Cardano (ADA) Faces Risk Of 30% Drop – On-Chain Metrics Confirm A Slow Demand

Cardano has seen a strong 26% surge following the Federal Reserve’s interest rate cuts announcement two weeks ago, boosting optimism across the crypto market.

Analysts and investors are questioning the sustainability of the recent surge. Despite the initial rally, Cardano’s price failed to close above a key resistance level, signaling potential weakness in the uptrend.

On-chain data from Santiment reveals a decline in demand for ADA, adding to investor caution. Decreased network activity and buying pressure raise doubts about the sustainability of the current rally.

As the market awaits further developments, investors are closely watching for signs of a reversal or continuation of the uptrend, understanding that ADA’s next move could set the tone for its performance in the weeks ahead.

Cardano Indicator Shows Concerning Data

Cardano faces a significant risk of a 30% drop to its yearly low of around $0.27, as on-chain data from Santiment reveals rising selling pressure and diminishing demand.

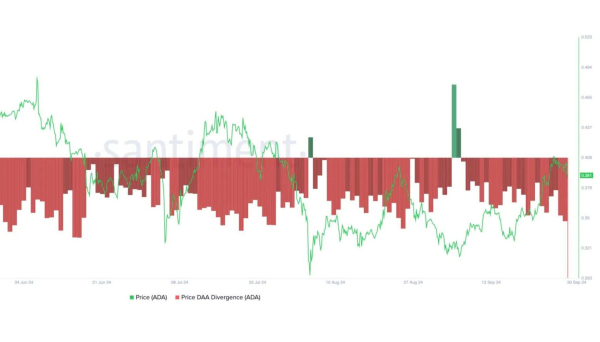

The warning signs for ADA’s price have become clearer, with its daily active-address (DAA) divergence showing a negative reading of -43.3% at the time of writing. This metric, which tracks the correlation between an asset’s price movements and changes in its daily active addresses, has remained negative since September 7, indicating a troubling trend for Cardano.

The negative DAA divergence suggests that much of ADA’s rally this month, following the Federal Reserve’s interest rate cuts, has been fueled more by broader market sentiment than by any specific demand for ADA itself. This lack of organic demand increases the likelihood of a steep correction shortly.

Without sustained buying pressure, Cardano’s price could drop sharply as traders begin to lock in profits, further driving prices downward.

If ADA fails to break above its current resistance level of around $0.41, analysts expect a deeper correction, potentially pushing the price back to the yearly low of $0.27. With weakening demand and increasing selling pressure, Cardano’s near-term outlook looks uncertain, and traders are bracing for further downside risk.

ADA Price Action: Testing A Crucial Supply Level

ADA trades at $0.38, following a 10% dip from its daily 200 exponential moving average (EMA) at $0.41. This level has become a crucial resistance area, as the price formed a new local high around this zone.

ADA must reclaim the $0.41 level and push above the next key resistance at $0.45 to confirm a bullish trend for the coming weeks. Successfully breaking past these levels would signal renewed strength, giving the bulls control and potentially leading to higher prices.

However, if ADA fails to push above these critical levels, the altcoin could face further downside pressure. A failure to reclaim $0.41 and surpass $0.45 would likely result in increased selling, triggering a potential 30% drop. In such a scenario, ADA would be at risk of revisiting its yearly low of around $0.27.

Given the current market uncertainty and declining demand, traders are carefully watching ADA’s price movements, as the next few days could be pivotal for determining whether a bullish breakout or a deeper correction is on the horizon.

Featured image from Dall-E, chart from TradingView

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  USDC

USDC  Solana

Solana  TRON

TRON  Lido Staked Ether

Lido Staked Ether  Dogecoin

Dogecoin  Figure Heloc

Figure Heloc  WhiteBIT Coin

WhiteBIT Coin  Cardano

Cardano  USDS

USDS  Bitcoin Cash

Bitcoin Cash  Wrapped stETH

Wrapped stETH  LEO Token

LEO Token  Hyperliquid

Hyperliquid  Wrapped Bitcoin

Wrapped Bitcoin  Chainlink

Chainlink  Binance Bridged USDT (BNB Smart Chain)

Binance Bridged USDT (BNB Smart Chain)  Monero

Monero  Ethena USDe

Ethena USDe  Canton

Canton  Stellar

Stellar  Wrapped eETH

Wrapped eETH  USD1

USD1  Rain

Rain  sUSDS

sUSDS  Hedera

Hedera  Litecoin

Litecoin  Dai

Dai  Coinbase Wrapped BTC

Coinbase Wrapped BTC  PayPal USD

PayPal USD  Avalanche

Avalanche  Zcash

Zcash  WETH

WETH  Sui

Sui  Shiba Inu

Shiba Inu  Cronos

Cronos  USDT0

USDT0  Toncoin

Toncoin  World Liberty Financial

World Liberty Financial  Tether Gold

Tether Gold  Polkadot

Polkadot  PAX Gold

PAX Gold  Uniswap

Uniswap  MemeCore

MemeCore  Ethena Staked USDe

Ethena Staked USDe  Mantle

Mantle  BlackRock USD Institutional Digital Liquidity Fund

BlackRock USD Institutional Digital Liquidity Fund  Circle USYC

Circle USYC  Bittensor

Bittensor  Aave

Aave  Aster

Aster  Global Dollar

Global Dollar  Sky

Sky  Pi Network

Pi Network  Falcon USD

Falcon USD  NEAR Protocol

NEAR Protocol  OKB

OKB  syrupUSDC

syrupUSDC  Ripple USD

Ripple USD  Pepe

Pepe  Bitget Token

Bitget Token  HTX DAO

HTX DAO  Internet Computer

Internet Computer  Ethereum Classic

Ethereum Classic  Ondo

Ondo  BFUSD

BFUSD  Worldcoin

Worldcoin  Pump.fun

Pump.fun  Gate

Gate  POL (ex-MATIC)

POL (ex-MATIC)  KuCoin

KuCoin  Jupiter Perpetuals Liquidity Provider Token

Jupiter Perpetuals Liquidity Provider Token  Superstate Short Duration U.S. Government Securities Fund (USTB)

Superstate Short Duration U.S. Government Securities Fund (USTB)  Midnight

Midnight  Ethena

Ethena  Cosmos Hub

Cosmos Hub  Jito Staked SOL

Jito Staked SOL  Ondo US Dollar Yield

Ondo US Dollar Yield  NEXO

NEXO  USDtb

USDtb  Binance-Peg WETH

Binance-Peg WETH  Rocket Pool ETH

Rocket Pool ETH  Spiko EU T-Bills Money Market Fund

Spiko EU T-Bills Money Market Fund  Binance Bridged USDC (BNB Smart Chain)

Binance Bridged USDC (BNB Smart Chain)  Algorand

Algorand  Official Trump

Official Trump  Wrapped BNB

Wrapped BNB  Aptos

Aptos  Function FBTC

Function FBTC  Filecoin

Filecoin  OUSG

OUSG  Render

Render  Janus Henderson Anemoy AAA CLO Fund

Janus Henderson Anemoy AAA CLO Fund  syrupUSDT

syrupUSDT  USDD

USDD  Jupiter

Jupiter  VeChain

VeChain  Binance Staked SOL

Binance Staked SOL  Arbitrum

Arbitrum  Stable

Stable  Beldex

Beldex  YLDS

YLDS  Janus Henderson Anemoy Treasury Fund

Janus Henderson Anemoy Treasury Fund  Usual USD

Usual USD  Polygon Bridged USDC (Polygon PoS)

Polygon Bridged USDC (Polygon PoS)  Bonk

Bonk  Solv Protocol BTC

Solv Protocol BTC  Decred

Decred  Lombard Staked BTC

Lombard Staked BTC  GHO

GHO  A7A5

A7A5  Virtuals Protocol

Virtuals Protocol  clBTC

clBTC  Stacks

Stacks  TrueUSD

TrueUSD  Sei

Sei  PancakeSwap

PancakeSwap  EURC

EURC  StakeWise Staked ETH

StakeWise Staked ETH  Pudgy Penguins

Pudgy Penguins  USDai

USDai  Kinetiq Staked HYPE

Kinetiq Staked HYPE  Dash

Dash  tBTC

tBTC  JUST

JUST  WrappedM by M0

WrappedM by M0  Tezos

Tezos  Ether.fi

Ether.fi  Kinesis Gold

Kinesis Gold  LayerZero

LayerZero  Curve DAO

Curve DAO  Chiliz

Chiliz  Mantle Staked Ether

Mantle Staked Ether  c8ntinuum

c8ntinuum  Polygon PoS Bridged DAI (Polygon POS)

Polygon PoS Bridged DAI (Polygon POS)  Gnosis

Gnosis  Resolv wstUSR

Resolv wstUSR  COCA

COCA  Artificial Superintelligence Alliance

Artificial Superintelligence Alliance  SPX6900

SPX6900  Aerodrome Finance

Aerodrome Finance  Liquid Staked ETH

Liquid Staked ETH  BitTorrent

BitTorrent  Arbitrum Bridged WBTC (Arbitrum One)

Arbitrum Bridged WBTC (Arbitrum One)  River

River  AINFT

AINFT  PRIME

PRIME  Wrapped Flare

Wrapped Flare  Kaia

Kaia  Lighter

Lighter  L2 Standard Bridged WETH (Base)

L2 Standard Bridged WETH (Base)  pippin

pippin  Steakhouse USDC Morpho Vault

Steakhouse USDC Morpho Vault  Injective

Injective  Story

Story  Bitcoin SV

Bitcoin SV  Sun Token

Sun Token  Celestia

Celestia  Binance-Peg XRP

Binance-Peg XRP  ADI

ADI  Ether.Fi Liquid ETH

Ether.Fi Liquid ETH  Pyth Network

Pyth Network  Renzo Restaked ETH

Renzo Restaked ETH  IOTA

IOTA  The Graph

The Graph  sBTC

sBTC  JasmyCoin

JasmyCoin  FLOKI

FLOKI  Maple Finance

Maple Finance  Jupiter Staked SOL

Jupiter Staked SOL  Venice Token

Venice Token  Savings USDD

Savings USDD  Optimism

Optimism  Olympus

Olympus  Lido DAO

Lido DAO  Marinade Staked SOL

Marinade Staked SOL  Siren

Siren  Arbitrum Bridged WETH (Arbitrum One)

Arbitrum Bridged WETH (Arbitrum One)  Legacy Frax Dollar

Legacy Frax Dollar  Plasma

Plasma  Conflux

Conflux  crvUSD

crvUSD  Staked Aave

Staked Aave  DoubleZero

DoubleZero  Telcoin

Telcoin