Lyn Alden Highlights 2 Key Drivers Behind Bitcoin Stock and Bond Boom

In 2025, there has been a sharp increase in companies using Bitcoin as a reserve asset, which has led to the rise of Bitcoin-related stocks and bonds. Fund manager Lyn Alden pointed out two main reasons behind this trend.

These reasons reflect institutional demand and highlight the strategic advantages companies derive from leveraging Bitcoin.

Reason 1: A Substitute for Investment-Restricted Funds

One key reason Lyn Alden mentioned is the limitation many investment funds face. Several funds are only allowed to invest in stocks or bonds and are prohibited from directly buying Bitcoin or cryptocurrency-related ETFs.

As a result, this creates a significant barrier for fund managers who want exposure to Bitcoin—especially those who believe in its strong growth potential. To bypass this restriction, stocks of Bitcoin-holding companies like Strategy (formerly MicroStrategy) (MSTR) have become a valid alternative.

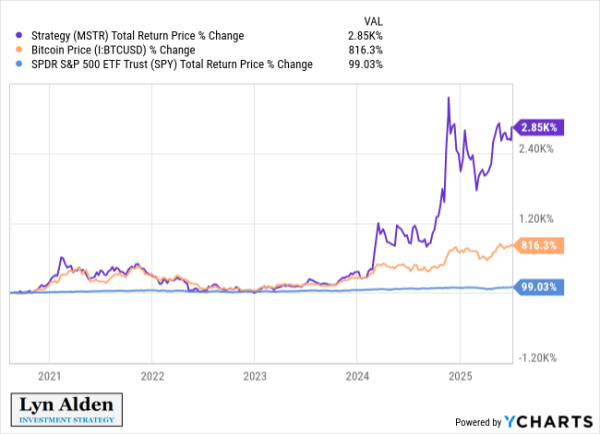

Comparing Bitcoin, MSTR, and SPY Performance. Source: Lyn Alden

A chart provided by Lyn Alden shows MSTR’s total price return from 2021 to mid-2025 at 2,850%. Bitcoin (BTC/USD) rose 816.3% during the same period, while SPY increased by only 99.03%. This suggests that MSTR outperformed the broader equity market and served as an indirect way for funds to gain Bitcoin exposure.

“In short, there are many funds, due to mandates, that can only own stocks or bonds with bitcoin exposure; not ETFs or similar securities. Bitcoin treasury corporations give them access,” Lyn Alden explained.

She also shared her personal experience managing her model portfolio. In 2020, she chose MSTR because her exchange platform didn’t support direct Bitcoin or GBTC purchases. This flexibility enabled funds with strategy restrictions to gain Bitcoin exposure without violating rules.

Reason 2: The Advantage of Long-Term Bonds and Safer Leverage

Lyn Alden emphasized the second reason: companies’ ability to issue long-term bonds. This helps them avoid the margin call risk that hedge funds often face.

Hedge funds typically use margin borrowing, which can trigger forced asset sales when Bitcoin prices fall sharply.

In contrast, companies like Strategy can issue multi-year bonds. This allows them to hold their Bitcoin positions even during volatile market conditions.

This approach creates a safer form of leverage. It helps companies more effectively capitalize on Bitcoin’s price swings than leveraged ETFs.

Lyn Alden pointed out that long-term bonds offer greater resilience against volatility than margin loans. Companies are not forced to liquidate during short-term downturns.

“This type of longer-duration corporate leverage is also usually better in the long run than leveraged ETFs. Since leveraged ETFs don’t use long-term debt, their leverage resets daily, and so volatility is often quite bad for them,” she added.

Investors Are Increasingly Interested in DATs

Lyn Alden’s insights shed light on the growing investor interest in the stocks of companies embracing strategic crypto reserves.

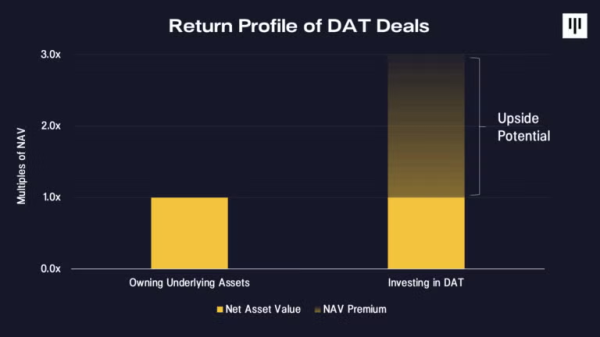

A recent report from Pantera Capital highlighted that Digital Asset Treasury stocks (DATs) bridge traditional finance and digital assets. They allow investors to gain exposure through familiar instruments.

Pantera also believes investing in DATs could generate higher returns than the underlying digital assets.

Return Profile of DAT Deals. Source: Pantera Capital

“The game has changed after Coinbase gets included in S&P500. Every tradfi PM is hungry and forced to add some digital assets. It’s DAT season, not alts season… The trend is still in the early stage,” investor Nachi commented.

Additionally, a recent BeInCrypto report shows that during this altcoin winter, the stocks of crypto-focused companies like Coinbase, Circle, and Robinhood are outperforming major tokens.

However, this shift in investor focus toward external profit opportunities may cause the crypto industry to lose its growth momentum.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  USDC

USDC  Solana

Solana  TRON

TRON  Lido Staked Ether

Lido Staked Ether  Dogecoin

Dogecoin  Figure Heloc

Figure Heloc  Bitcoin Cash

Bitcoin Cash  WhiteBIT Coin

WhiteBIT Coin  Cardano

Cardano  USDS

USDS  Wrapped stETH

Wrapped stETH  LEO Token

LEO Token  Hyperliquid

Hyperliquid  Wrapped Bitcoin

Wrapped Bitcoin  Chainlink

Chainlink  Binance Bridged USDT (BNB Smart Chain)

Binance Bridged USDT (BNB Smart Chain)  Ethena USDe

Ethena USDe  Canton

Canton  Monero

Monero  Stellar

Stellar  Wrapped eETH

Wrapped eETH  USD1

USD1  Rain

Rain  sUSDS

sUSDS  Hedera

Hedera  Zcash

Zcash  Litecoin

Litecoin  Coinbase Wrapped BTC

Coinbase Wrapped BTC  Dai

Dai  PayPal USD

PayPal USD  Avalanche

Avalanche  WETH

WETH  Shiba Inu

Shiba Inu  Sui

Sui  Toncoin

Toncoin  USDT0

USDT0  World Liberty Financial

World Liberty Financial  Cronos

Cronos  Tether Gold

Tether Gold  MemeCore

MemeCore  PAX Gold

PAX Gold  Uniswap

Uniswap  Polkadot

Polkadot  Ethena Staked USDe

Ethena Staked USDe  Mantle

Mantle  BlackRock USD Institutional Digital Liquidity Fund

BlackRock USD Institutional Digital Liquidity Fund  Aave

Aave  Falcon USD

Falcon USD  Aster

Aster  Pepe

Pepe  Bittensor

Bittensor  OKB

OKB  Bitget Token

Bitget Token  Global Dollar

Global Dollar  Circle USYC

Circle USYC  syrupUSDC

syrupUSDC  Ripple USD

Ripple USD  HTX DAO

HTX DAO  Pi Network

Pi Network  Sky

Sky  Ethereum Classic

Ethereum Classic  NEAR Protocol

NEAR Protocol  BFUSD

BFUSD  Ondo

Ondo  Pump.fun

Pump.fun  Superstate Short Duration U.S. Government Securities Fund (USTB)

Superstate Short Duration U.S. Government Securities Fund (USTB)  Internet Computer

Internet Computer  Cosmos Hub

Cosmos Hub  POL (ex-MATIC)

POL (ex-MATIC)  Gate

Gate  KuCoin

KuCoin  Jupiter Perpetuals Liquidity Provider Token

Jupiter Perpetuals Liquidity Provider Token  Worldcoin

Worldcoin  Midnight

Midnight  Quant

Quant  NEXO

NEXO  Jito Staked SOL

Jito Staked SOL  Ethena

Ethena  USDtb

USDtb  Binance-Peg WETH

Binance-Peg WETH  Official Trump

Official Trump  Rocket Pool ETH

Rocket Pool ETH  Spiko EU T-Bills Money Market Fund

Spiko EU T-Bills Money Market Fund  Binance Bridged USDC (BNB Smart Chain)

Binance Bridged USDC (BNB Smart Chain)  Algorand

Algorand  USDD

USDD  Wrapped BNB

Wrapped BNB  Render

Render  Function FBTC

Function FBTC  Janus Henderson Anemoy AAA CLO Fund

Janus Henderson Anemoy AAA CLO Fund  Filecoin

Filecoin  OUSG

OUSG  Ondo US Dollar Yield

Ondo US Dollar Yield  syrupUSDT

syrupUSDT  Aptos

Aptos  VeChain

VeChain  Beldex

Beldex  Binance Staked SOL

Binance Staked SOL  Janus Henderson Anemoy Treasury Fund

Janus Henderson Anemoy Treasury Fund  Usual USD

Usual USD  pippin

pippin  Arbitrum

Arbitrum  Bonk

Bonk  GHO

GHO  Polygon Bridged USDC (Polygon PoS)

Polygon Bridged USDC (Polygon PoS)  Stable

Stable  Solv Protocol BTC

Solv Protocol BTC  Jupiter

Jupiter  Lombard Staked BTC

Lombard Staked BTC  A7A5

A7A5  TrueUSD

TrueUSD  USDai

USDai  clBTC

clBTC  Sei

Sei  Decred

Decred  EURC

EURC  Stacks

Stacks  PancakeSwap

PancakeSwap  StakeWise Staked ETH

StakeWise Staked ETH  Dash

Dash  Kinetiq Staked HYPE

Kinetiq Staked HYPE  tBTC

tBTC  Pudgy Penguins

Pudgy Penguins  Virtuals Protocol

Virtuals Protocol  WrappedM by M0

WrappedM by M0  Tezos

Tezos  Kinesis Gold

Kinesis Gold  Story

Story  JUST

JUST  Lighter

Lighter  Artificial Superintelligence Alliance

Artificial Superintelligence Alliance  Mantle Staked Ether

Mantle Staked Ether  Injective

Injective  c8ntinuum

c8ntinuum  Polygon PoS Bridged DAI (Polygon POS)

Polygon PoS Bridged DAI (Polygon POS)  LayerZero

LayerZero  Resolv wstUSR

Resolv wstUSR  Chiliz

Chiliz  COCA

COCA  Curve DAO

Curve DAO  Ether.fi

Ether.fi  Liquid Staked ETH

Liquid Staked ETH  BitTorrent

BitTorrent  Arbitrum Bridged WBTC (Arbitrum One)

Arbitrum Bridged WBTC (Arbitrum One)  PRIME

PRIME  Kaia

Kaia  AINFT

AINFT  Sun Token

Sun Token  Wrapped Flare

Wrapped Flare  Bitcoin SV

Bitcoin SV  Gnosis

Gnosis  L2 Standard Bridged WETH (Base)

L2 Standard Bridged WETH (Base)  ADI

ADI  Steakhouse USDC Morpho Vault

Steakhouse USDC Morpho Vault  Pyth Network

Pyth Network  Humanity

Humanity  Aerodrome Finance

Aerodrome Finance  IOTA

IOTA  SPX6900

SPX6900  Binance-Peg XRP

Binance-Peg XRP  The Graph

The Graph  Ether.Fi Liquid ETH

Ether.Fi Liquid ETH  crvUSD

crvUSD  Renzo Restaked ETH

Renzo Restaked ETH  Celestia

Celestia  FLOKI

FLOKI  sBTC

sBTC  JasmyCoin

JasmyCoin  Helium

Helium  Legacy Frax Dollar

Legacy Frax Dollar  Jupiter Staked SOL

Jupiter Staked SOL  Lido DAO

Lido DAO  Savings USDD

Savings USDD  Olympus

Olympus  Conflux

Conflux  Optimism

Optimism  Marinade Staked SOL

Marinade Staked SOL  Telcoin

Telcoin  Arbitrum Bridged WETH (Arbitrum One)

Arbitrum Bridged WETH (Arbitrum One)  BTSE Token

BTSE Token  Maple Finance

Maple Finance  Ethereum Name Service

Ethereum Name Service  ZKsync

ZKsync  Staked Aave

Staked Aave