Hedera Price Prediction Highlights Path to Recovery After 60% Pullback From Peak

The asset remains under pressure, but recent price behavior and trading metrics suggest a potential base could be forming.

While momentum has weakened, structural indicators show signs of stabilization. Investors are closely monitoring volume and open interest for clues on the next direction. The market remains cautious, though a sustained hold above support levels could mark the start of a recovery.

Hourly and Daily Structure Shows Stabilization After Extended Decline

The HBAR/USDT price prediction hourly chart between June 13 and June 21 illustrates a clear downward trend, beginning with a sharp fall from $0.17 to around $0.15. This steep decline was followed by a phase of sideways consolidation, marked by limited volatility and tighter price ranges. A small bullish movement attempted to reclaim the $0.155 resistance on June 16 but failed, reinforcing selling pressure. The decline continued from June 17 to June 20, reaching a low near $0.14.

Source: Open Interest

Open interest also decreased in this period, reflecting reduced participation from leveraged positions and overall market disengagement. This type of synchronized price and OI drop is typically bearish and can suggest capital flight. However, by late June 20 into early June 21, a small price recovery to $0.146 was observed, with a marginal uptick in open interest. While not strong, this pairing could imply early accumulation as market participants begin positioning for a potential shift.

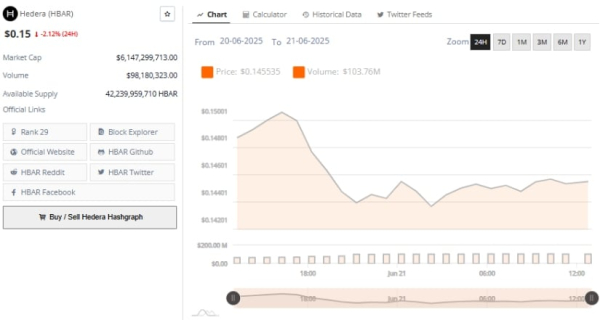

Source: Brave New Coin

The daily 24-hour chart adds more context, showing that Hedera Price Prediction experienced a brief rally near $0.15001 on June 20 before gradually sliding back. Trading volume peaked during the rally and tapered off as the asset declined, indicating that the upward move lacked the support needed for continuation. Price has since flattened near $0.145, suggesting a developing support zone. With volume subdued, buyers may remain on the sidelines until clearer momentum forms.

Weekly Indicators Point to Weak Momentum but Highlight Long-Term Support

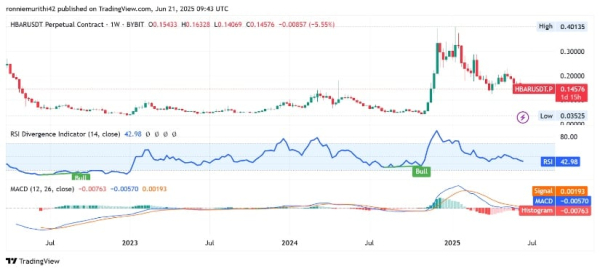

The weekly HBAR/USDT Price Prediction chart offers a longer-term perspective, tracking price, RSI, and MACD movement since 2022. After a prolonged accumulation in the $0.05 to $0.08 range, HBAR broke out strongly in early 2025, hitting $0.40. The rally was followed by a more than 60% decline, leading to this week’s price near $0.14576. The most recent weekly candle shows a 5.55% drop, continuing a broader trend of lower highs and fading bullish energy.

Source: TradingView

The Relative Strength Index (RSI) now stands at 42.98, falling below the neutral 50 level. This indicates weakening buying strength but does not yet suggest oversold conditions. In early 2025, the RSI reached overbought territory above 70, but it has since trended down steadily.

The chart does not show current bullish divergence, meaning momentum may continue to drift sideways or lower unless new catalysts emerge. Previous RSI divergence in late 2023 preceded a rally, but no such signal is active now.

MACD readings reinforce the bearish narrative. The MACD line is at -0.00570, beneath the signal line at 0.00193, while the histogram shows -0.00763. These values suggest downward momentum remains intact. The MACD crossover to the downside occurred after the 2025 peak and has not reversed. Unless positive histogram bars begin forming or a bullish crossover occurs, price is likely to remain in a corrective phase.

Hedera Price Prediction: Recovery Outlook Hinges on Volume Support

As HBAR Price Prediction trades near the $0.145 level, technical analysts are watching for signs of base formation. The key to a potential recovery lies in increased open interest and trading volume to confirm accumulation. So far, those metrics have shown mild improvement but lack conviction. If these trends continue, HBAR could gradually form a floor for future upward movement.

The long-term trend remains above historic lows and within the 2023–2025 structure. While indicators show weakening momentum in the short to mid-term, the asset has not yet breached critical support zones. Traders will look to volume patterns and price reaction at current levels to assess recovery potential. If buying pressure strengthens, HBAR may begin carving a path back toward previous resistance areas.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  USDC

USDC  Solana

Solana  JUSD

JUSD  TRON

TRON  Lido Staked Ether

Lido Staked Ether  Dogecoin

Dogecoin  Figure Heloc

Figure Heloc  WhiteBIT Coin

WhiteBIT Coin  Bitcoin Cash

Bitcoin Cash  Cardano

Cardano  USDS

USDS  Wrapped stETH

Wrapped stETH  Hyperliquid

Hyperliquid  LEO Token

LEO Token  Wrapped Bitcoin

Wrapped Bitcoin  Canton

Canton  Binance Bridged USDT (BNB Smart Chain)

Binance Bridged USDT (BNB Smart Chain)  Ethena USDe

Ethena USDe  Chainlink

Chainlink  Monero

Monero  Stellar

Stellar  Wrapped eETH

Wrapped eETH  USD1

USD1  Dai

Dai  sUSDS

sUSDS  Litecoin

Litecoin  Avalanche

Avalanche  Zcash

Zcash  Coinbase Wrapped BTC

Coinbase Wrapped BTC  Hedera

Hedera  Sui

Sui  PayPal USD

PayPal USD  WETH

WETH  Shiba Inu

Shiba Inu  Toncoin

Toncoin  Cronos

Cronos  USDT0

USDT0  Rain

Rain  MemeCore

MemeCore  World Liberty Financial

World Liberty Financial  Tether Gold

Tether Gold  Polkadot

Polkadot  PAX Gold

PAX Gold  Uniswap

Uniswap  Ethena Staked USDe

Ethena Staked USDe  Mantle

Mantle  Bitget Token

Bitget Token  BlackRock USD Institutional Digital Liquidity Fund

BlackRock USD Institutional Digital Liquidity Fund  Falcon USD

Falcon USD  Aave

Aave  Pepe

Pepe  OKB

OKB  Bittensor

Bittensor  Circle USYC

Circle USYC  Global Dollar

Global Dollar  Ripple USD

Ripple USD  syrupUSDC

syrupUSDC  HTX DAO

HTX DAO  Sky

Sky  NEAR Protocol

NEAR Protocol  Internet Computer

Internet Computer  Ethereum Classic

Ethereum Classic  Aster

Aster  BFUSD

BFUSD  Pi Network

Pi Network  Ondo

Ondo  MYX Finance

MYX Finance  Pump.fun

Pump.fun  Worldcoin

Worldcoin  Gate

Gate  KuCoin

KuCoin  Jupiter Perpetuals Liquidity Provider Token

Jupiter Perpetuals Liquidity Provider Token  Ethena

Ethena  POL (ex-MATIC)

POL (ex-MATIC)  Cosmos Hub

Cosmos Hub  USDD

USDD  Quant

Quant  Jito Staked SOL

Jito Staked SOL  Superstate Short Duration U.S. Government Securities Fund (USTB)

Superstate Short Duration U.S. Government Securities Fund (USTB)  Midnight

Midnight  Algorand

Algorand  Aptos

Aptos  Binance-Peg WETH

Binance-Peg WETH  USDtb

USDtb  Rocket Pool ETH

Rocket Pool ETH  Binance Bridged USDC (BNB Smart Chain)

Binance Bridged USDC (BNB Smart Chain)  Official Trump

Official Trump  NEXO

NEXO  Wrapped BNB

Wrapped BNB  Filecoin

Filecoin  Function FBTC

Function FBTC  Janus Henderson Anemoy AAA CLO Fund

Janus Henderson Anemoy AAA CLO Fund  Render

Render  VeChain

VeChain  Arbitrum

Arbitrum  syrupUSDT

syrupUSDT  Ondo US Dollar Yield

Ondo US Dollar Yield  Spiko EU T-Bills Money Market Fund

Spiko EU T-Bills Money Market Fund  OUSG

OUSG  Binance Staked SOL

Binance Staked SOL  Beldex

Beldex  Usual USD

Usual USD  Bonk

Bonk  Janus Henderson Anemoy Treasury Fund

Janus Henderson Anemoy Treasury Fund  USDai

USDai  Polygon Bridged USDC (Polygon PoS)

Polygon Bridged USDC (Polygon PoS)  Jupiter

Jupiter  Solv Protocol BTC

Solv Protocol BTC  GHO

GHO  Lombard Staked BTC

Lombard Staked BTC  Sei

Sei  A7A5

A7A5  TrueUSD

TrueUSD  clBTC

clBTC  Stacks

Stacks  Story

Story  Dash

Dash  PancakeSwap

PancakeSwap  Tezos

Tezos  StakeWise Staked ETH

StakeWise Staked ETH  EURC

EURC  Chiliz

Chiliz  Kinetiq Staked HYPE

Kinetiq Staked HYPE  tBTC

tBTC  Pudgy Penguins

Pudgy Penguins  Optimism

Optimism  WrappedM by M0

WrappedM by M0  Lighter

Lighter  Decred

Decred  Virtuals Protocol

Virtuals Protocol  Artificial Superintelligence Alliance

Artificial Superintelligence Alliance  Curve DAO

Curve DAO  c8ntinuum

c8ntinuum  Mantle Staked Ether

Mantle Staked Ether  Kinesis Gold

Kinesis Gold  JUST

JUST  Polygon PoS Bridged DAI (Polygon POS)

Polygon PoS Bridged DAI (Polygon POS)  Resolv USR

Resolv USR  Resolv wstUSR

Resolv wstUSR  AINFT

AINFT  COCA

COCA  DoubleZero

DoubleZero  LayerZero

LayerZero  Ether.fi

Ether.fi  Liquid Staked ETH

Liquid Staked ETH  Kaia

Kaia  Arbitrum Bridged WBTC (Arbitrum One)

Arbitrum Bridged WBTC (Arbitrum One)  BitTorrent

BitTorrent  Maple Finance

Maple Finance  Injective

Injective  Stable

Stable  Wrapped Flare

Wrapped Flare  Sun Token

Sun Token  FLOKI

FLOKI  L2 Standard Bridged WETH (Base)

L2 Standard Bridged WETH (Base)  IOTA

IOTA  Steakhouse USDC Morpho Vault

Steakhouse USDC Morpho Vault  Lido DAO

Lido DAO  Aerodrome Finance

Aerodrome Finance  The Graph

The Graph  Gnosis

Gnosis  Binance-Peg XRP

Binance-Peg XRP  Celestia

Celestia  Ether.Fi Liquid ETH

Ether.Fi Liquid ETH  Bitcoin SV

Bitcoin SV  Renzo Restaked ETH

Renzo Restaked ETH  crvUSD

crvUSD  Telcoin

Telcoin  sBTC

sBTC  Kinesis Silver

Kinesis Silver  JasmyCoin

JasmyCoin  SPX6900

SPX6900  Jupiter Staked SOL

Jupiter Staked SOL  Legacy Frax Dollar

Legacy Frax Dollar  Savings USDD

Savings USDD  Starknet

Starknet  Olympus

Olympus  Marinade Staked SOL

Marinade Staked SOL  Pyth Network

Pyth Network  Arbitrum Bridged WETH (Arbitrum One)

Arbitrum Bridged WETH (Arbitrum One)  Conflux

Conflux  AB

AB  PRIME

PRIME