Bybit Crypto Insights Report: Ether Becomes a Treasury Token

ETH turns up front

Ethereum has been thrust into the spotlight over the past week, marking a decisive break from the bearish sentiment that weighed on the asset during the first half of 2025. As of this writing, ETH has delivered a standout 7-day return of 23.9%, outperforming both Bitcoin (0.1%) and Solana (9.7%) over the same period. This sharp rebound has reignited market optimism, and positioned ETH as the focal point of community discussions.

The question is: What catalyzed this reversal?

ETH becomes the second treasury token

Source: DefiLlama

Ethereum’s core infrastructure and design remain unchanged, and there have been no overnight protocol upgrades or architectural shifts. However, news momentum has accelerated following BlackRock’s proposal to incorporate staking into its iShares Ethereum Trust ETF (ETHA), in response to the SEC’s regulatory clarity provided in May 2025. This move signals growing institutional interest in on-chain yield generation.

Investor enthusiasm has also been catalyzed by aggressive corporate accumulation. For example, SharpLink Gaming has acquired over 353,000 ETH, establishing itself as the largest Ether-holding treasury entity to date. BitMine has added 300,657 ETH to its balance sheet, backed by a 9.1% stake from Peter Thiel–linked investment vehicles. In parallel, crypto miner Bit Digital has disclosed a substantial 120,306 ETH holding.

Collectively, these developments reflect a strategic shift among TradFi players, many of whom are emulating Strategy’s precedent-setting Bitcoin accumulation. Ether is now widely regarded as the second treasury-grade digital asset — positioned just behind Bitcoin — marking a significant milestone in its institutional adoption journey.

However, the ETH treasury concept is at an early stage

.

Number of ETH

% of total circulating ETH

Holdings by SharpLink, BitMine and Bit Digital

773,963

0.64%

.

Number of BTC

% of total circulating BTC

Holding by Strategy

601,550

3.01%

Source: Bybit

As highlighted in the table above, ETH accumulation remains in its early phase. Notably, the share of circulating Bitcoin held by Strategy (formerly MicroStrategy) alone exceeds the combined holdings of the top three ETH accumulators when measured as a percentage of the total Ether supply. This disparity underscores the relative nascence of ETH’s adoption as a treasury-grade asset as compared to Bitcoin.

Leverage: What makes the ETH treasury better than Bitcoin

BTCS Inc. (NASDAQ: BTCS) reportedly holds 31,855 ETH, of which 16,232 ETH have been collateralized to secure a loan on AAVE. This exemplifies Ethereum’s extensive utility within decentralized finance (DeFi), particularly when contrasted with Bitcoin, which lacks comparable on-chain lending infrastructure. And while Strategy raises traditional finance (TradFi) bonds to leverage its Bitcoin positions, institutional and corporate actors can readily access DeFi lending protocols such as Aave (AAVE) in order to obtain ETH-backed liquidity.

DeFi’s inherent flexibility and accessibility allow for higher leverage levels on ETH accumulation without necessitating reliance on conventional lending channels. This dynamic introduces a compounding effect, whereby increased leverage amplifies buying power, potentially exacerbating imbalances between ETH supply and demand. As such, the decentralized nature of ETH-based financing could intensify its price trajectory and market volatility, relative to assets governed by stricter TradFi constraints.

ETH Spot ETFs still lag behind Bitcoin Spot ETFs

Source: BITCOINTREASURIES.NET

Corporate treasuries remain a minority in the acquisition of treasury tokens. For example, Bitcoin Spot ETFs hold a significantly larger amount of spot Bitcoin as compared to all corporate buyers (including Strategy). Specifically, the top 10 corporate owners of Bitcoin Strategy hold approximately 700,000 bitcoins, whereas all of the Bitcoin Spot ETFs collectively own approximately 1,459K bitcoins.

Bitcoin held by Bitcoin Spot ETFs and funds

approx. 1,459K

Percent of the total BTC circulating supply

6.9%

Ether held by ETH Spot ETFs

approx. 3,983K

As % of the total ETH circulating supply

3.3%

Source: Bybit

As illustrated in the table above, ETH Spot ETFs currently hold only half the percentage of the circulating supply, compared to Bitcoin Spot ETFs. This disparity underscores a significant gap in treasury accumulation, suggesting that Ether still has considerable room to grow in aligning with Bitcoin’s institutional adoption levels.

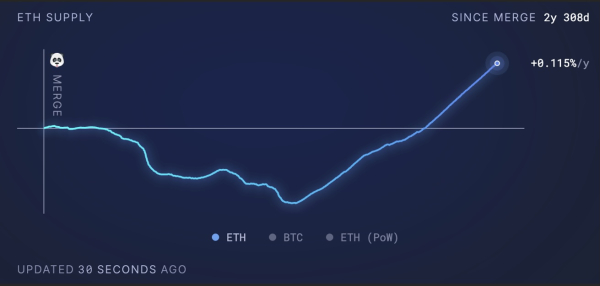

Still, Ether is a net inflationary token

Source: ultrasound.money

Since February 2025, Ethereum’s supply has turned net inflationary, driven by a reduction in on-chain activity and lower burn rates of transaction fees. This shift weakens the potential for a supply squeeze, particularly when large corporate treasuries accumulate ETH for long-term strategic purposes without clear short-term liquidation plans. In contrast, Bitcoin’s hard-coded supply cap of 21 million remains a core pillar of its value proposition, reinforcing scarcity and strengthening investor conviction through predictable issuance.

Nonetheless, ETH accumulation in recent months has been exceptionally robust — far outpacing its annual net issuance of approximately 836,000 ETH. This strong buy-side pressure indicates heightened demand from institutional players, DeFi protocols and treasury investors. If accumulation continues at this rate, Ether could face a structural supply imbalance, triggering a pronounced squeeze effect despite its inflationary supply profile. Such dynamics may accelerate upward price momentum and place ETH on a realistic trajectory to revisit its all-time high of $4,891 that was set in November 2021.

Moving forward, treasury token status and RWAs could provide support for ETH’s price movements

While ETH’s price struggles with declining on-chain transactions, Layer 2 (L2) solutions demonstrate significant growth. Daily L2 transactions now surpass those on L1s by a factor of 12.7x, and active L2 addresses outnumber L1s five to one. Furthermore, L2s host almost six times as many smart contracts, with over 500 daily interactions, and L2 DeFi velocity is 7.5x that of L1s.

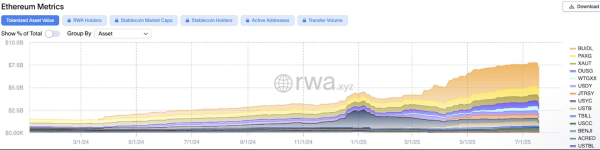

Source: rwa.xyz

Despite transactions moving to L2s, capital remains predominantly concentrated within the Ethereum mainnet, with real-world assets (RWAs) increasingly gaining institutional traction. BlackRock’s tokenized treasury product, BUIDL, has recorded sustained inflows from TradFi institutions, signaling growing confidence in on-chain fixed income instruments.

In parallel, Ether (ETH) continues to solidify its status as a treasury-grade asset. Note that, if current adoption trends and macroeconomic conditions persist, ETH is well-positioned to reach the $5,000 mark by Q4 2025.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  USDC

USDC  Solana

Solana  TRON

TRON  Lido Staked Ether

Lido Staked Ether  Figure Heloc

Figure Heloc  Dogecoin

Dogecoin  WhiteBIT Coin

WhiteBIT Coin  USDS

USDS  Cardano

Cardano  Bitcoin Cash

Bitcoin Cash  Wrapped stETH

Wrapped stETH  LEO Token

LEO Token  Hyperliquid

Hyperliquid  Wrapped Bitcoin

Wrapped Bitcoin  Monero

Monero  Binance Bridged USDT (BNB Smart Chain)

Binance Bridged USDT (BNB Smart Chain)  Chainlink

Chainlink  Ethena USDe

Ethena USDe  Canton

Canton  Stellar

Stellar  Wrapped eETH

Wrapped eETH  USD1

USD1  Rain

Rain  sUSDS

sUSDS  Dai

Dai  PayPal USD

PayPal USD  Hedera

Hedera  Coinbase Wrapped BTC

Coinbase Wrapped BTC  Litecoin

Litecoin  Avalanche

Avalanche  Sui

Sui  WETH

WETH  Zcash

Zcash  Toncoin

Toncoin  Shiba Inu

Shiba Inu  USDT0

USDT0  Cronos

Cronos  Tether Gold

Tether Gold  World Liberty Financial

World Liberty Financial  MemeCore

MemeCore  PAX Gold

PAX Gold  Polkadot

Polkadot  Uniswap

Uniswap  Ethena Staked USDe

Ethena Staked USDe  Mantle

Mantle  Pi Network

Pi Network  Circle USYC

Circle USYC  OKB

OKB  BlackRock USD Institutional Digital Liquidity Fund

BlackRock USD Institutional Digital Liquidity Fund  Falcon USD

Falcon USD  Aster

Aster  Global Dollar

Global Dollar  Bittensor

Bittensor  Aave

Aave  Sky

Sky  syrupUSDC

syrupUSDC  Ripple USD

Ripple USD  NEAR Protocol

NEAR Protocol  Bitget Token

Bitget Token  HTX DAO

HTX DAO  Pepe

Pepe  Internet Computer

Internet Computer  BFUSD

BFUSD  Ethereum Classic

Ethereum Classic  Ondo

Ondo  Gate

Gate  Worldcoin

Worldcoin  Pump.fun

Pump.fun  Superstate Short Duration U.S. Government Securities Fund (USTB)

Superstate Short Duration U.S. Government Securities Fund (USTB)  POL (ex-MATIC)

POL (ex-MATIC)  KuCoin

KuCoin  Jupiter Perpetuals Liquidity Provider Token

Jupiter Perpetuals Liquidity Provider Token  Midnight

Midnight  Ondo US Dollar Yield

Ondo US Dollar Yield  Cosmos Hub

Cosmos Hub  Jito Staked SOL

Jito Staked SOL  Spiko EU T-Bills Money Market Fund

Spiko EU T-Bills Money Market Fund  Ethena

Ethena  NEXO

NEXO  USDtb

USDtb  Binance-Peg WETH

Binance-Peg WETH  Rocket Pool ETH

Rocket Pool ETH  Algorand

Algorand  Binance Bridged USDC (BNB Smart Chain)

Binance Bridged USDC (BNB Smart Chain)  OUSG

OUSG  Aptos

Aptos  Wrapped BNB

Wrapped BNB  Function FBTC

Function FBTC  Janus Henderson Anemoy AAA CLO Fund

Janus Henderson Anemoy AAA CLO Fund  Filecoin

Filecoin  Official Trump

Official Trump  USDD

USDD  Render

Render  syrupUSDT

syrupUSDT  Jupiter

Jupiter  VeChain

VeChain  Binance Staked SOL

Binance Staked SOL  Beldex

Beldex  YLDS

YLDS  Stable

Stable  Arbitrum

Arbitrum  Janus Henderson Anemoy Treasury Fund

Janus Henderson Anemoy Treasury Fund  GHO

GHO  Polygon Bridged USDC (Polygon PoS)

Polygon Bridged USDC (Polygon PoS)  Usual USD

Usual USD  Solv Protocol BTC

Solv Protocol BTC  Bonk

Bonk  Lombard Staked BTC

Lombard Staked BTC  Decred

Decred  A7A5

A7A5  TrueUSD

TrueUSD  clBTC

clBTC  Stacks

Stacks  EURC

EURC  Virtuals Protocol

Virtuals Protocol  Sei

Sei  StakeWise Staked ETH

StakeWise Staked ETH  PancakeSwap

PancakeSwap  USDai

USDai  Kinetiq Staked HYPE

Kinetiq Staked HYPE  tBTC

tBTC  JUST

JUST  Pudgy Penguins

Pudgy Penguins  WrappedM by M0

WrappedM by M0  Kinesis Gold

Kinesis Gold  Dash

Dash  Tezos

Tezos  Ether.fi

Ether.fi  LayerZero

LayerZero  c8ntinuum

c8ntinuum  pippin

pippin  Mantle Staked Ether

Mantle Staked Ether  Chiliz

Chiliz  Polygon PoS Bridged DAI (Polygon POS)

Polygon PoS Bridged DAI (Polygon POS)  Curve DAO

Curve DAO  Resolv wstUSR

Resolv wstUSR  AINFT

AINFT  COCA

COCA  Gnosis

Gnosis  Artificial Superintelligence Alliance

Artificial Superintelligence Alliance  BitTorrent

BitTorrent  Liquid Staked ETH

Liquid Staked ETH  PRIME

PRIME  Arbitrum Bridged WBTC (Arbitrum One)

Arbitrum Bridged WBTC (Arbitrum One)  Siren

Siren  Kaia

Kaia  Aerodrome Finance

Aerodrome Finance  Sun Token

Sun Token  Wrapped Flare

Wrapped Flare  ADI

ADI  Humanity

Humanity  L2 Standard Bridged WETH (Base)

L2 Standard Bridged WETH (Base)  SPX6900

SPX6900  Steakhouse USDC Morpho Vault

Steakhouse USDC Morpho Vault  Celestia

Celestia  Story

Story  Injective

Injective  River

River  Bitcoin SV

Bitcoin SV  Binance-Peg XRP

Binance-Peg XRP  Lighter

Lighter  Ether.Fi Liquid ETH

Ether.Fi Liquid ETH  IOTA

IOTA  Renzo Restaked ETH

Renzo Restaked ETH  The Graph

The Graph  JasmyCoin

JasmyCoin  sBTC

sBTC  Legacy Frax Dollar

Legacy Frax Dollar  Maple Finance

Maple Finance  Venice Token

Venice Token  Jupiter Staked SOL

Jupiter Staked SOL  Pyth Network

Pyth Network  Savings USDD

Savings USDD  FLOKI

FLOKI  Olympus

Olympus  crvUSD

crvUSD  Marinade Staked SOL

Marinade Staked SOL  Lombard

Lombard  Arbitrum Bridged WETH (Arbitrum One)

Arbitrum Bridged WETH (Arbitrum One)  DoubleZero

DoubleZero  BTSE Token

BTSE Token  Optimism

Optimism  Conflux

Conflux  Staked Aave

Staked Aave