Solana Price Nears Key Resistance, Global Liquidity Signals Upside Potential

Solana (SOL) price is approaching a critical resistance level, capturing the attention of many investors. Recent trends indicate an uptick in the global money supply, signaling favorable conditions for risk assets like Solana coin.

As M2 global liquidity expands, Solana price appears to be poised for a potential breakout beyond its current resistance, aligning with positive macroeconomic conditions that could lead to significant upward movement.

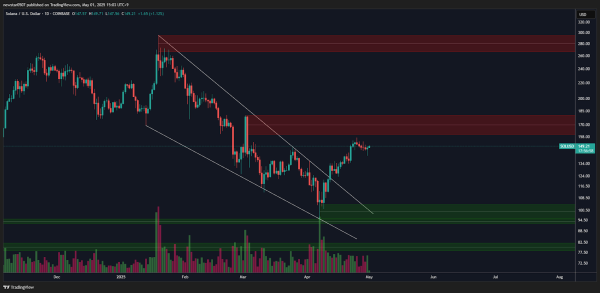

Solana Price Faces Key Resistance Levels

Solana price has demonstrated strength recently, bouncing off support zones between $134 and $140.

That suggested a potential bullish reversal. It was testing the upper boundary of a descending channel at press time, which often occurs before upward movements.

A break above the $150 resistance could lead to further gains, with targets between $170 and $185, and possibly even $260 and $320.

Rising trading volume supports the likelihood of a breakout. Increased volume typically indicates growing interest from traders, often leading to larger price movements. It suggested that Solana could be preparing for a move above its current resistance levels.

Source: X

Strong price momentum and favorable macroeconomic conditions, especially the rise in global liquidity, further strengthen the breakout potential.

If Solana manages to break the $150 resistance, it could signal a continued upward trajectory with significant price gains ahead.

Global Liquidity Expansion Fuels Bullish Sentiment

Recent increases in global liquidity suggest favorable conditions for risk assets like Solana price. The rise in M2 money supply, which tracks the total money in circulation, often signals increased market liquidity and investor confidence.

Historically, such expansions have contributed to price growth in assets like cryptocurrencies.

This boost in liquidity could help Solana price break through its current resistance levels. There was a well-established correlation between rising global liquidity and bullish market conditions at the time of writing.

As the money supply expands, speculative activity typically increases, driving asset prices higher. Solana’s price action was in line with that trend, suggesting strong upside potential if it could break through its current sell wall.

$SOL #Solana vs M2 Global Liquidity (M2 Global Money Supply)

BULLISH CHART!

SOL COULD PUMP AT ANY TIME 🟢📈 pic.twitter.com/JG9JdlALtb— Bull Bear Spot (@m2globalmoney) May 1, 2025

The increase in open interest in Solana futures also supported this bullish outlook. Open interest, which measures the number of outstanding futures contracts, rose alongside Solana’s price. That reflected growing market confidence.

As more traders enter the market, betting on future price growth, Solana’s potential for a breakout strengthens, particularly as global liquidity continues to rise.

Solana’s Rising Open Interest Supports Bullish Outlook

The rise in open interest in Solana price futures has become a key indicator supporting a bullish outlook. From early 2024, both Solana’s price and open interest began to increase in tandem, signaling growing confidence in the asset’s future performance.

As Solana’s price surged from $50 in early 2024 to around $150 by April 2025, open interest also saw a significant rise. That reflected traders’ optimism.

This strong correlation between price and open interest is often viewed as a bullish signal. When both increase together, it indicates that traders are not only confident in the price direction but are also committing more capital to the market.

This growing market participation could help Solana break through its resistance levels. It could help Solana price continue its upward trend.

The sharp spike in open interest in April 2025 suggested that speculative activity was intensifying. As Solana’s price rose, more traders were positioning themselves for a potential breakout.

With rising global liquidity and increasing participation from traders, Solana’s bullish outlook was gaining momentum.

Institutional Confidence in Solana Strengthens Market Sentiment

Institutional investments are becoming a major sign of confidence in the future development that Solana price will experience.

Recently, a NASDAQ-listed company, namely, Upexi Inc., bought more than 45,000 Solana tokens through its treasury management. The price of all those SOL coins amounted to $100 million, proving its institutional appreciation of Solana’s worth.

This move, accompanied by funding from top venture capital firms, proved that big names started to take notice of Solana.

It serves as a stream that keeps on building up the next level of the price appreciation as more institutional players begin to enter the market, with a boost from global liquidity.

And another one: #Solana Reserve company Upexi purchases 45,733 $SOL Tokens as it Begins Deploying $100 Million Treasury in Solana Strategy (NASDAQ Traded UPXI)

Upexi Inc. (NASDAQ: UPXI), a brand owner specializing in the development, manufacturing and distribution of consumer… pic.twitter.com/UQcRdA1vpW

— MartyParty (@martypartymusic) April 30, 2025

With the increased institutional interest, the upward trend in value, and the relative openness, Solana could hit its upper resistance. Those factors point to the positive direction, and, therefore, the possibility of Solana price shooting up soon.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  USDC

USDC  Solana

Solana  TRON

TRON  Lido Staked Ether

Lido Staked Ether  Figure Heloc

Figure Heloc  Dogecoin

Dogecoin  WhiteBIT Coin

WhiteBIT Coin  USDS

USDS  Cardano

Cardano  Bitcoin Cash

Bitcoin Cash  Wrapped stETH

Wrapped stETH  Hyperliquid

Hyperliquid  LEO Token

LEO Token  Wrapped Bitcoin

Wrapped Bitcoin  Monero

Monero  Binance Bridged USDT (BNB Smart Chain)

Binance Bridged USDT (BNB Smart Chain)  Chainlink

Chainlink  Ethena USDe

Ethena USDe  Canton

Canton  Stellar

Stellar  Wrapped eETH

Wrapped eETH  USD1

USD1  Rain

Rain  sUSDS

sUSDS  Dai

Dai  Litecoin

Litecoin  Avalanche

Avalanche  Coinbase Wrapped BTC

Coinbase Wrapped BTC  PayPal USD

PayPal USD  Hedera

Hedera  Sui

Sui  WETH

WETH  Shiba Inu

Shiba Inu  Zcash

Zcash  Toncoin

Toncoin  USDT0

USDT0  Cronos

Cronos  Tether Gold

Tether Gold  World Liberty Financial

World Liberty Financial  MemeCore

MemeCore  PAX Gold

PAX Gold  Polkadot

Polkadot  Pi Network

Pi Network  Ethena Staked USDe

Ethena Staked USDe  Uniswap

Uniswap  Mantle

Mantle  Circle USYC

Circle USYC  Bittensor

Bittensor  BlackRock USD Institutional Digital Liquidity Fund

BlackRock USD Institutional Digital Liquidity Fund  OKB

OKB  Sky

Sky  Falcon USD

Falcon USD  Global Dollar

Global Dollar  Aster

Aster  NEAR Protocol

NEAR Protocol  Aave

Aave  syrupUSDC

syrupUSDC  Ripple USD

Ripple USD  Bitget Token

Bitget Token  HTX DAO

HTX DAO  Internet Computer

Internet Computer  Pepe

Pepe  BFUSD

BFUSD  Ondo US Dollar Yield

Ondo US Dollar Yield  Ethereum Classic

Ethereum Classic  Ondo

Ondo  Pump.fun

Pump.fun  Gate

Gate  Superstate Short Duration U.S. Government Securities Fund (USTB)

Superstate Short Duration U.S. Government Securities Fund (USTB)  KuCoin

KuCoin  Jupiter Perpetuals Liquidity Provider Token

Jupiter Perpetuals Liquidity Provider Token  Worldcoin

Worldcoin  POL (ex-MATIC)

POL (ex-MATIC)  Spiko EU T-Bills Money Market Fund

Spiko EU T-Bills Money Market Fund  Quant

Quant  Cosmos Hub

Cosmos Hub  Jito Staked SOL

Jito Staked SOL  NEXO

NEXO  Ethena

Ethena  Render

Render  USDtb

USDtb  Binance-Peg WETH

Binance-Peg WETH  Rocket Pool ETH

Rocket Pool ETH  Midnight

Midnight  Algorand

Algorand  Binance Bridged USDC (BNB Smart Chain)

Binance Bridged USDC (BNB Smart Chain)  USDD

USDD  Wrapped BNB

Wrapped BNB  Function FBTC

Function FBTC  OUSG

OUSG  Aptos

Aptos  Official Trump

Official Trump  Janus Henderson Anemoy Treasury Fund

Janus Henderson Anemoy Treasury Fund  syrupUSDT

syrupUSDT  Filecoin

Filecoin  Beldex

Beldex  VeChain

VeChain  Binance Staked SOL

Binance Staked SOL  YLDS

YLDS  Stable

Stable  Arbitrum

Arbitrum  GHO

GHO  Jupiter

Jupiter  Usual USD

Usual USD  Polygon Bridged USDC (Polygon PoS)

Polygon Bridged USDC (Polygon PoS)  Bonk

Bonk  Solv Protocol BTC

Solv Protocol BTC  TrueUSD

TrueUSD  Lombard Staked BTC

Lombard Staked BTC  A7A5

A7A5  JUST

JUST  clBTC

clBTC  Stacks

Stacks  Decred

Decred  Virtuals Protocol

Virtuals Protocol  PancakeSwap

PancakeSwap  Pudgy Penguins

Pudgy Penguins  EURC

EURC  StakeWise Staked ETH

StakeWise Staked ETH  Sei

Sei  Kinetiq Staked HYPE

Kinetiq Staked HYPE  tBTC

tBTC  Ether.fi

Ether.fi  Janus Henderson Anemoy AAA CLO Fund

Janus Henderson Anemoy AAA CLO Fund  WrappedM by M0

WrappedM by M0  Siren

Siren  LayerZero

LayerZero  Dash

Dash  Kinesis Gold

Kinesis Gold  Tezos

Tezos  Chiliz

Chiliz  c8ntinuum

c8ntinuum  Artificial Superintelligence Alliance

Artificial Superintelligence Alliance  Mantle Staked Ether

Mantle Staked Ether  Polygon PoS Bridged DAI (Polygon POS)

Polygon PoS Bridged DAI (Polygon POS)  River

River  Resolv wstUSR

Resolv wstUSR  pippin

pippin  COCA

COCA  Curve DAO

Curve DAO  ADI

ADI  Gnosis

Gnosis  Liquid Staked ETH

Liquid Staked ETH  USDai

USDai  Arbitrum Bridged WBTC (Arbitrum One)

Arbitrum Bridged WBTC (Arbitrum One)  AINFT

AINFT  PRIME

PRIME  BitTorrent

BitTorrent  Kaia

Kaia  Wrapped Flare

Wrapped Flare  The Graph

The Graph  Aerodrome Finance

Aerodrome Finance  L2 Standard Bridged WETH (Base)

L2 Standard Bridged WETH (Base)  Sun Token

Sun Token  Steakhouse USDC Morpho Vault

Steakhouse USDC Morpho Vault  Injective

Injective  Celestia

Celestia  Bitcoin SV

Bitcoin SV  FLOKI

FLOKI  SPX6900

SPX6900  Binance-Peg XRP

Binance-Peg XRP  JasmyCoin

JasmyCoin  Ether.Fi Liquid ETH

Ether.Fi Liquid ETH  Lighter

Lighter  Renzo Restaked ETH

Renzo Restaked ETH  Maple Finance

Maple Finance  Story

Story  sBTC

sBTC  Conflux

Conflux  DoubleZero

DoubleZero  Legacy Frax Dollar

Legacy Frax Dollar  Jupiter Staked SOL

Jupiter Staked SOL  IOTA

IOTA  Savings USDD

Savings USDD  Venice Token

Venice Token  Pyth Network

Pyth Network  BTSE Token

BTSE Token  Marinade Staked SOL

Marinade Staked SOL  Olympus

Olympus  Arbitrum Bridged WETH (Arbitrum One)

Arbitrum Bridged WETH (Arbitrum One)  crvUSD

crvUSD  Official FO

Official FO  Lombard

Lombard  Lido DAO

Lido DAO