Avalanche Price Prediction: Can AVAX Hit $30 as Bullish Momentum Builds?

- AVAX holds above $25 with bulls defending the channel, momentum slows as volume dips slightly.

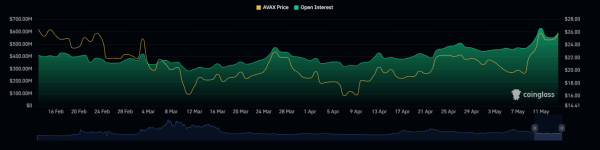

- Open interest surged to $650M in early May, aligning with a price spike from $20 to $25.

Avalanche (AVAX) continues to gain traction as its price flirts around $25. This price has served as a resistance level since last Sunday and is a pivotal level for any upward continuation. As of the last price check, AVAX traded around $25.15, remaining within an uptrend channel. Should bulls successfully clear this resistance level, the subsequent test should happen around the psychological $30 level.

Source: TradingView

The trend is supported by technical strength. AVAX once again retested the 100-day Exponential Moving Average (EMA) of $23.20 last week before resuming its uptrend. This support rebound gives more confidence-building for the buyers moving towards the 200-day EMA, which is being retested again. Any sustained close above this moving average may add more optimism to the buyer’s sentiments.

Signs of positive change are also evident in the Relative Strength Index (RSI). At 64.48 on the daily chart, it is creeping toward its overbought threshold of 70. This reading is a bullish indicator but is a warning signal as well. A breakout above 70 might represent prolonged strength or a forthcoming short-term pullback.

Open Interest Soars to $650M

In early May, open interest rose above $600M to around $650M on May 10–11, according to CoinGlass. During this period, the price of AVAX rose from below $20 to over $25. Both price and open interest jumps in this manner might indicate increased speculative action or more aggressive market participation on these dates.

Source: CoinGlass

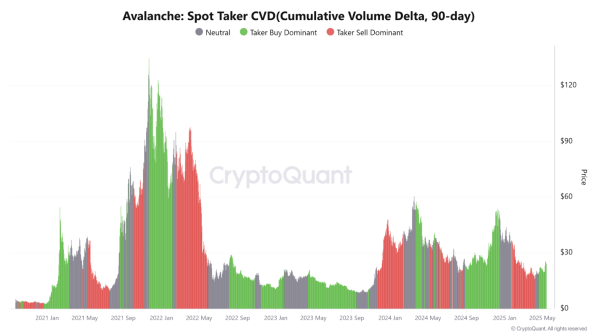

CryptoQuant’s gauges further affirm the trend. 90-day Taker Cumulative Volume Delta (CVD) has remained positive and ascending from the start of May. The growth indicates that buy-side volume is outweighing sell-side volume in this time frame. When there is a positive and ascending CVD, a Taker Buy Dominant Phase is common and is typically found in a positive price trend.

Source: CryptoQuant

In spite of the bullish indications, volume has edged lower in recent sessions. Such a decrease may signal decelerating momentum, particularly if buyers cannot force the price over $27. Falling from current levels could see a retest of support close to $22 to $23 if the pace slows near the upper boundary of the ascending channel.

Bulls Defend Key Channel Despite $27 Pullback

AVAX’s action within the uptrend channel is still intact, which tends to indicate price continuation in the near-term. The recent pullback from the level of just shy of $27 failed not with a breakdown but with signs of bullish resilience. Both price action and structure remain positive as of the current moment as long as key levels continue.

Any rejection around $26.07 in the near term is likely to see a retracement. The most probable fallback level of that scenario would be the 100-day EMA of $23.19. The zone there is likely to become a new base if selling does not intensify further.

The short-term trajectory of AVAX is set to follow the uptrend path, with price fluctuating within a defined ascending channel and increasing participation evident on-chain. A clear breakout over $27 would open the route for the next resistance range around $30.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  USDC

USDC  Solana

Solana  TRON

TRON  Lido Staked Ether

Lido Staked Ether  Dogecoin

Dogecoin  Figure Heloc

Figure Heloc  Bitcoin Cash

Bitcoin Cash  WhiteBIT Coin

WhiteBIT Coin  Cardano

Cardano  USDS

USDS  Wrapped stETH

Wrapped stETH  LEO Token

LEO Token  Hyperliquid

Hyperliquid  Wrapped Bitcoin

Wrapped Bitcoin  Monero

Monero  Binance Bridged USDT (BNB Smart Chain)

Binance Bridged USDT (BNB Smart Chain)  Ethena USDe

Ethena USDe  Chainlink

Chainlink  Canton

Canton  Stellar

Stellar  Wrapped eETH

Wrapped eETH  USD1

USD1  Zcash

Zcash  Hedera

Hedera  sUSDS

sUSDS  Litecoin

Litecoin  Dai

Dai  Coinbase Wrapped BTC

Coinbase Wrapped BTC  PayPal USD

PayPal USD  Avalanche

Avalanche  Shiba Inu

Shiba Inu  WETH

WETH  Sui

Sui  Toncoin

Toncoin  Rain

Rain  USDT0

USDT0  Cronos

Cronos  World Liberty Financial

World Liberty Financial  Tether Gold

Tether Gold  MemeCore

MemeCore  PAX Gold

PAX Gold  Polkadot

Polkadot  Uniswap

Uniswap  Ethena Staked USDe

Ethena Staked USDe  Mantle

Mantle  BlackRock USD Institutional Digital Liquidity Fund

BlackRock USD Institutional Digital Liquidity Fund  Aave

Aave  Aster

Aster  Falcon USD

Falcon USD  Bittensor

Bittensor  Bitget Token

Bitget Token  OKB

OKB  Sky

Sky  Pepe

Pepe  Circle USYC

Circle USYC  syrupUSDC

syrupUSDC  Global Dollar

Global Dollar  HTX DAO

HTX DAO  Ripple USD

Ripple USD  Pi Network

Pi Network  Ethereum Classic

Ethereum Classic  Internet Computer

Internet Computer  BFUSD

BFUSD  NEAR Protocol

NEAR Protocol  Ondo

Ondo  Pump.fun

Pump.fun  Gate

Gate  Worldcoin

Worldcoin  KuCoin

KuCoin  POL (ex-MATIC)

POL (ex-MATIC)  Cosmos Hub

Cosmos Hub  Jupiter Perpetuals Liquidity Provider Token

Jupiter Perpetuals Liquidity Provider Token  Quant

Quant  Ethena

Ethena  Superstate Short Duration U.S. Government Securities Fund (USTB)

Superstate Short Duration U.S. Government Securities Fund (USTB)  Midnight

Midnight  Jito Staked SOL

Jito Staked SOL  NEXO

NEXO  Algorand

Algorand  USDtb

USDtb  Binance-Peg WETH

Binance-Peg WETH  Rocket Pool ETH

Rocket Pool ETH  Official Trump

Official Trump  Spiko EU T-Bills Money Market Fund

Spiko EU T-Bills Money Market Fund  Binance Bridged USDC (BNB Smart Chain)

Binance Bridged USDC (BNB Smart Chain)  Aptos

Aptos  Wrapped BNB

Wrapped BNB  Filecoin

Filecoin  Function FBTC

Function FBTC  Janus Henderson Anemoy AAA CLO Fund

Janus Henderson Anemoy AAA CLO Fund  Render

Render  OUSG

OUSG  VeChain

VeChain  Ondo US Dollar Yield

Ondo US Dollar Yield  syrupUSDT

syrupUSDT  Arbitrum

Arbitrum  USDD

USDD  Binance Staked SOL

Binance Staked SOL  Beldex

Beldex  pippin

pippin  Usual USD

Usual USD  Janus Henderson Anemoy Treasury Fund

Janus Henderson Anemoy Treasury Fund  Bonk

Bonk  MYX Finance

MYX Finance  Polygon Bridged USDC (Polygon PoS)

Polygon Bridged USDC (Polygon PoS)  USDai

USDai  Solv Protocol BTC

Solv Protocol BTC  GHO

GHO  Lombard Staked BTC

Lombard Staked BTC  A7A5

A7A5  Jupiter

Jupiter  Sei

Sei  clBTC

clBTC  TrueUSD

TrueUSD  Stacks

Stacks  Dash

Dash  EURC

EURC  Tezos

Tezos  StakeWise Staked ETH

StakeWise Staked ETH  PancakeSwap

PancakeSwap  Decred

Decred  Kinetiq Staked HYPE

Kinetiq Staked HYPE  tBTC

tBTC  Stable

Stable  Chiliz

Chiliz  WrappedM by M0

WrappedM by M0  Pudgy Penguins

Pudgy Penguins  Humanity

Humanity  Story

Story  Lighter

Lighter  Optimism

Optimism  Virtuals Protocol

Virtuals Protocol  Mantle Staked Ether

Mantle Staked Ether  Kinesis Gold

Kinesis Gold  Polygon PoS Bridged DAI (Polygon POS)

Polygon PoS Bridged DAI (Polygon POS)  Artificial Superintelligence Alliance

Artificial Superintelligence Alliance  Resolv wstUSR

Resolv wstUSR  LayerZero

LayerZero  COCA

COCA  Curve DAO

Curve DAO  c8ntinuum

c8ntinuum  JUST

JUST  Liquid Staked ETH

Liquid Staked ETH  River

River  Arbitrum Bridged WBTC (Arbitrum One)

Arbitrum Bridged WBTC (Arbitrum One)  BitTorrent

BitTorrent  Gnosis

Gnosis  Bitcoin SV

Bitcoin SV  Kaia

Kaia  Wrapped Flare

Wrapped Flare  AINFT

AINFT  Ether.fi

Ether.fi  L2 Standard Bridged WETH (Base)

L2 Standard Bridged WETH (Base)  Sun Token

Sun Token  Steakhouse USDC Morpho Vault

Steakhouse USDC Morpho Vault  Maple Finance

Maple Finance  Injective

Injective  Celestia

Celestia  JasmyCoin

JasmyCoin  Binance-Peg XRP

Binance-Peg XRP  Lido DAO

Lido DAO  Ether.Fi Liquid ETH

Ether.Fi Liquid ETH  The Graph

The Graph  Renzo Restaked ETH

Renzo Restaked ETH  IOTA

IOTA  FLOKI

FLOKI  sBTC

sBTC  PRIME

PRIME  ADI

ADI  crvUSD

crvUSD  Jupiter Staked SOL

Jupiter Staked SOL  Kinesis Silver

Kinesis Silver  Savings USDD

Savings USDD  Pyth Network

Pyth Network  Aerodrome Finance

Aerodrome Finance  Conflux

Conflux  Marinade Staked SOL

Marinade Staked SOL  SPX6900

SPX6900  Arbitrum Bridged WETH (Arbitrum One)

Arbitrum Bridged WETH (Arbitrum One)  DoubleZero

DoubleZero  Telcoin

Telcoin  Legacy Frax Dollar

Legacy Frax Dollar  Olympus

Olympus  Staked Aave

Staked Aave