Crypto Market’s Massive Meltdown: What We Know and What’s Next

The events that transpired in the past day or so are not unusual in the ever-volatile cryptocurrency market, but they tend to harm certain traders more than others. While many felt the pain of being liquidated, others seem to profit.

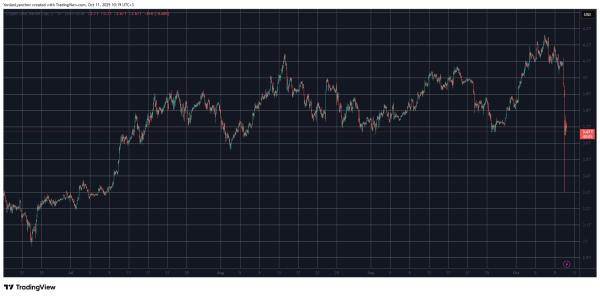

In the span of just 12 hours or so, the entire market went from a capitalization worth $4.120 trillion on TradingView to $3.3 trillion, which meant a wipe-out of almost $900 billion. This pushed the metric down to its lowest levels since July, erasing months of gains, before it recovered to $3.670 trillion as of press time.

What We Know

Whenever such crashes occur, the cryptocurrency community rushes to offer different views on the matter, trying to explain what happened and provide some insights on what might follow. The current collapse is no different, as Crypto X is full of various opinions and speculations on the matter, especially since it became the single-largest liquidation event in the digital asset market.

The most talked-about reason is, surprise, surprise, US President Donald Trump. In what felt like a deja vu, the POTUS alleged China of deception in certain areas and threatened to impose a new set of tariffs on Friday, which triggered the first wave of market-wide declines. He made it official a few hours later, confirming that these tariffs will begin on November 1.

The Kobeissi Letter, though, indicated that markets were “LOOKING” for a good reason to correct, given the massive amount of leverage, especially in crypto.

The blatant reality:

Heading into President Trump’s 100% China tariff announcement, markets were LOOKING for a catalyst to pull back on.

Leverage was through the roof and we had not seen a 2%+ decline in the S&P 500 for 6 months.

President Trump’s post became THE REASON to…

— The Kobeissi Letter (@KobeissiLetter) October 11, 2025

Bull Theory alleged that one of Bitcoin’s oldest wallets might have known what was about to happen as they opened big short positions on BTC and ETH a day before the announcement and doubled down as events started to unfold. They closed all shorts with a profit of roughly $200 million in just a day.

You may also like:

- Bitcoin (BTC) Dips Below $122K, ZCash (ZEC) Explodes by 35%: Market Watch

- Bitcoin’s (BTC) Emotional Comeback: Data Shows Market Confidence Returning After Weeks of Fear

- Analyst Insights: Bitcoin Could Drop More as Dollar Rebound Tightens Global Liquidity

Bull Theory added that this wasn’t a retail-driven dump, as it has been on some occasions in the past. Instead, they noted that it “felt structural, as if a fund or a desk was forced to unwind positions all at once.”

What’s Next?

Naturally, after trying to explain what happened, the next step is to offer a prediction of what’s to come. The majority of the crypto community seemed adamant that this is a proper buy-the-dip moment, as similar crashes are typically followed by large moves in the opposite direction.

“So yes, the headlines scream Market Crash. But zoom out the structure didn’t break. It just reset. The whales already took their entry. Retail panic is peaking. And history says, that’s exactly when the next leg begins,” said Bull Theory.

CZ concurred, indicating that this could be the next “COVID crash,” when BTC dumped to $4,000 but exploded in the following months.

👇 https://t.co/4O6i3MsfIA

— CZ 🔶 BNB (@cz_binance) October 11, 2025

However, Crypto Bully outlined a different projection, which is a lot more painful if Trump proceeds with the tariffs:

“- Unless Trump changes his statements immediately on Monday, this will not be a V reversal. Most alts with 50-70% wicks will bleed down and fill them or partially fill it before reversal.”

Different Perspective

While most are focused on price drops, reasoning, and future behavior, Cobie highlighted a different perspective on the situation. The popular X user believes such collapses are a perfect example of why investors should avoid taking leveraged positions, as they can wipe out years of gains.

Instead, they need to focus on building a long-term portfolio by holding only assets that they are bullish on and believe in. This means steer clear of speculative tokens that only chase hype without actual utility.

“When everyone is making hilarious amounts of money I am always tempted to start using leverage again. It is almost impossible to fight the feeling that you’re not making enough, or everyone else is outpacing you. Good reminder that fighting that feeling and avoid the wipeouts is worth it in the end. Don’t let a leverage blowup dictate your long-term views. The future is bright, good things to come, patience is rewarded.”

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  USDC

USDC  Solana

Solana  TRON

TRON  Lido Staked Ether

Lido Staked Ether  Figure Heloc

Figure Heloc  Dogecoin

Dogecoin  WhiteBIT Coin

WhiteBIT Coin  USDS

USDS  Bitcoin Cash

Bitcoin Cash  Cardano

Cardano  Wrapped stETH

Wrapped stETH  LEO Token

LEO Token  Hyperliquid

Hyperliquid  Wrapped Bitcoin

Wrapped Bitcoin  Ethena USDe

Ethena USDe  Binance Bridged USDT (BNB Smart Chain)

Binance Bridged USDT (BNB Smart Chain)  Canton

Canton  Monero

Monero  Chainlink

Chainlink  Stellar

Stellar  Wrapped eETH

Wrapped eETH  USD1

USD1  Rain

Rain  sUSDS

sUSDS  Dai

Dai  PayPal USD

PayPal USD  Hedera

Hedera  Coinbase Wrapped BTC

Coinbase Wrapped BTC  Litecoin

Litecoin  Zcash

Zcash  Avalanche

Avalanche  WETH

WETH  Shiba Inu

Shiba Inu  Sui

Sui  Toncoin

Toncoin  USDT0

USDT0  Cronos

Cronos  World Liberty Financial

World Liberty Financial  Tether Gold

Tether Gold  MemeCore

MemeCore  PAX Gold

PAX Gold  Uniswap

Uniswap  Polkadot

Polkadot  Ethena Staked USDe

Ethena Staked USDe  BlackRock USD Institutional Digital Liquidity Fund

BlackRock USD Institutional Digital Liquidity Fund  Mantle

Mantle  Falcon USD

Falcon USD  Aave

Aave  Aster

Aster  Global Dollar

Global Dollar  Pepe

Pepe  Bittensor

Bittensor  Circle USYC

Circle USYC  Ripple USD

Ripple USD  Bitget Token

Bitget Token  syrupUSDC

syrupUSDC  OKB

OKB  HTX DAO

HTX DAO  Pi Network

Pi Network  Sky

Sky  BFUSD

BFUSD  Ethereum Classic

Ethereum Classic  NEAR Protocol

NEAR Protocol  Superstate Short Duration U.S. Government Securities Fund (USTB)

Superstate Short Duration U.S. Government Securities Fund (USTB)  Ondo

Ondo  Gate

Gate  Internet Computer

Internet Computer  POL (ex-MATIC)

POL (ex-MATIC)  KuCoin

KuCoin  Worldcoin

Worldcoin  Pump.fun

Pump.fun  Jupiter Perpetuals Liquidity Provider Token

Jupiter Perpetuals Liquidity Provider Token  Cosmos Hub

Cosmos Hub  Midnight

Midnight  USDtb

USDtb  Jito Staked SOL

Jito Staked SOL  NEXO

NEXO  Spiko EU T-Bills Money Market Fund

Spiko EU T-Bills Money Market Fund  Ethena

Ethena  Binance-Peg WETH

Binance-Peg WETH  Rocket Pool ETH

Rocket Pool ETH  Official Trump

Official Trump  pippin

pippin  Binance Bridged USDC (BNB Smart Chain)

Binance Bridged USDC (BNB Smart Chain)  Algorand

Algorand  USDD

USDD  Wrapped BNB

Wrapped BNB  OUSG

OUSG  Function FBTC

Function FBTC  Janus Henderson Anemoy AAA CLO Fund

Janus Henderson Anemoy AAA CLO Fund  Ondo US Dollar Yield

Ondo US Dollar Yield  Render

Render  Filecoin

Filecoin  syrupUSDT

syrupUSDT  Aptos

Aptos  VeChain

VeChain  Beldex

Beldex  Binance Staked SOL

Binance Staked SOL  Janus Henderson Anemoy Treasury Fund

Janus Henderson Anemoy Treasury Fund  Usual USD

Usual USD  Arbitrum

Arbitrum  GHO

GHO  Stable

Stable  Polygon Bridged USDC (Polygon PoS)

Polygon Bridged USDC (Polygon PoS)  A7A5

A7A5  Solv Protocol BTC

Solv Protocol BTC  Bonk

Bonk  Lombard Staked BTC

Lombard Staked BTC  TrueUSD

TrueUSD  Decred

Decred  clBTC

clBTC  USDai

USDai  EURC

EURC  Jupiter

Jupiter  Sei

Sei  Stacks

Stacks  StakeWise Staked ETH

StakeWise Staked ETH  Kinesis Gold

Kinesis Gold  Dash

Dash  Kinetiq Staked HYPE

Kinetiq Staked HYPE  tBTC

tBTC  JUST

JUST  PancakeSwap

PancakeSwap  WrappedM by M0

WrappedM by M0  Tezos

Tezos  Pudgy Penguins

Pudgy Penguins  Virtuals Protocol

Virtuals Protocol  Story

Story  Chiliz

Chiliz  Artificial Superintelligence Alliance

Artificial Superintelligence Alliance  Mantle Staked Ether

Mantle Staked Ether  Lighter

Lighter  PRIME

PRIME  Polygon PoS Bridged DAI (Polygon POS)

Polygon PoS Bridged DAI (Polygon POS)  Resolv wstUSR

Resolv wstUSR  c8ntinuum

c8ntinuum  COCA

COCA  Ether.fi

Ether.fi  AINFT

AINFT  BitTorrent

BitTorrent  Liquid Staked ETH

Liquid Staked ETH  Curve DAO

Curve DAO  Arbitrum Bridged WBTC (Arbitrum One)

Arbitrum Bridged WBTC (Arbitrum One)  Injective

Injective  Sun Token

Sun Token  Gnosis

Gnosis  Kaia

Kaia  Wrapped Flare

Wrapped Flare  ADI

ADI  LayerZero

LayerZero  L2 Standard Bridged WETH (Base)

L2 Standard Bridged WETH (Base)  Bitcoin SV

Bitcoin SV  Steakhouse USDC Morpho Vault

Steakhouse USDC Morpho Vault  crvUSD

crvUSD  Pyth Network

Pyth Network  IOTA

IOTA  Aerodrome Finance

Aerodrome Finance  Legacy Frax Dollar

Legacy Frax Dollar  Binance-Peg XRP

Binance-Peg XRP  The Graph

The Graph  Ether.Fi Liquid ETH

Ether.Fi Liquid ETH  JasmyCoin

JasmyCoin  Renzo Restaked ETH

Renzo Restaked ETH  FLOKI

FLOKI  Olympus

Olympus  sBTC

sBTC  BTSE Token

BTSE Token  Celestia

Celestia  Helium

Helium  Jupiter Staked SOL

Jupiter Staked SOL  SPX6900

SPX6900  Savings USDD

Savings USDD  Lido DAO

Lido DAO  Optimism

Optimism  Conflux

Conflux  Marinade Staked SOL

Marinade Staked SOL  AB

AB  Arbitrum Bridged WETH (Arbitrum One)

Arbitrum Bridged WETH (Arbitrum One)  Humanity

Humanity  Telcoin

Telcoin  Neutrl USD

Neutrl USD  Maple Finance

Maple Finance  Staked Aave

Staked Aave  DoubleZero

DoubleZero