Crypto Whales Bought These Altcoins in the First Week of September 2024

In the first week of September, a noticeable decline in trading activity has taken hold, with many market participants opting to stay on the sidelines. This is reflected in a 5% drop in global cryptocurrency market capitalization over the past week.

Meanwhile, large investors, known as crypto whales, are capitalizing on the market dip. This week, they’ve been acquiring altcoins such as Polygon (POL), Ethereum (ETH), and frog-themed meme coin Pepe (PEPE).

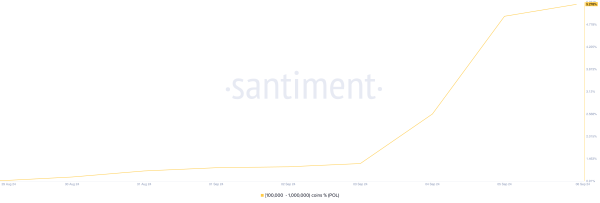

Polygon Ecosystem Token (POL)

On September 4, Polygon completed the 1:1 migration of its native token from MATIC to POL. Afterward, the token saw a spike in whale accumulation as the number of wallet addresses holding between 100,000 and 1,000,000 POL skyrocketed by over 90%.

Currently, this group of POL holders comprises 33 addresses and controls 5% of the altcoin’s total circulating supply.

POL Supply Distribution. Source: Santiment

Despite the migration being considered a “sell the news” event, the number of POL whales continues to grow. These large investors have kept accumulating tokens, undeterred by the muted price reaction. As previously reported by BeinCrypto, POL’s value has remained muted since the migration, showing little sign of recovery. At the time of writing, the altcoin is trading at $0.38.

Ethereum (ETH)

Ethereum has faced significant resistance at the $2560 price level this week. However, this has not stopped its large holders’ from accumulating the leading altcoin, as can be gleaned from the 38% uptick in their netflow over the past seven days.

Large holders are whale addresses that hold over 0.1% of an asset’s circulating supply. Their net flow measures the difference between the coins they buy and those they sell over a specific period.

Ethereum Large Holders Netflow. Source: IntoTheBlock

When the net flow of large holders rises, these whales increase their holdings. This is a bullish signal that may prompt retail investors to do the same, driving up an asset’s value.

If ETH witnesses a surge in market-wide accumulation, it may rally past resistance to trade at $2868.

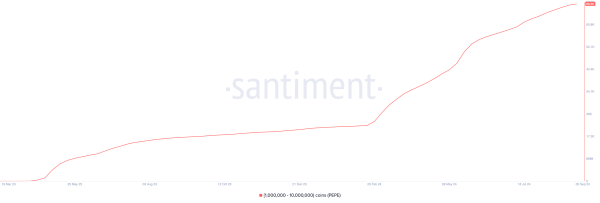

Pepe (PEPE)

In the past week, demand for the Ethereum-based meme coin PEPE has increased among crypto whales. Data from Santiment shows that the number of addresses holding between 1 million and 10 million PEPE has hit a record high of 69,000.

PEPE Supply Distribution. Source: Santiment

This is a 1.2% rise over the last seven days, confirming that large investors are buying more PEPE.

These addresses have been encouraged to accumulate the meme coin following a buy signal from its Market Value to Realized Value (MVRV) ratio. This on-chain metric, calculated using a 30-day moving average, stands at -5.67% at the time of writing.

PEPE MVRV Ratio. Source: Santiment

When an asset’s MVRV ratio is below zero, it indicates the asset is undervalued. In other words, its current price is lower than the average price paid for all tokens in circulation. This often signals a good opportunity for investors aiming to “buy the dip.”

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  USDC

USDC  Solana

Solana  TRON

TRON  Lido Staked Ether

Lido Staked Ether  Dogecoin

Dogecoin  Figure Heloc

Figure Heloc  WhiteBIT Coin

WhiteBIT Coin  Cardano

Cardano  USDS

USDS  Bitcoin Cash

Bitcoin Cash  Wrapped stETH

Wrapped stETH  LEO Token

LEO Token  Hyperliquid

Hyperliquid  Wrapped Bitcoin

Wrapped Bitcoin  Canton

Canton  Binance Bridged USDT (BNB Smart Chain)

Binance Bridged USDT (BNB Smart Chain)  Monero

Monero  Chainlink

Chainlink  Ethena USDe

Ethena USDe  Stellar

Stellar  Wrapped eETH

Wrapped eETH  USD1

USD1  Rain

Rain  sUSDS

sUSDS  Hedera

Hedera  Litecoin

Litecoin  PayPal USD

PayPal USD  Coinbase Wrapped BTC

Coinbase Wrapped BTC  Dai

Dai  Avalanche

Avalanche  Zcash

Zcash  WETH

WETH  Sui

Sui  Shiba Inu

Shiba Inu  Toncoin

Toncoin  USDT0

USDT0  Cronos

Cronos  World Liberty Financial

World Liberty Financial  Tether Gold

Tether Gold  Polkadot

Polkadot  MemeCore

MemeCore  PAX Gold

PAX Gold  Uniswap

Uniswap  Ethena Staked USDe

Ethena Staked USDe  Mantle

Mantle  BlackRock USD Institutional Digital Liquidity Fund

BlackRock USD Institutional Digital Liquidity Fund  Circle USYC

Circle USYC  Aave

Aave  Bittensor

Bittensor  Falcon USD

Falcon USD  Global Dollar

Global Dollar  Aster

Aster  OKB

OKB  Pepe

Pepe  Pi Network

Pi Network  syrupUSDC

syrupUSDC  Ripple USD

Ripple USD  Sky

Sky  Bitget Token

Bitget Token  HTX DAO

HTX DAO  NEAR Protocol

NEAR Protocol  Internet Computer

Internet Computer  Ethereum Classic

Ethereum Classic  BFUSD

BFUSD  Ondo

Ondo  POL (ex-MATIC)

POL (ex-MATIC)  Worldcoin

Worldcoin  Superstate Short Duration U.S. Government Securities Fund (USTB)

Superstate Short Duration U.S. Government Securities Fund (USTB)  Gate

Gate  KuCoin

KuCoin  Pump.fun

Pump.fun  Jupiter Perpetuals Liquidity Provider Token

Jupiter Perpetuals Liquidity Provider Token  Midnight

Midnight  Cosmos Hub

Cosmos Hub  Jito Staked SOL

Jito Staked SOL  Ethena

Ethena  NEXO

NEXO  USDtb

USDtb  Binance-Peg WETH

Binance-Peg WETH  Rocket Pool ETH

Rocket Pool ETH  Spiko EU T-Bills Money Market Fund

Spiko EU T-Bills Money Market Fund  Official Trump

Official Trump  Binance Bridged USDC (BNB Smart Chain)

Binance Bridged USDC (BNB Smart Chain)  Algorand

Algorand  Aptos

Aptos  Wrapped BNB

Wrapped BNB  Filecoin

Filecoin  Function FBTC

Function FBTC  USDD

USDD  Render

Render  OUSG

OUSG  Stable

Stable  Janus Henderson Anemoy AAA CLO Fund

Janus Henderson Anemoy AAA CLO Fund  syrupUSDT

syrupUSDT  Ondo US Dollar Yield

Ondo US Dollar Yield  pippin

pippin  Binance Staked SOL

Binance Staked SOL  VeChain

VeChain  Arbitrum

Arbitrum  Beldex

Beldex  Decred

Decred  Janus Henderson Anemoy Treasury Fund

Janus Henderson Anemoy Treasury Fund  Usual USD

Usual USD  Polygon Bridged USDC (Polygon PoS)

Polygon Bridged USDC (Polygon PoS)  Jupiter

Jupiter  Solv Protocol BTC

Solv Protocol BTC  Bonk

Bonk  Lombard Staked BTC

Lombard Staked BTC  GHO

GHO  A7A5

A7A5  TrueUSD

TrueUSD  clBTC

clBTC  Stacks

Stacks  Sei

Sei  EURC

EURC  Virtuals Protocol

Virtuals Protocol  USDai

USDai  StakeWise Staked ETH

StakeWise Staked ETH  Pudgy Penguins

Pudgy Penguins  Dash

Dash  Kinetiq Staked HYPE

Kinetiq Staked HYPE  tBTC

tBTC  PancakeSwap

PancakeSwap  Tezos

Tezos  WrappedM by M0

WrappedM by M0  Kinesis Gold

Kinesis Gold  JUST

JUST  Ether.fi

Ether.fi  Curve DAO

Curve DAO  Artificial Superintelligence Alliance

Artificial Superintelligence Alliance  Mantle Staked Ether

Mantle Staked Ether  c8ntinuum

c8ntinuum  Story

Story  Polygon PoS Bridged DAI (Polygon POS)

Polygon PoS Bridged DAI (Polygon POS)  Resolv wstUSR

Resolv wstUSR  BitTorrent

BitTorrent  COCA

COCA  LayerZero

LayerZero  Chiliz

Chiliz  Lighter

Lighter  Liquid Staked ETH

Liquid Staked ETH  PRIME

PRIME  Arbitrum Bridged WBTC (Arbitrum One)

Arbitrum Bridged WBTC (Arbitrum One)  Gnosis

Gnosis  AINFT

AINFT  Kaia

Kaia  ADI

ADI  Wrapped Flare

Wrapped Flare  Aerodrome Finance

Aerodrome Finance  Power Protocol

Power Protocol  L2 Standard Bridged WETH (Base)

L2 Standard Bridged WETH (Base)  Injective

Injective  Steakhouse USDC Morpho Vault

Steakhouse USDC Morpho Vault  Bitcoin SV

Bitcoin SV  Sun Token

Sun Token  Pyth Network

Pyth Network  Celestia

Celestia  IOTA

IOTA  Binance-Peg XRP

Binance-Peg XRP  SPX6900

SPX6900  Ether.Fi Liquid ETH

Ether.Fi Liquid ETH  The Graph

The Graph  Renzo Restaked ETH

Renzo Restaked ETH  crvUSD

crvUSD  JasmyCoin

JasmyCoin  sBTC

sBTC  FLOKI

FLOKI  DoubleZero

DoubleZero  Maple Finance

Maple Finance  Jupiter Staked SOL

Jupiter Staked SOL  Siren

Siren  Savings USDD

Savings USDD  Legacy Frax Dollar

Legacy Frax Dollar  Olympus

Olympus  Lido DAO

Lido DAO  Marinade Staked SOL

Marinade Staked SOL  Optimism

Optimism  Arbitrum Bridged WETH (Arbitrum One)

Arbitrum Bridged WETH (Arbitrum One)  Conflux

Conflux  Helium

Helium  BTSE Token

BTSE Token  Telcoin

Telcoin  Staked Aave

Staked Aave  AB

AB