply, especially USDC, which the U.S.-regulated Circle Internet Financial issues, could be a reflection of investor frustration over delays in the Clarity Act – a proposed law to regulate these dollar-tied tokens in the U.S.

“Narrative-wise, investors and traders appear to be pricing out the U.S. crypto mojo. The CLARITY Act remains stuck in the Senate, while Republicans are prioritizing purchasing-power-focused legislation ahead of the midterms, reducing near-term regulatory momentum for crypto,” Aurelie Barthere, principal research analyst at Nansen, said in an email.

She added that the passage of the bill would be a meaningful upside catalyst for the market.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  Wrapped SOL

Wrapped SOL  USDC

USDC  JUSD

JUSD  Lido Staked Ether

Lido Staked Ether  TRON

TRON  Dogecoin

Dogecoin  Figure Heloc

Figure Heloc  Cardano

Cardano  Wrapped stETH

Wrapped stETH  Bitcoin Cash

Bitcoin Cash  WhiteBIT Coin

WhiteBIT Coin  Wrapped Bitcoin

Wrapped Bitcoin  Wrapped eETH

Wrapped eETH  USDS

USDS  Binance Bridged USDT (BNB Smart Chain)

Binance Bridged USDT (BNB Smart Chain)  Monero

Monero  LEO Token

LEO Token  Chainlink

Chainlink  Hyperliquid

Hyperliquid  Coinbase Wrapped BTC

Coinbase Wrapped BTC  WETH

WETH  Stellar

Stellar  Ethena USDe

Ethena USDe  Zcash

Zcash  Canton

Canton  Sui

Sui  Litecoin

Litecoin  Avalanche

Avalanche  USD1

USD1  Hedera

Hedera  Shiba Inu

Shiba Inu  World Liberty Financial

World Liberty Financial  USDT0

USDT0  Dai

Dai  sUSDS

sUSDS  PayPal USD

PayPal USD  Ethena Staked USDe

Ethena Staked USDe  Toncoin

Toncoin  Cronos

Cronos  Rain

Rain  Polkadot

Polkadot  Uniswap

Uniswap  Mantle

Mantle  Tether Gold

Tether Gold  MemeCore

MemeCore  Bitget Token

Bitget Token  Aave

Aave  Bittensor

Bittensor  OKB

OKB  PAX Gold

PAX Gold  Falcon USD

Falcon USD  Pepe

Pepe  NEAR Protocol

NEAR Protocol  Pump.fun

Pump.fun  Binance-Peg WETH

Binance-Peg WETH  Jito Staked SOL

Jito Staked SOL  Ethereum Classic

Ethereum Classic  Internet Computer

Internet Computer  Aster

Aster  BlackRock USD Institutional Digital Liquidity Fund

BlackRock USD Institutional Digital Liquidity Fund  Ondo

Ondo  Circle USYC

Circle USYC  HTX DAO

HTX DAO  Global Dollar

Global Dollar  Jupiter Perpetuals Liquidity Provider Token

Jupiter Perpetuals Liquidity Provider Token  Sky

Sky  Pi Network

Pi Network  KuCoin

KuCoin  Ripple USD

Ripple USD  Binance Staked SOL

Binance Staked SOL  Wrapped BNB

Wrapped BNB  Ethena

Ethena  syrupUSDC

syrupUSDC  BFUSD

BFUSD  Binance Bridged USDC (BNB Smart Chain)

Binance Bridged USDC (BNB Smart Chain)  Worldcoin

Worldcoin  POL (ex-MATIC)

POL (ex-MATIC)  Rocket Pool ETH

Rocket Pool ETH  Aptos

Aptos  MYX Finance

MYX Finance  Gate

Gate  USDD

USDD  River

River  Cosmos Hub

Cosmos Hub  Algorand

Algorand  Arbitrum

Arbitrum  Lombard Staked BTC

Lombard Staked BTC  Render

Render  Midnight

Midnight  Function FBTC

Function FBTC  Official Trump

Official Trump  Filecoin

Filecoin  NEXO

NEXO  Polygon Bridged USDC (Polygon PoS)

Polygon Bridged USDC (Polygon PoS)  VeChain

VeChain  USDtb

USDtb  Mantle Staked Ether

Mantle Staked Ether  Superstate Short Duration U.S. Government Securities Fund (USTB)

Superstate Short Duration U.S. Government Securities Fund (USTB)  Liquid Staked ETH

Liquid Staked ETH  syrupUSDT

syrupUSDT  Dash

Dash  Bonk

Bonk  Kinetiq Staked HYPE

Kinetiq Staked HYPE  WrappedM by M0

WrappedM by M0  Story

Story  Solv Protocol BTC

Solv Protocol BTC  Janus Henderson Anemoy AAA CLO Fund

Janus Henderson Anemoy AAA CLO Fund  Renzo Restaked ETH

Renzo Restaked ETH  Sei

Sei  Arbitrum Bridged WBTC (Arbitrum One)

Arbitrum Bridged WBTC (Arbitrum One)  Ondo US Dollar Yield

Ondo US Dollar Yield  StakeWise Staked ETH

StakeWise Staked ETH  clBTC

clBTC  OUSG

OUSG  Jupiter

Jupiter  COCA

COCA  Spiko EU T-Bills Money Market Fund

Spiko EU T-Bills Money Market Fund  L2 Standard Bridged WETH (Base)

L2 Standard Bridged WETH (Base)  PancakeSwap

PancakeSwap  Pudgy Penguins

Pudgy Penguins  USDai

USDai  Polygon PoS Bridged DAI (Polygon POS)

Polygon PoS Bridged DAI (Polygon POS)  Jupiter Staked SOL

Jupiter Staked SOL  Binance-Peg XRP

Binance-Peg XRP  Wrapped Flare

Wrapped Flare  Tezos

Tezos  Beldex

Beldex  Optimism

Optimism  Chiliz

Chiliz  Usual USD

Usual USD  Arbitrum Bridged WETH (Arbitrum One)

Arbitrum Bridged WETH (Arbitrum One)  c8ntinuum

c8ntinuum  Virtuals Protocol

Virtuals Protocol  Stacks

Stacks  tBTC

tBTC  Janus Henderson Anemoy Treasury Fund

Janus Henderson Anemoy Treasury Fund  Artificial Superintelligence Alliance

Artificial Superintelligence Alliance  GHO

GHO  A7A5

A7A5  Curve DAO

Curve DAO  GTETH

GTETH  pippin

pippin  TrueUSD

TrueUSD  Lighter

Lighter  Ether.Fi Liquid ETH

Ether.Fi Liquid ETH  Injective

Injective  Lido DAO

Lido DAO  Ether.fi

Ether.fi  Marinade Staked SOL

Marinade Staked SOL  Cap USD

Cap USD  DoubleZero

DoubleZero  Coinbase Wrapped Staked ETH

Coinbase Wrapped Staked ETH  LayerZero

LayerZero  Kinesis Silver

Kinesis Silver  Steakhouse USDC Morpho Vault

Steakhouse USDC Morpho Vault  Aerodrome Finance

Aerodrome Finance  Stader ETHx

Stader ETHx  Axie Infinity

Axie Infinity  FLOKI

FLOKI  Kaia

Kaia  sBTC

sBTC  Kinesis Gold

Kinesis Gold  EURC

EURC  Maple Finance

Maple Finance  BitTorrent

BitTorrent  Resolv USR

Resolv USR  Celestia

Celestia  Staked Aave

Staked Aave  Stable

Stable  Resolv wstUSR

Resolv wstUSR  The Graph

The Graph  AB

AB  Gnosis

Gnosis  JUST

JUST  IOTA

IOTA  Trust Wallet

Trust Wallet  Wrapped ApeCoin

Wrapped ApeCoin  SPX6900

SPX6900  Starknet

Starknet  Bitcoin SV

Bitcoin SV  Pyth Network

Pyth Network  Conflux

Conflux  crvUSD

crvUSD  Telcoin

Telcoin  AINFT

AINFT